Answered step by step

Verified Expert Solution

Question

1 Approved Answer

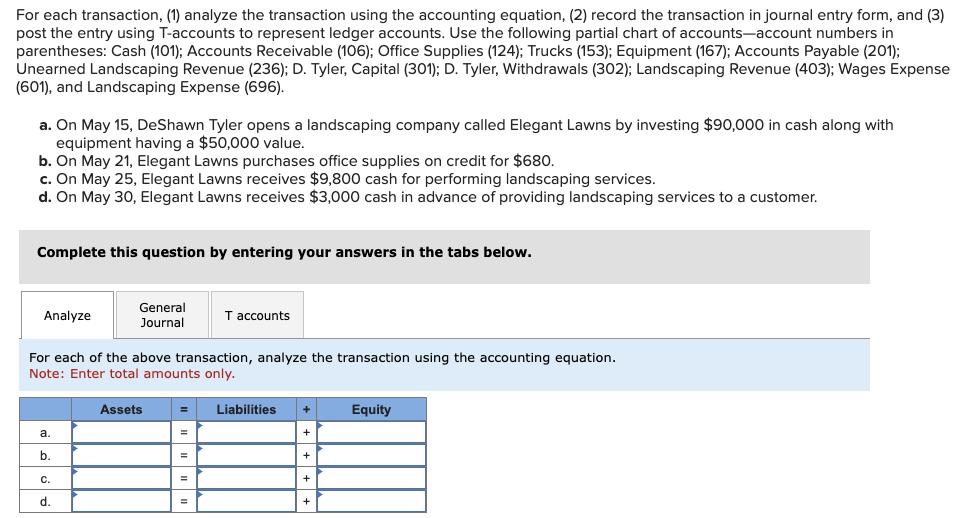

For each transaction, (1) analyze the transaction using the accounting equation, (2) record the transaction in journal entry form, and (3) post the entry

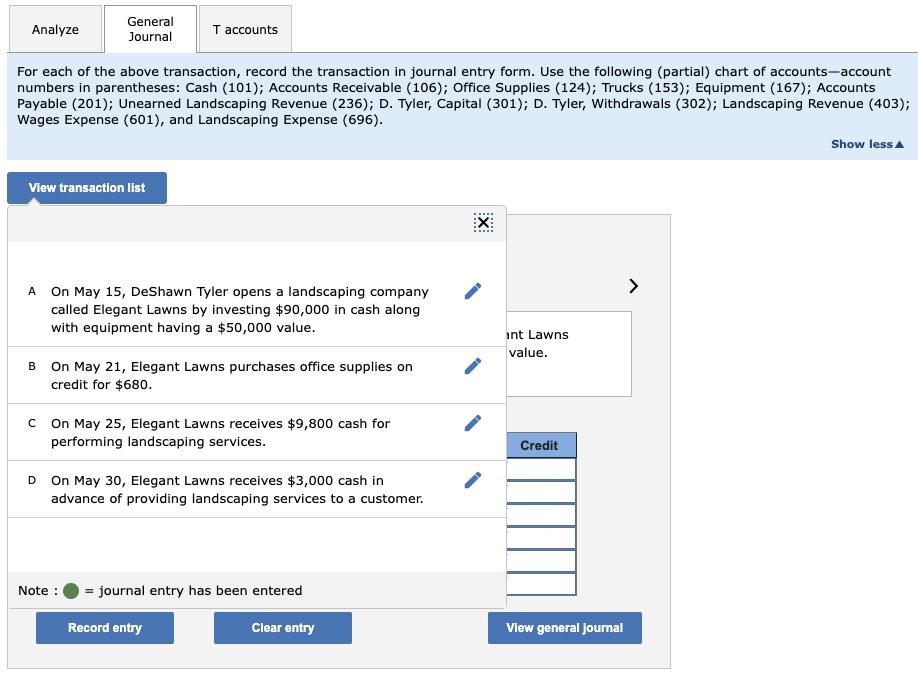

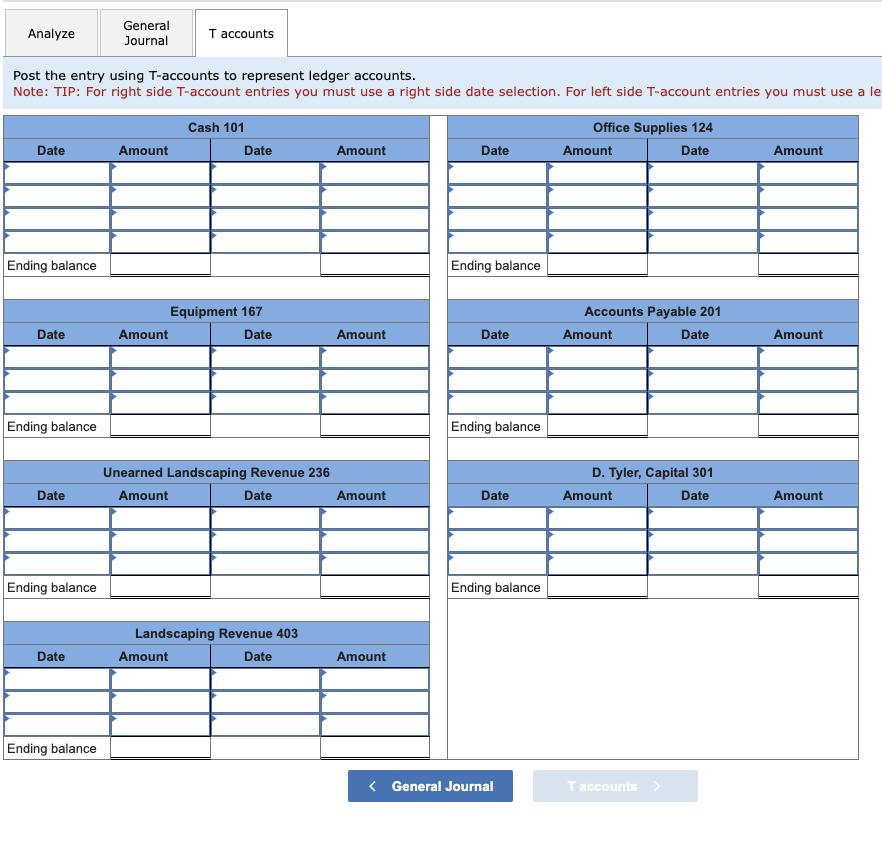

For each transaction, (1) analyze the transaction using the accounting equation, (2) record the transaction in journal entry form, and (3) post the entry using T-accounts to represent ledger accounts. Use the following partial chart of accounts-account numbers in parentheses: Cash (101); Accounts Receivable (106); Office Supplies (124); Trucks (153); Equipment (167); Accounts Payable (201); Unearned Landscaping Revenue (236); D. Tyler, Capital (301); D. Tyler, Withdrawals (302); Landscaping Revenue (403); Wages Expense (601), and Landscaping Expense (696). a. On May 15, DeShawn Tyler opens a landscaping company called Elegant Lawns by investing $90,000 in cash along with equipment having a $50,000 value. b. On May 21, Elegant Lawns purchases office supplies on credit for $680. c. On May 25, Elegant Lawns receives $9,800 cash for performing landscaping services. d. On May 30, Elegant Lawns receives $3,000 cash in advance of providing landscaping services to a customer. Complete this question by entering your answers in the tabs below. Analyze a. For each of the above transaction, analyze the transaction using the accounting equation. Note: Enter total amounts only. b. C. General Journal d. Assets T accounts |||||||||| Liabilities + + + + + Equity Analyze General Journal For each of the above transaction, record the transaction in journal entry form. Use the following (partial) chart of accounts-account numbers in parentheses: Cash (101); Accounts Receivable (106); Office Supplies (124); Trucks (153); Equipment (167); Accounts Payable (201); Unearned Landscaping Revenue (236); D. Tyler, Capital (301); D. Tyler, Withdrawals (302); Landscaping Revenue (403); Wages Expense (601), and Landscaping Expense (696). View transaction list T accounts A On May 15, DeShawn Tyler opens a landscaping company called Elegant Lawns by investing $90,000 in cash along with equipment having a $50,000 value. B On May 21, Elegant Lawns purchases office supplies on credit for $680. c On May 25, Elegant Lawns receives $9,800 cash for performing landscaping services. Note : D On May 30, Elegant Lawns receives $3,000 cash in advance of providing landscaping services to a customer. = journal entry has been entered Record entry Clear entry X X int Lawns value. Credit View general Journal Show less A Analyze Date Post the entry using T-accounts to represent ledger accounts. Note: TIP: For right side T-account entries you must use a right side date selection. For left side T-account entries you must use a le Cash 101 Ending balance Date Ending balance Date Ending balance Date General Journal Ending balance Amount Amount T accounts Date Amount Equipment 167 Date Unearned Landscaping Revenue 236 Amount Date Landscaping Revenue 403 Date Amount Amount Amount Amount Date Ending balance Date Ending balance Date Ending balance < General Journal Office Supplies 124 Date Amount Accounts Payable 201 Date Amount D. Tyler, Capital 301 Date Amount T accounts > Amount Amount Amount

Step by Step Solution

★★★★★

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 Transaction analyzed as per accounting equation are as follows Assets Liabilities Equity a 140000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started