Answered step by step

Verified Expert Solution

Question

1 Approved Answer

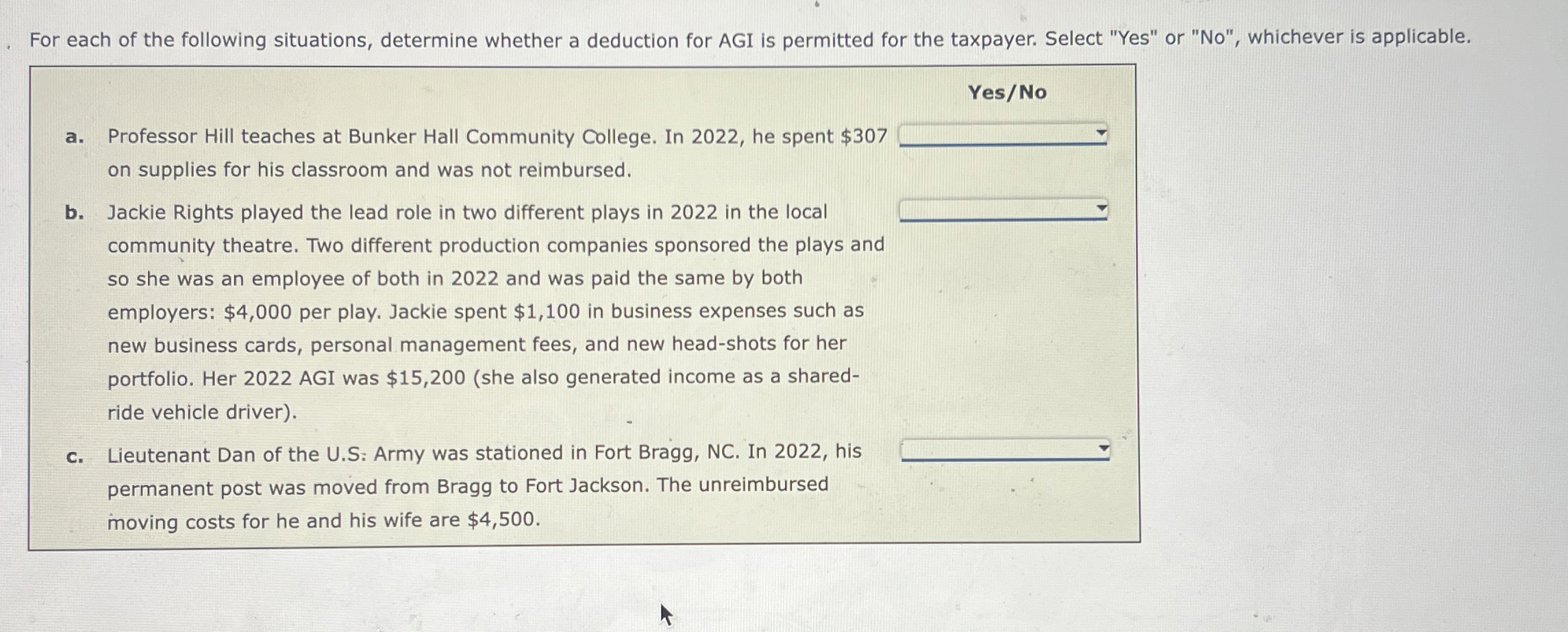

For each of the following situations, determine whether a deduction for AGI is permitted for the taxpayer. Select Yes or No , whichever

For each of the following situations, determine whether a deduction for AGI is permitted for the taxpayer. Select "Yes" or No whichever is applicable.

YesNo

a Professor Hill teaches at Bunker Hall Community College. In he spent $

on supplies for his classroom and was not reimbursed.

b Jackie Rights played the lead role in two different plays in in the local

community theatre. Two different production companies sponsored the plays and

so she was an employee of both in and was paid the same by both

employers: $ per play. Jackie spent $ in business expenses such as

new business cards, personal management fees, and new headshots for her

portfolio. Her AGI was $she also generated income as a shared

ride vehicle driver

c Lieutenant Dan of the US: Army was stationed in Fort Bragg, NC In his

permanent post was moved from Bragg to Fort Jackson. The unreimbursed

moving costs for he and his wife are $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started