Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve in excel 8. Teletech Co. wants to use a decision tree in evaluating a venture capital investment in cable TV. The projected investment

please solve in excel

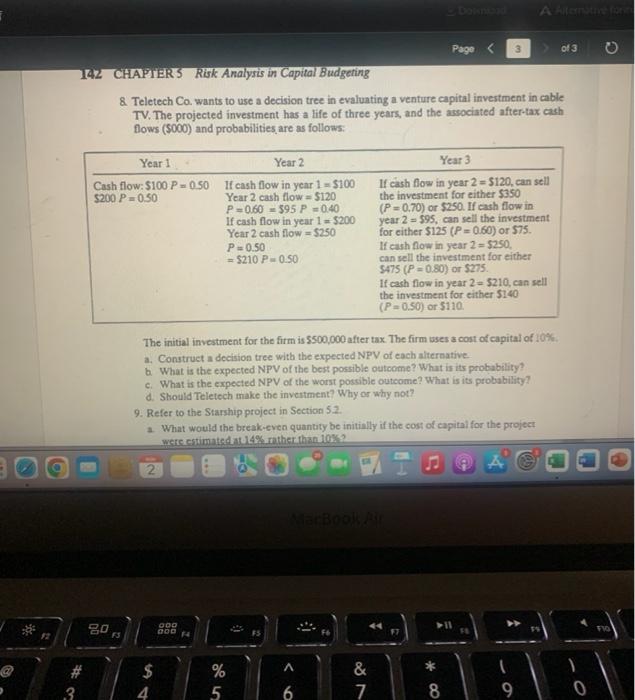

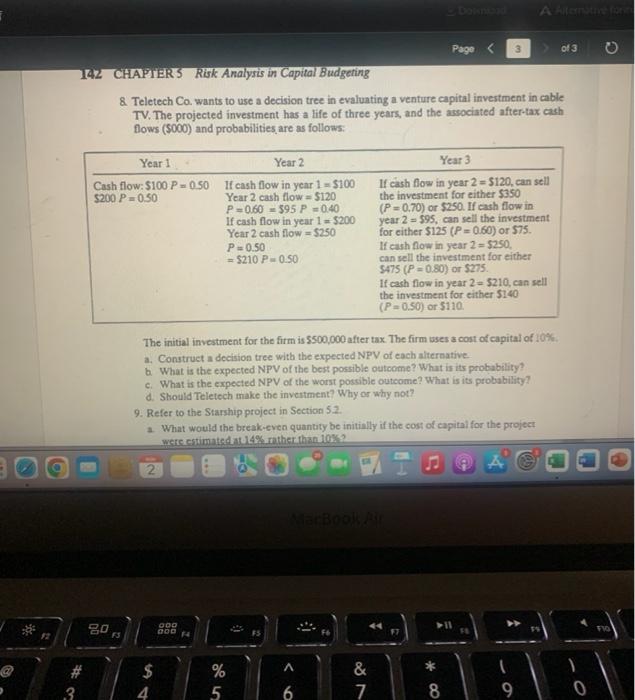

8. Teletech Co. wants to use a decision tree in evaluating a venture capital investment in cable TV. The projected investment has a life of three years, and the associated after-tax cash flows (5000) and probabilities are as follows: The initial investment for the firm is 5500,000 after tax. The firm uses a cost of capital of 10%. a. Construct a decision tree with the expected NPV of each aliternative. b. What is the expected NPV of the best possible outcome? What is its probability? c. What is the expected NPV of the worst possible outcome? What is its probability? d. Should Teletech make the investment? Why or why not? 9. Refer to the Starship project in Section 52. a. What would the break-even quantity be initially if the cost of eapital for the project were estimated at 14% mather than 100% 8. Teletech Co. wants to use a decision tree in evaluating a venture capital investment in cable TV. The projected investment has a life of three years, and the associated after-tax cash flows (5000) and probabilities are as follows: The initial investment for the firm is 5500,000 after tax. The firm uses a cost of capital of 10%. a. Construct a decision tree with the expected NPV of each aliternative. b. What is the expected NPV of the best possible outcome? What is its probability? c. What is the expected NPV of the worst possible outcome? What is its probability? d. Should Teletech make the investment? Why or why not? 9. Refer to the Starship project in Section 52. a. What would the break-even quantity be initially if the cost of eapital for the project were estimated at 14% mather than 100%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started