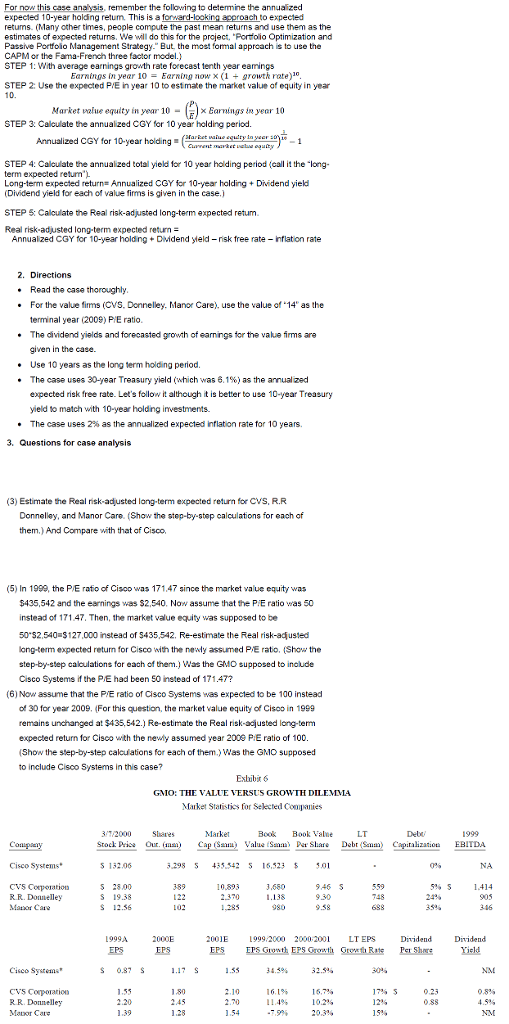

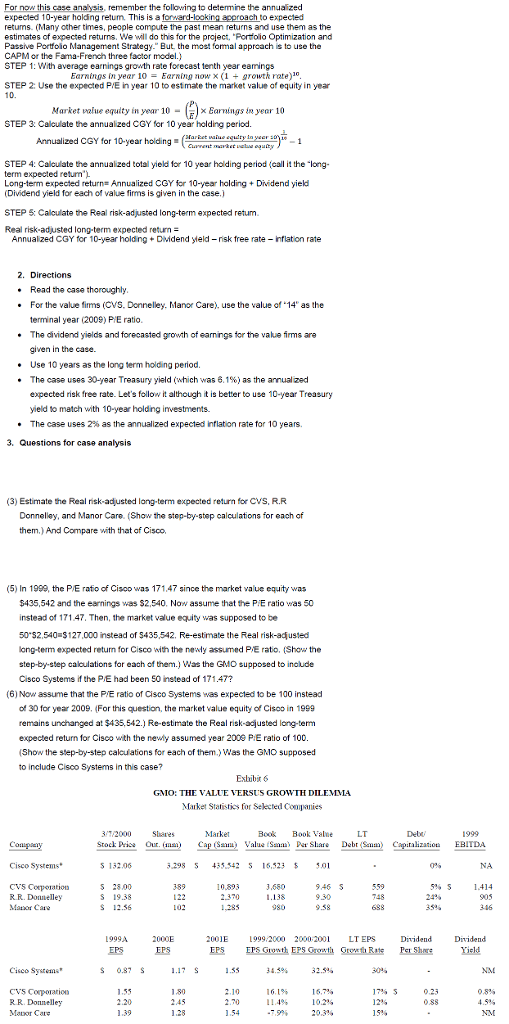

For now this case analysis, remember the following to determine the annualized expected 10-year holding return. This is a forward-looking approach to expected returns. (Many other times, people compute the past mean returns and use them as the estimates of expected returns. We will do this for the project. 'Portfolio Optimization and Passive Portfolio Management Strategy." But e most formal approach is to use the CAPM or the Fame-French three factor model.) STEP 1: With average earnings growth rate forecast tenth year earnings in year 10 = Earning now times (1 + growth rate)^10. STEP 2: Use the expected P/E in year 10 to estimate the market value of equity in year 10. Market value equity in year 10 = (P/E) times Earnings in year 10 STEP 3: Calculate the annualized CGY for 10 year holding period. Annualized CGY for 10-year holding = STEP 4: Calculate the annualized total yield for 10 year holding period (call it the 'long-term expected return"). Long-term expected return = Annualized CGY for 10-year holding + Dividend yield (Dividend yield for each of value firms is given in the case.) STEP 5: Calculate the Real risk-adjusted long-term expected return. Real risk-adjusted long-term expected return = Annualized CGY for 10-year holding + Dividend yield - risk free rate - inflation rate Read the case thoroughly. For the value firms (CVS. Donnelley. Manor Care), use the value of '14' as the terminal year (2009) P/E ratio. The dividend yields and forecasted growth of earnings for the value firms are given in the case. Use 10 years as the long term holding period. The case uses 30 year Treasury yield (which was 6.1%) as the annualized expected risk free rate. Let's follow it although it is better to use 10-year Treasury yield to match with 10-year holding investments. The case uses 2% as the annualized expected inflation rate for 10 years. Estimate the Real risk-adjusted long-term expected return for CVS, R.R Donnelley, and Manor Care. (Show the step-by-step calculations for each of them.) And Compare with that of Cisco. In 1999, the P/E ratio of Cisco was 171.47 since the market value equity was exist435, 542 and the earnings was exist2, 540. Now assume that the P/E ratio was 50 instead of 171.47. Then, the market value equity was supposed to be 50*exist2.540 = exist127,000 instead of exist435, 542. Re-estimate the Real risk-adjusted long-term expected return for Cisco with the newly assumed P/E ratio. (Show the step-by-step calculations for each of them.) Was the GMO supposed to include Cisco Systems if the P/E had been 50 instead of 171.47? Now assume that the PME ratio of Cisco Systems was expected to be 100 instead of 30 for year 2009. (For this question the market value equity of Cisco in 1999 remains unchanged at exist435, 542.) Re-estimate the Real risk-adjusted long-term expected return for Cisco with the newly assumed year 2009 P/E ratio of 100. (Show the step-by-step calculations for each of them.) Was the GMO supposed to include Cisco Systems in this case? For now this case analysis, remember the following to determine the annualized expected 10-year holding return. This is a forward-looking approach to expected returns. (Many other times, people compute the past mean returns and use them as the estimates of expected returns. We will do this for the project. 'Portfolio Optimization and Passive Portfolio Management Strategy." But e most formal approach is to use the CAPM or the Fame-French three factor model.) STEP 1: With average earnings growth rate forecast tenth year earnings in year 10 = Earning now times (1 + growth rate)^10. STEP 2: Use the expected P/E in year 10 to estimate the market value of equity in year 10. Market value equity in year 10 = (P/E) times Earnings in year 10 STEP 3: Calculate the annualized CGY for 10 year holding period. Annualized CGY for 10-year holding = STEP 4: Calculate the annualized total yield for 10 year holding period (call it the 'long-term expected return"). Long-term expected return = Annualized CGY for 10-year holding + Dividend yield (Dividend yield for each of value firms is given in the case.) STEP 5: Calculate the Real risk-adjusted long-term expected return. Real risk-adjusted long-term expected return = Annualized CGY for 10-year holding + Dividend yield - risk free rate - inflation rate Read the case thoroughly. For the value firms (CVS. Donnelley. Manor Care), use the value of '14' as the terminal year (2009) P/E ratio. The dividend yields and forecasted growth of earnings for the value firms are given in the case. Use 10 years as the long term holding period. The case uses 30 year Treasury yield (which was 6.1%) as the annualized expected risk free rate. Let's follow it although it is better to use 10-year Treasury yield to match with 10-year holding investments. The case uses 2% as the annualized expected inflation rate for 10 years. Estimate the Real risk-adjusted long-term expected return for CVS, R.R Donnelley, and Manor Care. (Show the step-by-step calculations for each of them.) And Compare with that of Cisco. In 1999, the P/E ratio of Cisco was 171.47 since the market value equity was exist435, 542 and the earnings was exist2, 540. Now assume that the P/E ratio was 50 instead of 171.47. Then, the market value equity was supposed to be 50*exist2.540 = exist127,000 instead of exist435, 542. Re-estimate the Real risk-adjusted long-term expected return for Cisco with the newly assumed P/E ratio. (Show the step-by-step calculations for each of them.) Was the GMO supposed to include Cisco Systems if the P/E had been 50 instead of 171.47? Now assume that the PME ratio of Cisco Systems was expected to be 100 instead of 30 for year 2009. (For this question the market value equity of Cisco in 1999 remains unchanged at exist435, 542.) Re-estimate the Real risk-adjusted long-term expected return for Cisco with the newly assumed year 2009 P/E ratio of 100. (Show the step-by-step calculations for each of them.) Was the GMO supposed to include Cisco Systems in this case