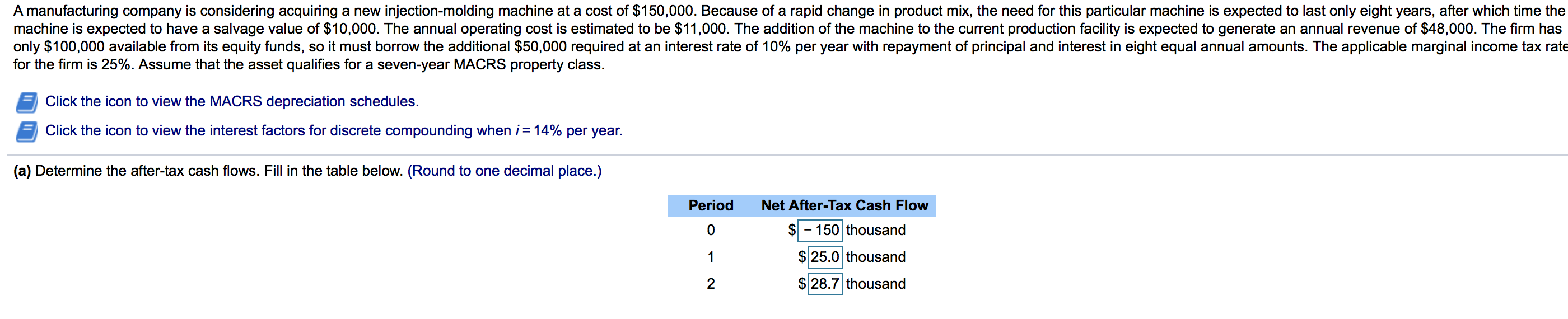

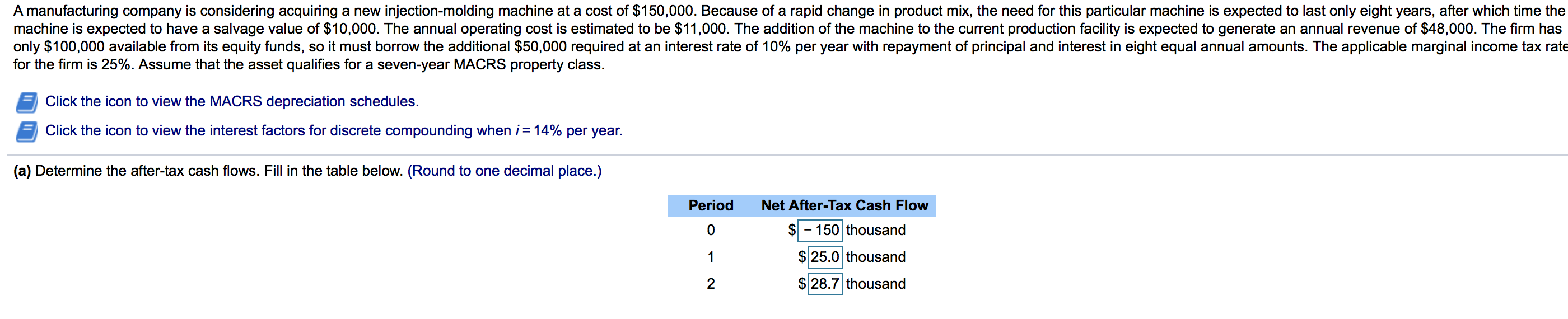

For part a, please solve for years 0-8. Thanks.

A manufacturing company is considering acquiring a new injection-molding machine at a cost of $150,000. Because of a rapid change in product mix, the need for this particular machine is expected to last only eight years, after which time the machine is expected to have a salvage value of $10,000. The annual operating cost is estimated to be $11,000. The addition of the machine to the current production facility is expected to generate an annual revenue of $48,000. The firm has only $100,000 available from its equity funds, so it must borrow the additional $50,000 required at an interest rate of 10% per year with repayment of principal and interest in eight equal annual amounts. The applicable marginal income tax rate for the firm is 25%. Assume that the asset qualifies for a seven-year MACRS property class. - Click the icon to view the MACRS depreciation schedules. Click the icon to view the interest factors for discrete compounding when i = 14% per year. (a) Determine the after-tax cash flows. Fill in the table below. (Round to one decimal place.) Period Net After-Tax Cash Flow $ - 150 thousand $25.0 thousand $28.7 thousand A manufacturing company is considering acquiring a new injection-molding machine at a cost of $150,000. Because of a rapid change in product mix, the need for this particular machine is expected to last only eight years, after which time the machine is expected to have a salvage value of $10,000. The annual operating cost is estimated to be $11,000. The addition of the machine to the current production facility is expected to generate an annual revenue of $48,000. The firm has only $100,000 available from its equity funds, so it must borrow the additional $50,000 required at an interest rate of 10% per year with repayment of principal and interest in eight equal annual amounts. The applicable marginal income tax rate for the firm is 25%. Assume that the asset qualifies for a seven-year MACRS property class. - Click the icon to view the MACRS depreciation schedules. Click the icon to view the interest factors for discrete compounding when i = 14% per year. (a) Determine the after-tax cash flows. Fill in the table below. (Round to one decimal place.) Period Net After-Tax Cash Flow $ - 150 thousand $25.0 thousand $28.7 thousand