Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For P9-6 the problem states the note is non-interest bearing. the problem includes the effective interest rate, but it does not provide the discount amount.

For P9-6 the problem states the note is non-interest bearing. the problem includes the effective interest rate, but it does not provide the discount amount. How do I calculate the cost of the equipment?

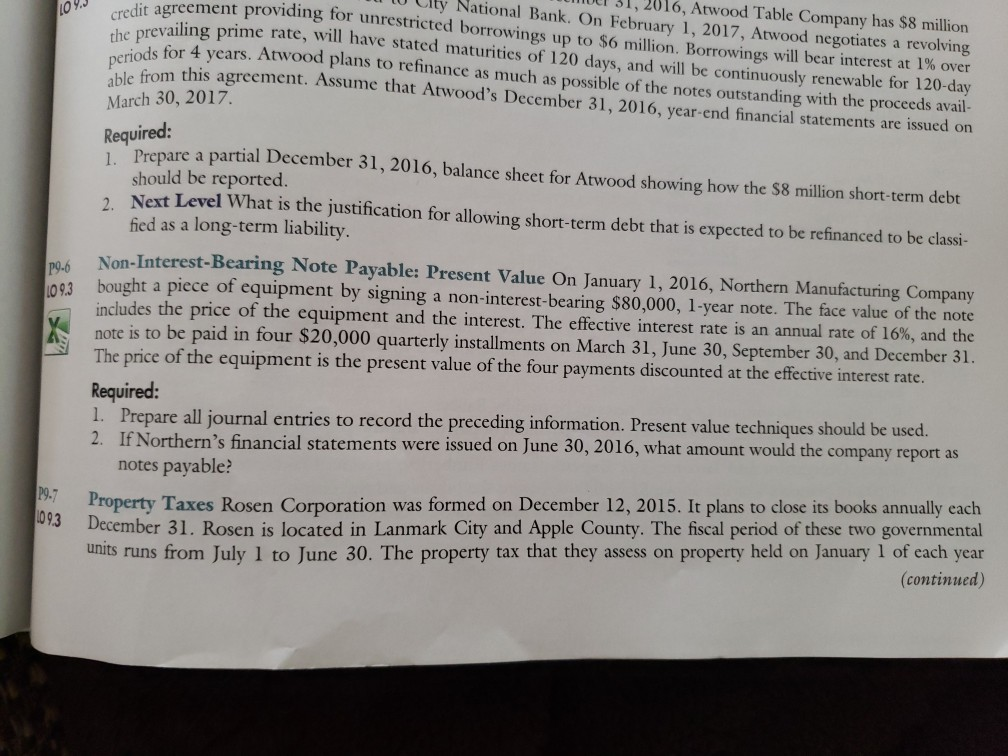

OY,J TUINTOLI 31, 2016, Atwood Table Company has $8 million U U Ulty National Bank. On February 1, 2017, Atwood negotiates a revolving it agreement providing for unrestricted borrowings up to $6 million. Borrowings will bear interest at 1% over iling prime rate, will have stated maturities of 120 days, and will be continuously renewable for 120-day ds for 4 years. Atwood plans to refinance as much as possible of the notes outstanding with the proceeds avail- from this agreement. Assume that Atwood's December 31, 2016, year-end financial statements are issued on able from this March 30, 2017 Required: 1093 i Prepare a partial December 31, 2016, balance sheet for Atwood showing how the $8 million short-term debt should be reported. 2 Next Level What is the justification for allowing short-term debt that is expected to be refinanced to be classi- fied as a long-term liability. Non-Interest-Bearing Note Payable: Present Value On January 1, 2016, Northern Manufacturing Company bought a piece of equipment by signing a non-interest-bearing $80,000, 1-year note. The face value of the note includes the price of the equipment and the interest. The effective interest rate is an annual rate of 16%, and the note is to be paid in four $20,000 quarterly installments on March 31, June 30, September 30, and December 31. The price of the equipment is the present value of the four payments discounted at the effective interest rate. Required: 1. Prepare all journal entries to record the preceding information. Present value techniques should be used. 2. If Northern's financial statements were issued on June 30, 2016, what amount would the company report as notes payable? P9.7 Property Taxes Rosen Corporation was formed on December 12, 2015. It plans to close its books annually each December 31. Rosen is located in Lanmark City and Apple County. The fiscal period of these two governmental units runs from July 1 to June 30. The property tax that they assess on property held on January 1 of each year (continued)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started