Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For part (e), find the interest rate that will equalize the two infinite duration annuities Rick has just hit the venerable age of 65. At

For part (e), find the interest rate that will equalize the two infinite duration annuities

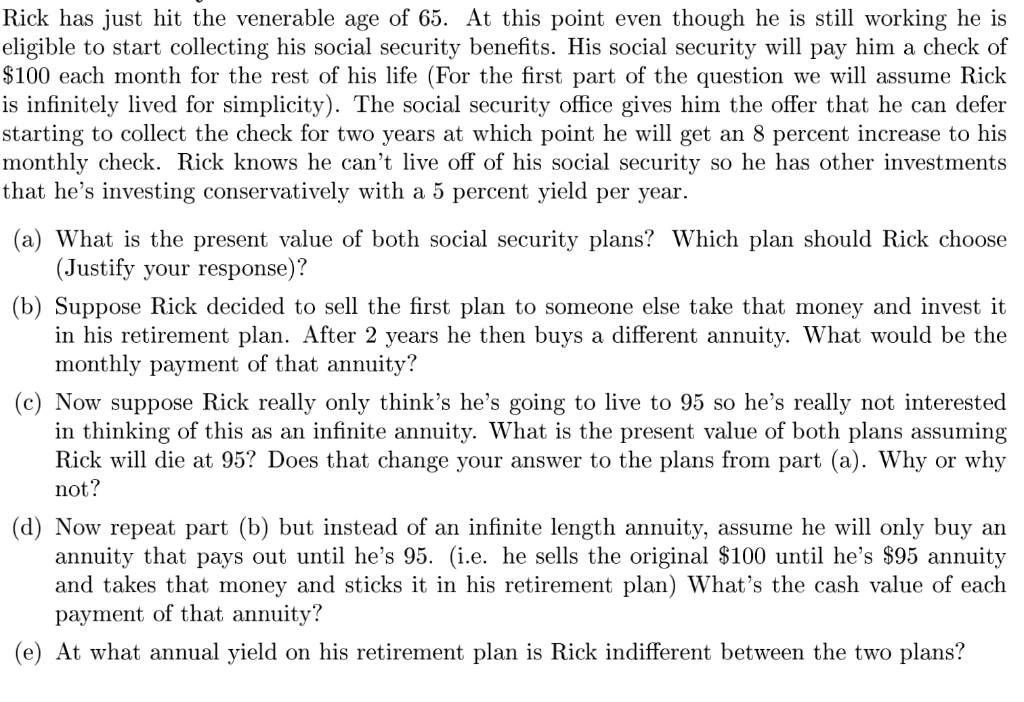

Rick has just hit the venerable age of 65. At this point even though he is still working he is eligible to start collecting his social security benefits. His social security will pay him a check of $100 each month for the rest of his life (For the first part of the question we will assume Rick is infinitely lived for simplicity). The social security office gives him the offer that he can defer starting to collect the check for two years at which point he will get an 8 percent increase to his monthly check. Rick knows he can't live off of his social security so he has other investments that he's investing conservatively with a 5 percent yield per year. (a) What is the present value of both social security plans? Which plan should Rick choose (Justify your response)? (b) Suppose Rick decided to sell the first plan to someone else take that money and invest it in his retirement plan. After 2 years he then buys a different annuity. What would be the monthly payment of that annuity? (c) Now suppose Rick really only think's he's going to live to 95 so he's really not interested in thinking of this as an infinite annuity. What is the present value of both plans assuming Rick will die at 95? Does that change your answer to the plans from part (a). Why or why not? (d) Now repeat part (b) but instead of an infinite length annuity, assume he will only buy an annuity that pays out until he's 95. (i.e. he sells the original $100 until he's $95 annuity and takes that money and sticks it in his retirement plan) What's the cash value of each payment of that annuity? (e) At what annual yield on his retirement plan is Rick indifferent between the two plans? Rick has just hit the venerable age of 65. At this point even though he is still working he is eligible to start collecting his social security benefits. His social security will pay him a check of $100 each month for the rest of his life (For the first part of the question we will assume Rick is infinitely lived for simplicity). The social security office gives him the offer that he can defer starting to collect the check for two years at which point he will get an 8 percent increase to his monthly check. Rick knows he can't live off of his social security so he has other investments that he's investing conservatively with a 5 percent yield per year. (a) What is the present value of both social security plans? Which plan should Rick choose (Justify your response)? (b) Suppose Rick decided to sell the first plan to someone else take that money and invest it in his retirement plan. After 2 years he then buys a different annuity. What would be the monthly payment of that annuity? (c) Now suppose Rick really only think's he's going to live to 95 so he's really not interested in thinking of this as an infinite annuity. What is the present value of both plans assuming Rick will die at 95? Does that change your answer to the plans from part (a). Why or why not? (d) Now repeat part (b) but instead of an infinite length annuity, assume he will only buy an annuity that pays out until he's 95. (i.e. he sells the original $100 until he's $95 annuity and takes that money and sticks it in his retirement plan) What's the cash value of each payment of that annuity? (e) At what annual yield on his retirement plan is Rick indifferent between the two plansStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started