Answered step by step

Verified Expert Solution

Question

1 Approved Answer

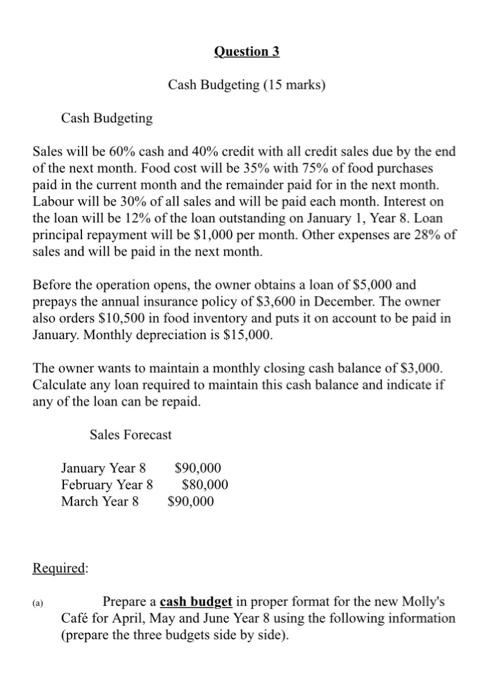

for jan feb and march Question 3 Cash Budgeting (15 marks) Cash Budgeting Sales will be 60% cash and 40% credit with all credit sales

for jan feb and march

Question 3 Cash Budgeting (15 marks) Cash Budgeting Sales will be 60% cash and 40% credit with all credit sales due by the end of the next month. Food cost will be 35% with 75% of food purchases paid in the current month and the remainder paid for in the next month. Labour will be 30% of all sales and will be paid each month. Interest on the loan will be 12% of the loan outstanding on January 1, Year 8. Loan principal repayment will be $1,000 per month. Other expenses are 28% of sales and will be paid in the next month. Before the operation opens, the owner obtains a loan of $5,000 and prepays the annual insurance policy of $3,600 in December. The owner also orders $10,500 in food inventory and puts it on account to be paid in January, Monthly depreciation is $15,000. The owner wants to maintain a monthly closing cash balance of $3,000. Calculate any loan required to maintain this cash balance and indicate if any of the loan can be repaid. Sales Forecast January Year 8 February Year 8 March Year 8 $90,000 $80,000 $90,000 Required: (a) Prepare a cash budget in proper format for the new Molly's Caf for April, May and June Year 8 using the following information (prepare the three budgets side by side) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started