The question says - For new machine the company's EBIT in first year is ?

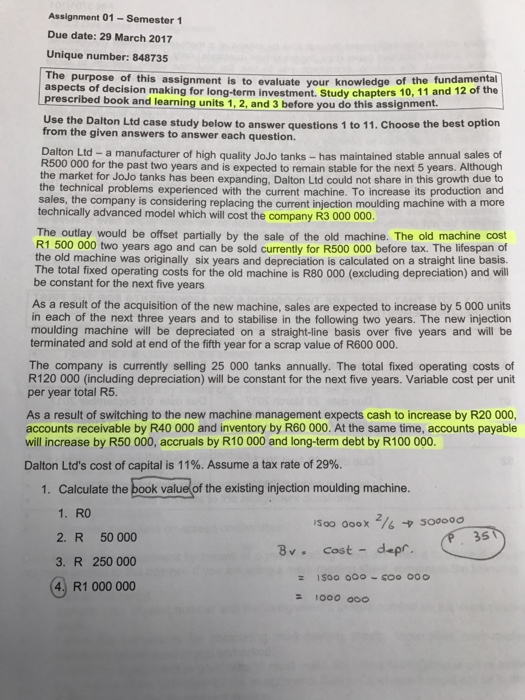

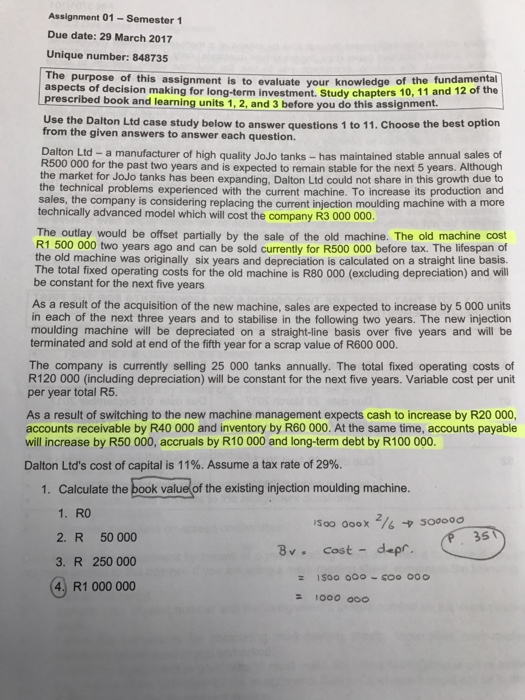

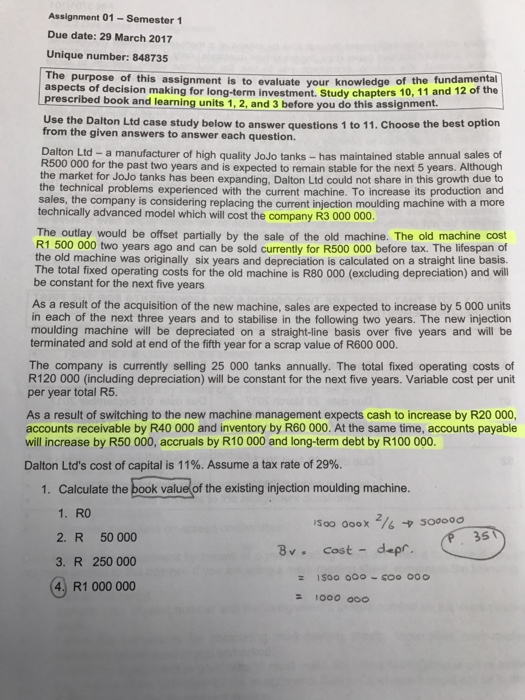

Assignment Semester 1 Due date: 29 March 2017 Unique number: 848735 The purpose of this assignment is to evaluate your knowledge of the fundamental aspects of decision making for long-term investment. Study chapters 10, 11 rescribed book and units 1, 2, and 3 before you do this assignments Use the Dalton Ltd case study below to answer questions 1 to 11. choose the best option from the given answers to answer each question. Dalton Ltd a manufacturer of high quality JoJo tanks has maintained stable annual sales of R500 000 for the past two years and is expected to remain stable for the next 5 years. Although the market for JoJo tanks has been expanding, Dalton Ltd could not share in this growth due to the technical problems experienced with the current machine. To increase production and sales, the company is considering replacing the current injection moulding machine with a more technically advanced model which will cost the company R3 000 000 The outlay would be offset partially by the sale of old machine. The old machine cost R1 500 000 two years ago and can be sold currently for R500 000 before tax. The lifespan of the old machine was originally six years and depreciation is calculated on a straight line b The total fixed operating costs for the old machine is R80 000 (excluding depreciation) and will be constant for the next five years As a result of the acquisition of the new machine, sales are expected to increase by 5 000 units n each of the next three years and to stabilise in the following two years. The new injection moulding machine will be depreciated on a straight-line basis over five years and will be terminated and sold at end of the fifth year for a scrap value of R600 000 The company is currently selling 25 000 tanks annually. The total fixed operating costs of R120 000 (including depreciation) will be constant for the next five years. Variable cost per unit per year total R5 As a result of switching to the new machine management expects cash to increase by R20 000, accounts receivable by R40 000 and inventory by R60 000. At the same time, accounts payable will increase by R50 000, accruals by R10 000 and long-term debt by R100 000 Dalton Ltd's cost of capital is 11%. Assume a tax rate of 29%. 1. Calculate the book value of the existing injection moulding machine. 1. RO 35 2. R 50 000 3, R 250 000 isoo ooo soo COO 4. R1 000 000