Answered step by step

Verified Expert Solution

Question

1 Approved Answer

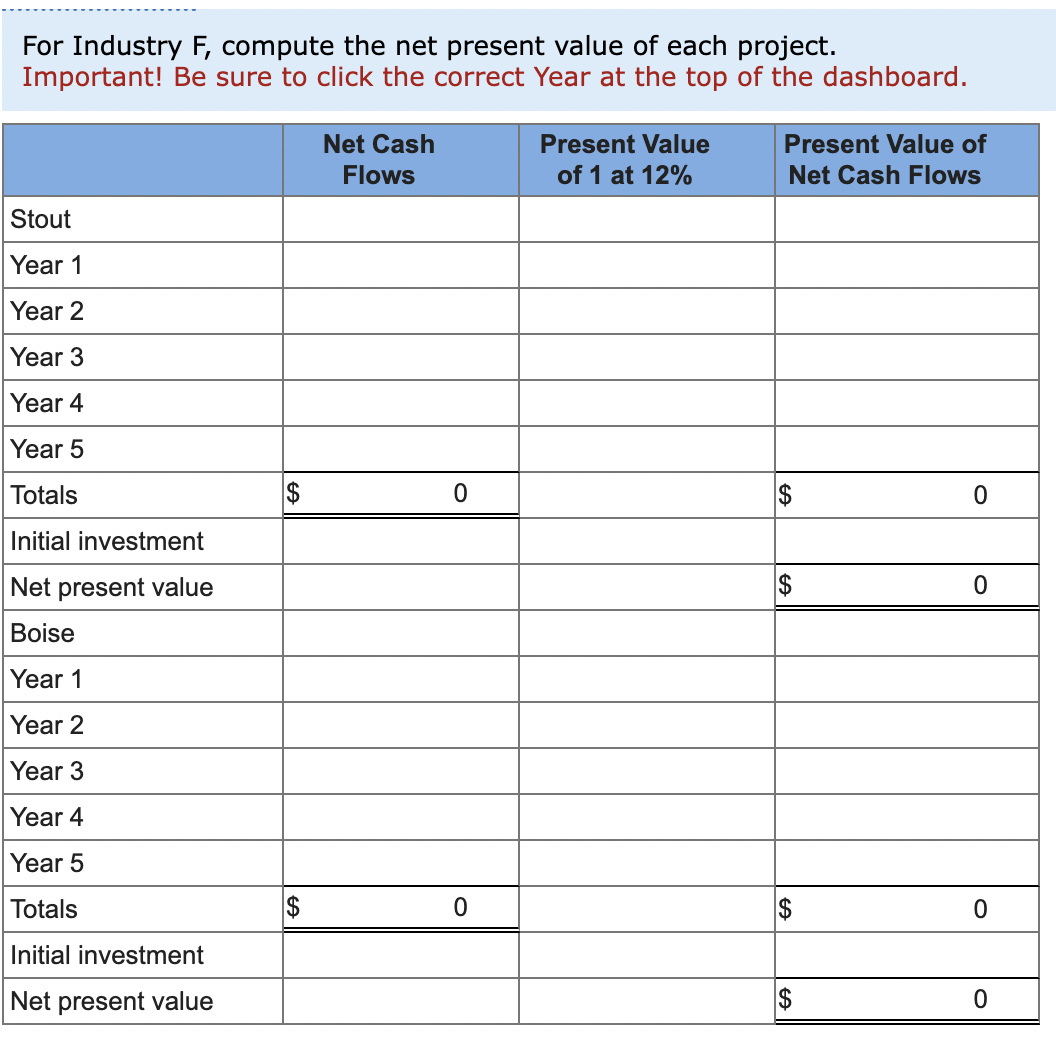

For Industry F, compute the net present value of each project. Important! Be sure to click the correct Year at the top of the

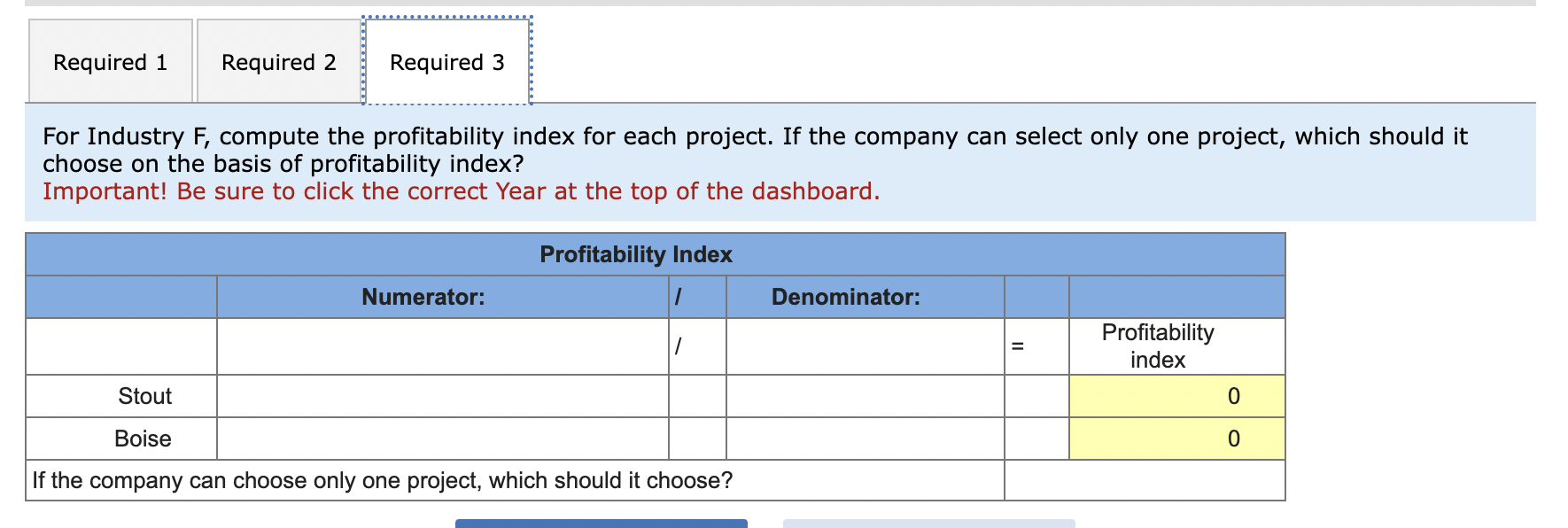

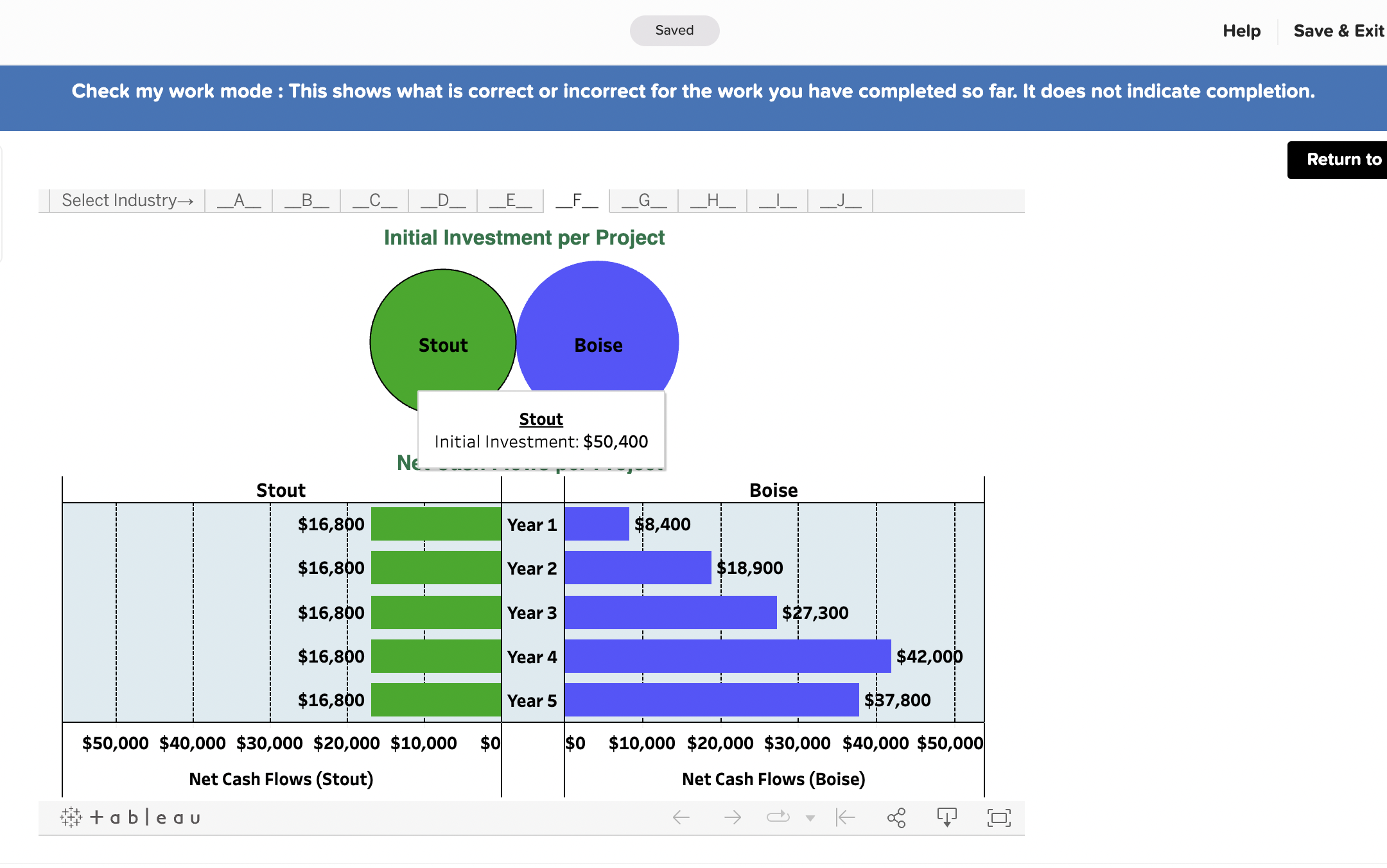

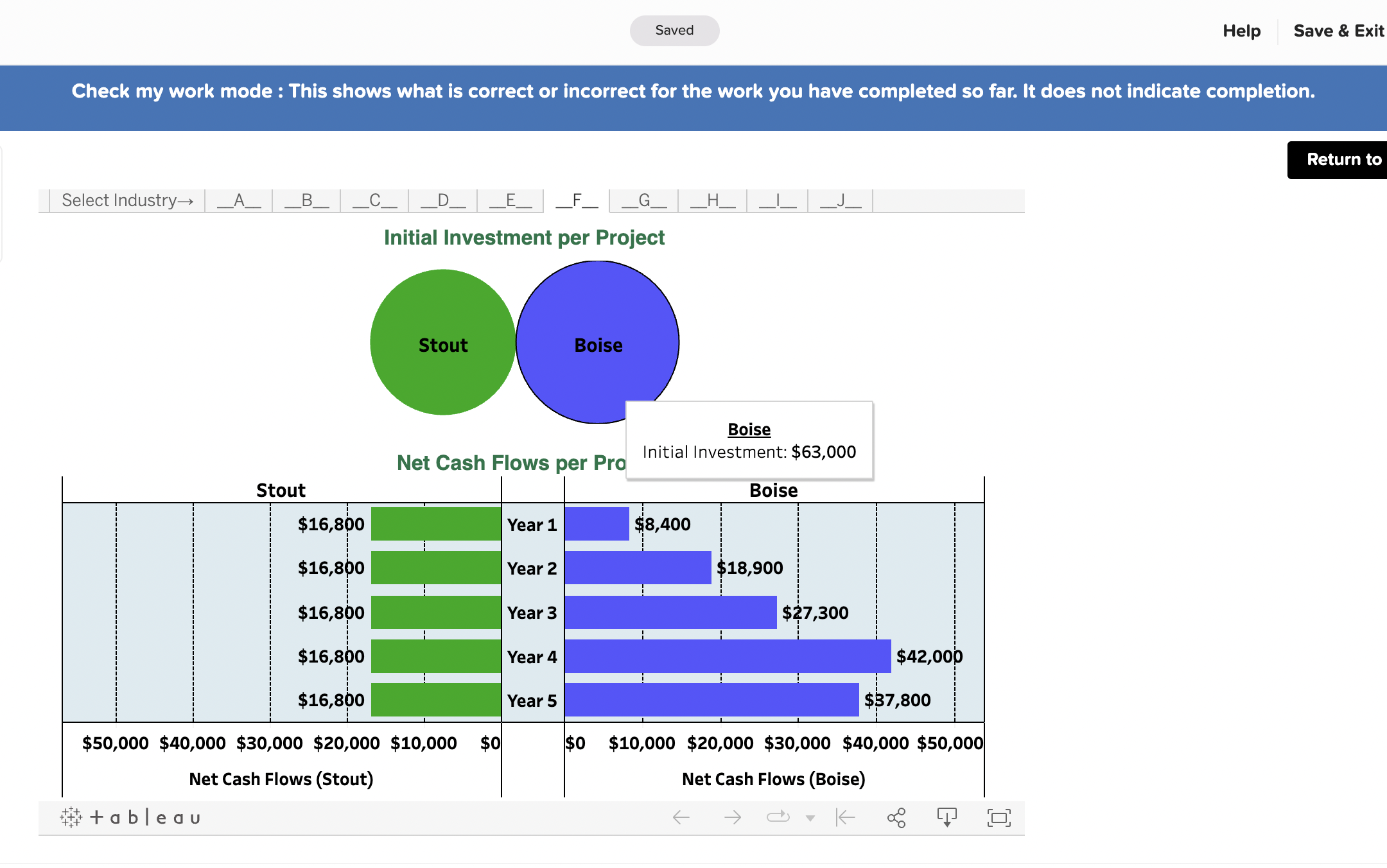

For Industry F, compute the net present value of each project. Important! Be sure to click the correct Year at the top of the dashboard. Net Cash Flows Present Value of 1 at 12% Present Value of Net Cash Flows Stout Year 1 Year 2 Year 3 Year 4 Year 5 Totals Initial investment Net present value Boise Year 1 Year 2 Year 3 Year 4 Year 5 Totals Initial investment Net present value $ 0 $ EA 0 0 $ 0 $ 0 $ 0 Required 1 Required 2 Required 3 For Industry F, compute the profitability index for each project. If the company can select only one project, which should it choose on the basis of profitability index? Important! Be sure to click the correct Year at the top of the dashboard. Stout Numerator: Profitability Index 1 Denominator: I Boise If the company can choose only one project, which should it choose? || Profitability index 0 0 Saved Help Save & Exit Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Select Industry _A_ _B__ __E_ F Initial Investment per Project Stout Ne Boise Stout Initial Investment: $50,400 _H_ Stout Boise $16,800 Year 1 $8,400 $16,800 Year 2 $18,900 $16,800 Year 3 $27,300 $16,800 Year 4 $42,000 $16,800 Year 5 $37,800 $50,000 $40,000 $30,000 $20,000 $10,000 $0 $0 $10,000 $20,000 $30,000 $40,000 $50,000 Net Cash Flows (Stout) +ableau Net Cash Flows (Boise) K G D Return to Saved Help Save & Exit Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Select Industry _A_ _B__ _E_ F Initial Investment per Project Stout Boise _H_ Boise Initial Investment: $63,000 Net Cash Flows per Pro Stout Boise $16,800 Year 1 $8,400 $16,800 Year 2 $18,900 $16,800 Year 3 $27,300 $16,800 Year 4 $42,000 $16,800 Year 5 $37,800 $50,000 $40,000 $30,000 $20,000 $10,000 $0 $0 $10,000 $20,000 $30,000 $40,000 $50,000 Net Cash Flows (Stout) +ableau Net Cash Flows (Boise) K G D Return to Mac Company is considering investing in two different projects, Stout and Boise. The company requests our help analyzing accounting data to ensure it makes the right investment decision. The Tableau Dashboard is provided for our analysis. The company requires a 12% return on its investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Select Industry _A_ B _C_ _D_ _F_ _G__H_ Initial Investment por Proiect

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started