Answered step by step

Verified Expert Solution

Question

1 Approved Answer

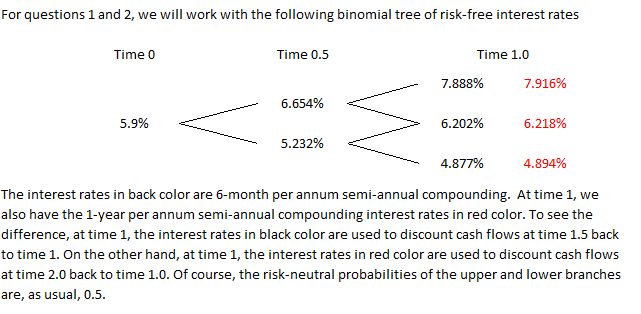

For questions 1 and 2, we will work with the following binomial tree of risk-free interest rates Time 0 Time 0.5 Time 1.0 7.888% 7.916%

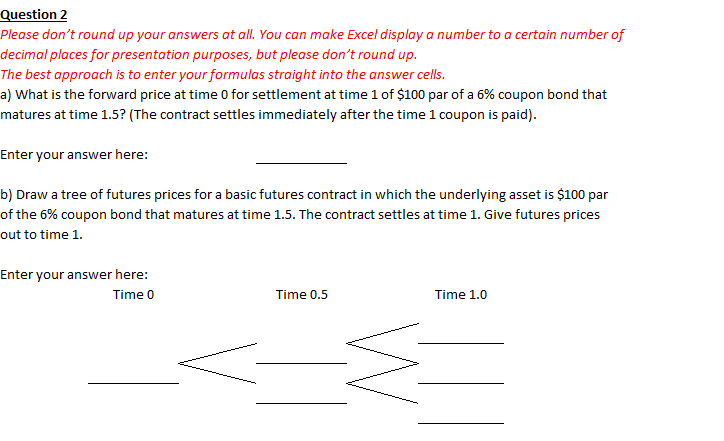

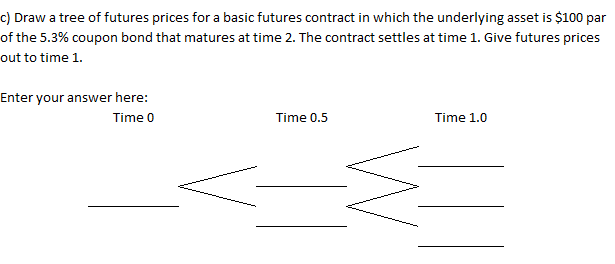

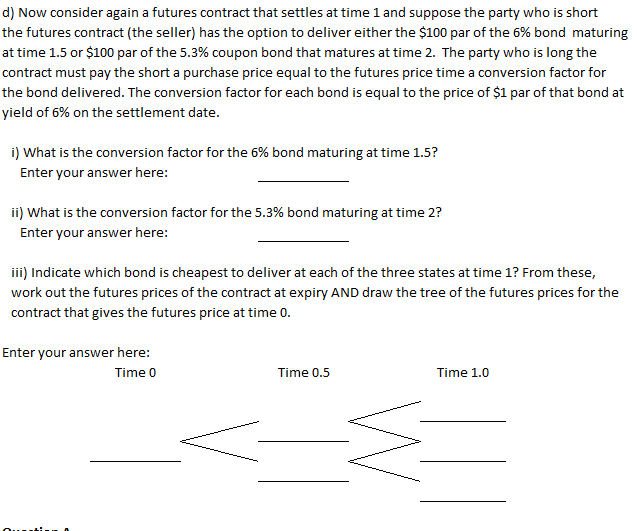

For questions 1 and 2, we will work with the following binomial tree of risk-free interest rates Time 0 Time 0.5 Time 1.0 7.888% 7.916% 6.654% 5.9% 6.202% 6.218% 5.232% 4.877% 4.894% The interest rates in back color are 6-month per annum semi-annual compounding. At time 1, we also have the 1-year per annum semi-annual compounding interest rates in red color. To see the difference, at time 1, the interest rates in black color are used to discount cash flows at time 1.5 back to time 1. On the other hand, at time 1, the interest rates in red color are used to discount cash flows at time 2.0 back to time 1.0. Of course, the risk-neutral probabilities of the upper and lower branches are, as usual, 0.5. Question 2 Please don't round up your answers at all. You can make Excel display a number to a certain number of decimal places for presentation purposes, but please don't round up. The best approach is to enter your formulas straight into the answer cells. a) What is the forward price at time 0 for settlement at time 1 of $100 par of a 6% coupon bond that matures at time 1.5? (The contract settles immediately after the time 1 coupon is paid). Enter your answer here: b) Draw a tree of futures prices for a basic futures contract in which the underlying asset is $100 par of the 6% coupon bond that matures at time 1.5. The contract settles at time 1. Give futures prices out to time 1. Enter your answer here: Time 0 Time 0.5 Time 1.0 c) Draw a tree of futures prices for a basic futures contract in which the underlying asset is $100 par of the 5.3% coupon bond that matures at time 2. The contract settles at time 1. Give futures prices out to time 1. Enter your answer here: Time 0 Time 0.5 Time 1.0 TI d) Now consider again a futures contract that settles at time 1 and suppose the party who is short the futures contract (the seller) has the option to deliver either the $100 par of the 6% bond maturing at time 1.5 or $100 par of the 5.3% coupon bond that matures at time 2. The party who is long the contract must pay the short a purchase price equal to the futures price time a conversion factor for the bond delivered. The conversion factor for each bond is equal to the price of $1 par of that bond at yield of 6% on the settlement date. i) What is the conversion factor for the 6% bond maturing at time 1.5? Enter your answer here: ii) What is the conversion factor for the 5.3% bond maturing at time 2? Enter your answer here: iii) Indicate which bond is cheapest to deliver at each of the three states at time 1? From these, work out the futures prices of the contract at expiry AND draw the tree of the futures prices for the contract that gives the futures price at time 0. Enter your answer here: Time 0 Time 0.5 Time 1.0 For questions 1 and 2, we will work with the following binomial tree of risk-free interest rates Time 0 Time 0.5 Time 1.0 7.888% 7.916% 6.654% 5.9% 6.202% 6.218% 5.232% 4.877% 4.894% The interest rates in back color are 6-month per annum semi-annual compounding. At time 1, we also have the 1-year per annum semi-annual compounding interest rates in red color. To see the difference, at time 1, the interest rates in black color are used to discount cash flows at time 1.5 back to time 1. On the other hand, at time 1, the interest rates in red color are used to discount cash flows at time 2.0 back to time 1.0. Of course, the risk-neutral probabilities of the upper and lower branches are, as usual, 0.5. Question 2 Please don't round up your answers at all. You can make Excel display a number to a certain number of decimal places for presentation purposes, but please don't round up. The best approach is to enter your formulas straight into the answer cells. a) What is the forward price at time 0 for settlement at time 1 of $100 par of a 6% coupon bond that matures at time 1.5? (The contract settles immediately after the time 1 coupon is paid). Enter your answer here: b) Draw a tree of futures prices for a basic futures contract in which the underlying asset is $100 par of the 6% coupon bond that matures at time 1.5. The contract settles at time 1. Give futures prices out to time 1. Enter your answer here: Time 0 Time 0.5 Time 1.0 c) Draw a tree of futures prices for a basic futures contract in which the underlying asset is $100 par of the 5.3% coupon bond that matures at time 2. The contract settles at time 1. Give futures prices out to time 1. Enter your answer here: Time 0 Time 0.5 Time 1.0 TI d) Now consider again a futures contract that settles at time 1 and suppose the party who is short the futures contract (the seller) has the option to deliver either the $100 par of the 6% bond maturing at time 1.5 or $100 par of the 5.3% coupon bond that matures at time 2. The party who is long the contract must pay the short a purchase price equal to the futures price time a conversion factor for the bond delivered. The conversion factor for each bond is equal to the price of $1 par of that bond at yield of 6% on the settlement date. i) What is the conversion factor for the 6% bond maturing at time 1.5? Enter your answer here: ii) What is the conversion factor for the 5.3% bond maturing at time 2? Enter your answer here: iii) Indicate which bond is cheapest to deliver at each of the three states at time 1? From these, work out the futures prices of the contract at expiry AND draw the tree of the futures prices for the contract that gives the futures price at time 0. Enter your answer here: Time 0 Time 0.5 Time 1.0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started