Answered step by step

Verified Expert Solution

Question

1 Approved Answer

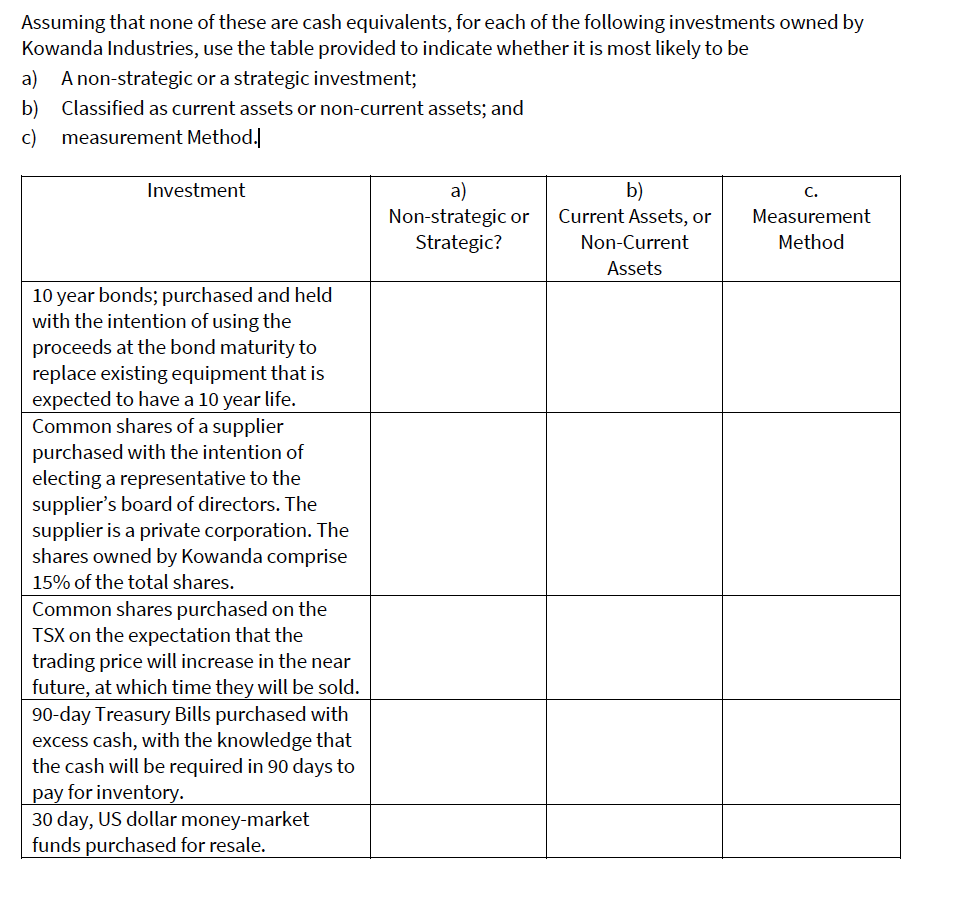

For measurement method, please identify whether it will be recorded at fair value or amortized cost. Assuming that none of these are cash equivalents, for

For measurement method, please identify whether it will be recorded at fair value or amortized cost.

Assuming that none of these are cash equivalents, for each of the following investments owned by Kowanda Industries, use the table provided to indicate whether it is most likely to be a) A non-strategic or a strategic investment; b) Classified as current assets or non-current assets; and c) measurement Method.|| Investment a) Non-strategic or Strategic? b) Current Assets, or Non-Current Assets C. Measurement Method 10 year bonds; purchased and held with the intention of using the proceeds at the bond maturity to replace existing equipment that is expected to have a 10 year life. Common shares of a supplier purchased with the intention of electing a representative to the supplier's board of directors. The supplier is a private corporation. The shares owned by Kowanda comprise 15% of the total shares. Common shares purchased on the TSX on the expectation that the trading price will increase in the near future, at which time they will be sold. 90-day Treasury Bills purchased with excess cash, with the knowledge that the cash will be required in 90 days to pay for inventory. 30 day, US dollar money-market funds purchased for resale. Assuming that none of these are cash equivalents, for each of the following investments owned by Kowanda Industries, use the table provided to indicate whether it is most likely to be a) A non-strategic or a strategic investment; b) Classified as current assets or non-current assets; and c) measurement Method.|| Investment a) Non-strategic or Strategic? b) Current Assets, or Non-Current Assets C. Measurement Method 10 year bonds; purchased and held with the intention of using the proceeds at the bond maturity to replace existing equipment that is expected to have a 10 year life. Common shares of a supplier purchased with the intention of electing a representative to the supplier's board of directors. The supplier is a private corporation. The shares owned by Kowanda comprise 15% of the total shares. Common shares purchased on the TSX on the expectation that the trading price will increase in the near future, at which time they will be sold. 90-day Treasury Bills purchased with excess cash, with the knowledge that the cash will be required in 90 days to pay for inventory. 30 day, US dollar money-market funds purchased for resaleStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started