Answered step by step

Verified Expert Solution

Question

1 Approved Answer

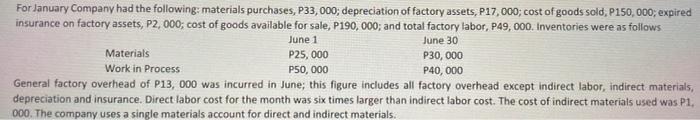

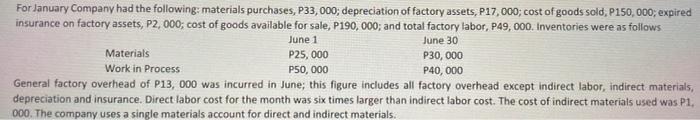

For January Company had the following: materials purchase: 33,000, depreciation of factory assets: 17,000, cost of goods sold: 150,000, expired insurance on factory assets: 2,000,

For January Company had the following: materials purchase: 33,000, depreciation of factory assets: 17,000, cost of goods sold: 150,000, expired insurance on factory assets: 2,000, cost of goods available for sale: 190,000, and total factory labor: 49,000. Inventories were as follows:

For January Company had the following: materials purchases, P33,000; depreciation of factory assets, 217,000; cost of goods sold, P150,000; expired insurance on factory assets, P2, 000; cost of goods available for sale, P190,000; and total factory labor, P49,000. Inventories were as follows June 1 June 30 Materials P25,000 P30,000 Work in Process P50,000 P40,000 General factory overhead of P13, 000 was incurred in June; this figure includes all factory overhead except indirect labor, indirect materials, depreciation and insurance. Direct labor cost for the month was six times larger than indirect labor cost. The cost of indirect materials used was P1, 000. The company uses a single materials account for direct and indirect materials General factory overhead of 13,000 was incurred in June; this figure includes all factory overhead except indirect labor, indirect materials, depreciation and insurance. Direct labor cost for the month was six (6) times larger than indirect labor cost. The cost of indirect materials used was 1,000. The company uses a single materials account for direct and indirect materials.

1. The amount of direct materials used?

2. The amount of finished goods inventory for June 1?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started