Answered step by step

Verified Expert Solution

Question

1 Approved Answer

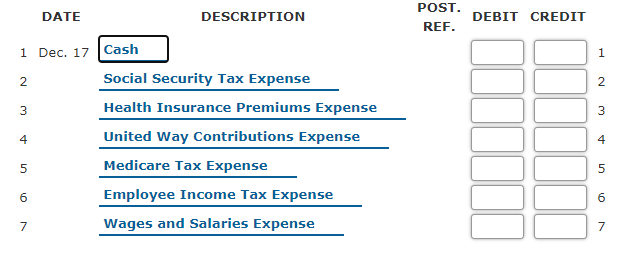

For question 3 I am not sure if the descriptions are right so please change if have to perri's Mason Supply Company has four employees

For question 3 I am not sure if the descriptions are right so please change if have to

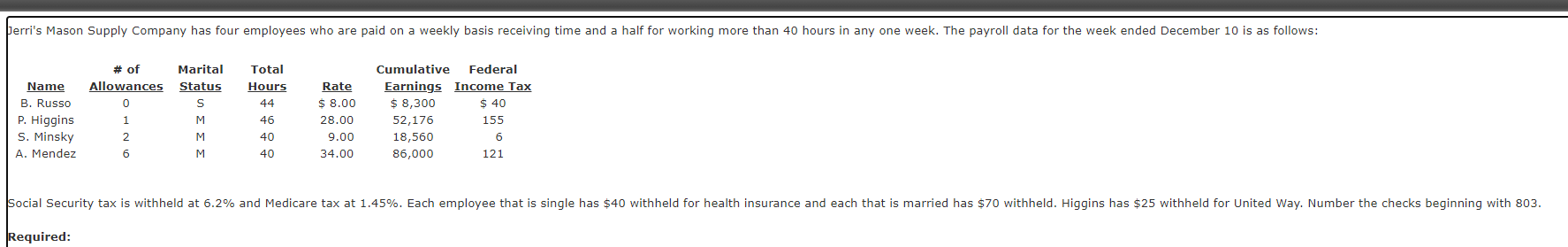

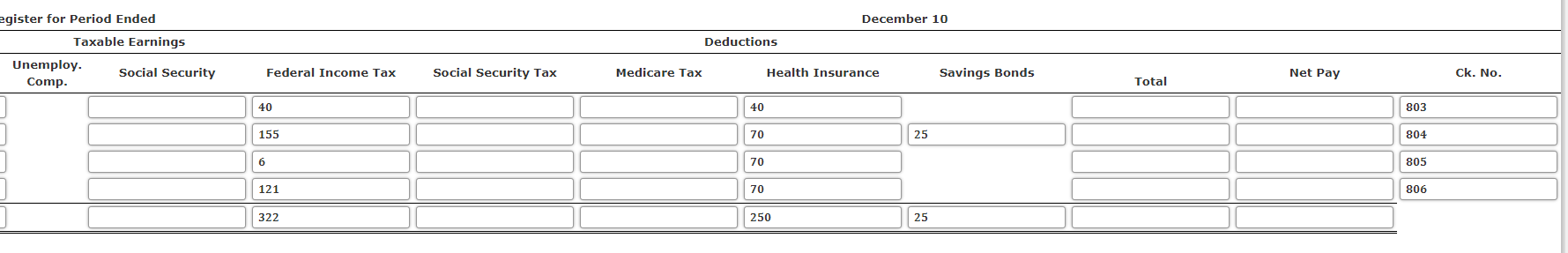

perri's Mason Supply Company has four employees who are paid on a weekly basis receiving time and a half for working more than 40 hours in any one week. The payroll data for the week ended December 10 is as follows: Marital Status # of Allowances 0 1 2 Total Hours 44 Name B. Russo P. Higgins S. Minsky A. Mendez S M Cumulative Federal Earnings Income Tax $ 8,300 $ 40 52,176 155 18,560 6 86,000 121 Rate $ 8.00 28.00 9.00 34.00 46 40 M M 6 40 Social Security tax is withheld at 6.2% and Medicare tax at 1.45%. Each employee that is single has $40 withheld for health insurance and each that is married has $70 withheld. Higgins has $25 withheld for United Way. Number the checks beginning with 803. Required: December 10 Deductions egister for Period Ended Taxable Earnings Unemploy. Social Security Comp. Federal Income Tax Social Security Tax Medicare Tax Health Insurance Savings Bonds ck. No. Net Pay Total 40 40 803 155 70 25 804 6 70 805 121 70 806 322 250 25 POST. REF. DEBIT CREDIT 1 N 2 3 3 4 5 DATE DESCRIPTION 1 Dec. 17 Cash Social Security Tax Expense Health Insurance Premiums Expense United Way Contributions Expense 5 Medicare Tax Expense Employee Income Tax Expense Wages and Salaries Expense 4 5 6 6 7 7Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started