Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For Questions 4 through 9 , assume you are the manager of a venture capital fund, and a bank is offering to loan $ 2

For Questions through assume you are the manager of a venture capital fund, and a bank is offering to loan $ million of the $ million financing requirement. The aftertax cash outflows to service the bank debt are $$$$ and $ million in Years through respectively. You are considering providing an equity investment for the remaining $ million required by AFC.

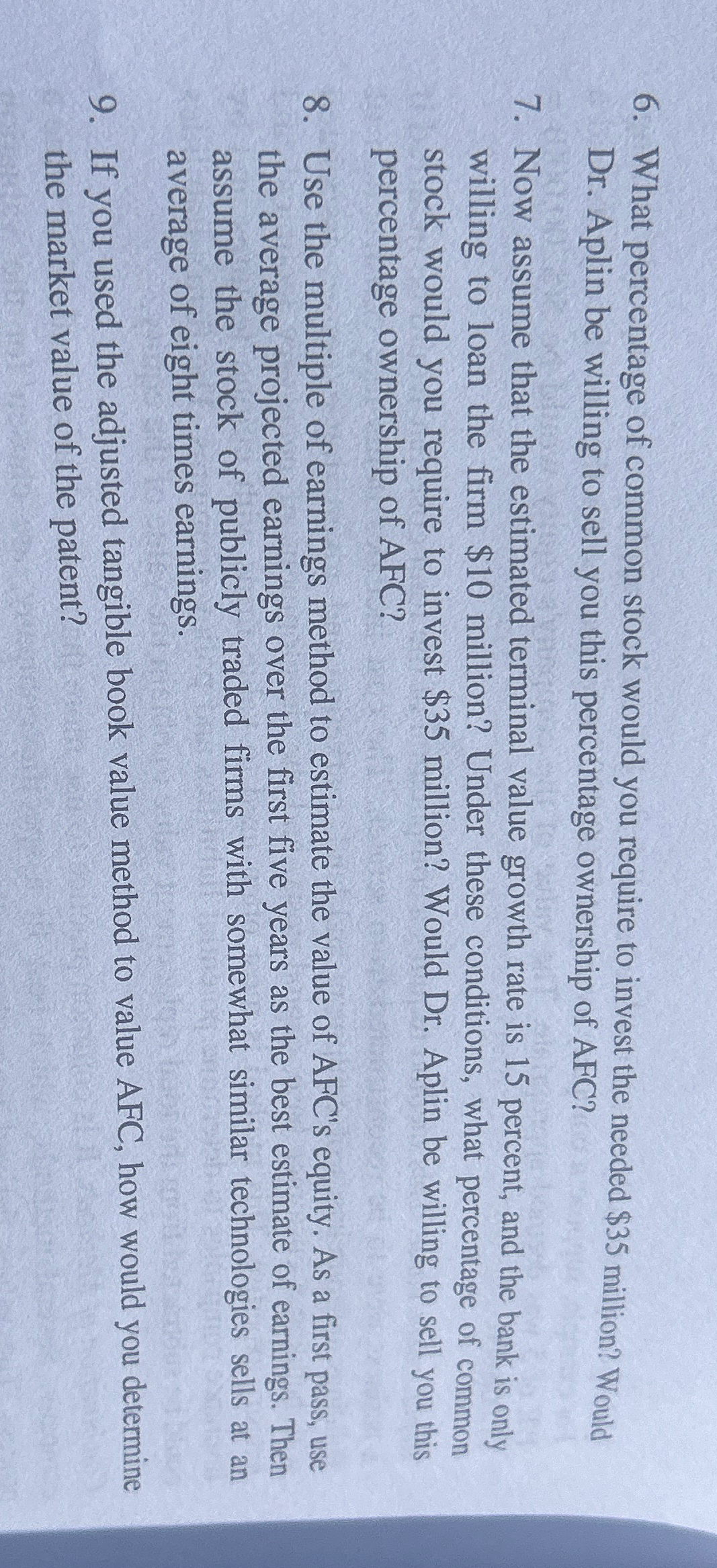

What percentage of common stock would you require to invest the needed $ million? Would Dr Aplin be willing to sell you this percentage ownership of AFC?

Now assume that the estimated terminal value growth rate is percent, and the bank is only willing to loan the firm $ million? Under these conditions, what percentage of common stock would you require to invest $ million? Would Dr Aplin be willing to sell you this percentage ownership of AFC?

Use the multiple of earnings method to estimate the value of AFC's equity. As a first pass, use the average projected earnings over the first five years as the best estimate of earnings. Then assume the stock of publicly traded firms with somewhat similar technologies sells at an average of eight times earnings.

If you used the adjusted tangible book value method to value AFC, how would you determine the market value of the patent?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started