Answered step by step

Verified Expert Solution

Question

1 Approved Answer

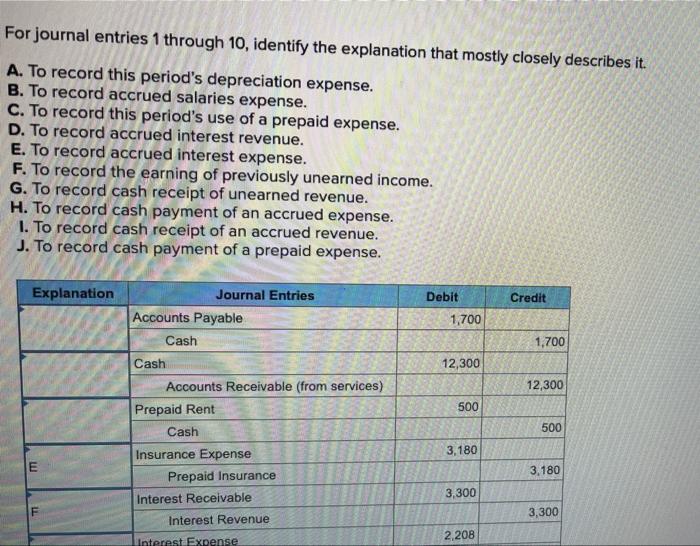

For journal entries 1 through 10, identify the explanation that mostly closely describes it. A. To record this period's depreciation expense. B. To record

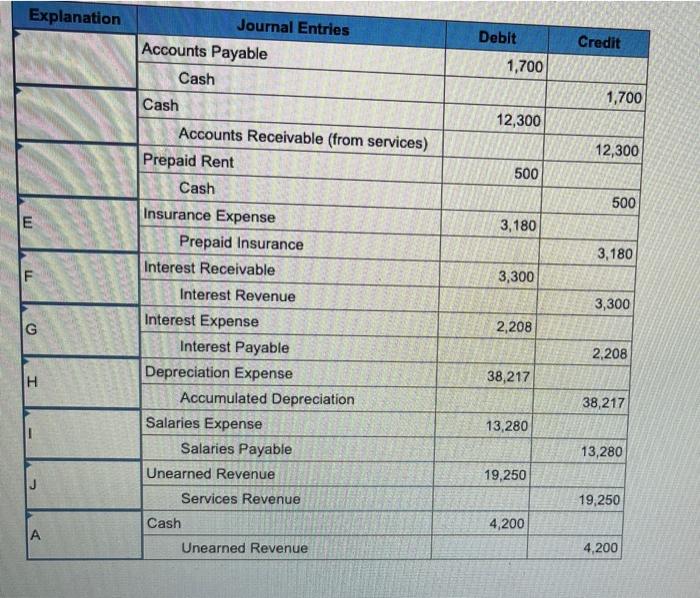

For journal entries 1 through 10, identify the explanation that mostly closely describes it. A. To record this period's depreciation expense. B. To record accrued salaries expense. C. To record this period's use of a prepaid expense. D. To record accrued interest revenue. E. To record accrued interest expense. F. To record the earning of previously unearned income. G. To record cash receipt of unearned revenue. H. To record cash payment of an accrued expense. 1. To record cash receipt of an accrued revenue. J. To record cash payment of a prepaid expense. Explanation E Accounts Payable Cash Cash Journal Entries Accounts Receivable (from services) Prepaid Rent Cash Insurance Expense Prepaid Insurance Interest Receivable Interest Revenue Interest Expense Debit 1,700 12,300 500 3,180 3,300 2,208 Credit 1,700 12,300 500 3,180 3,300 Explanation E LL G H A Accounts Payable Cash Cash Journal Entries Accounts Receivable (from services) Prepaid Rent Cash Insurance Expense Prepaid Insurance Interest Receivable Interest Revenue Interest Expense Interest Payable Depreciation Expense Accumulated Depreciation Salaries Expense Cash Salaries Payable Unearned Revenue Services Revenue Unearned Revenue Debit 1,700 12,300 500 3,180 3,300 2,208 38,217 13,280 19,250 4,200 Credit 1,700 12,300 500 3,180 3,300 2,208 38,217 13,280 19,250 4,200

Step by Step Solution

★★★★★

3.53 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started