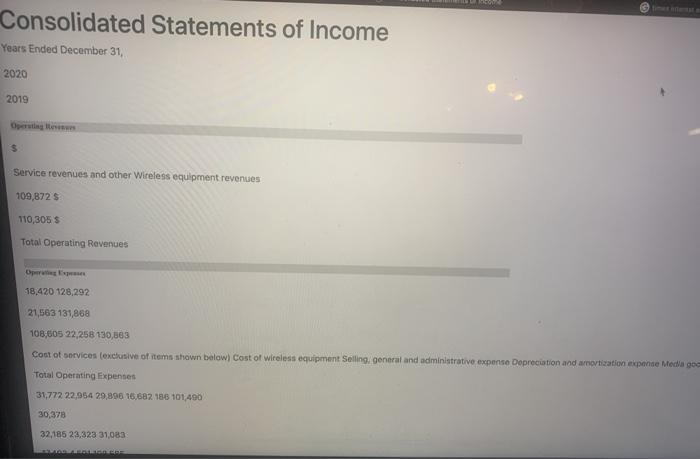

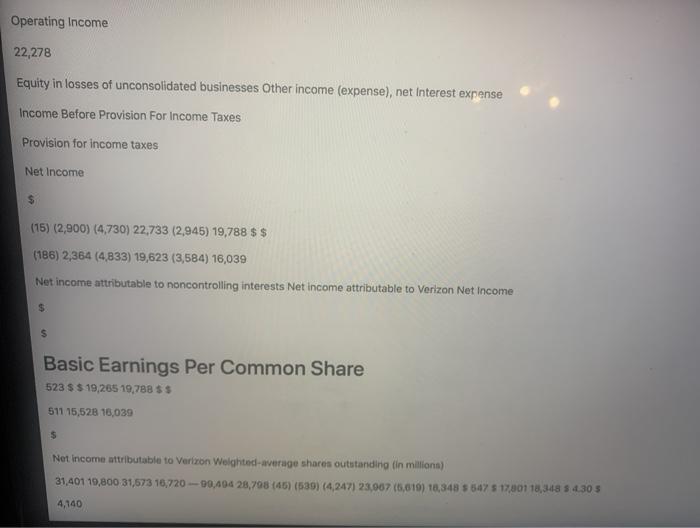

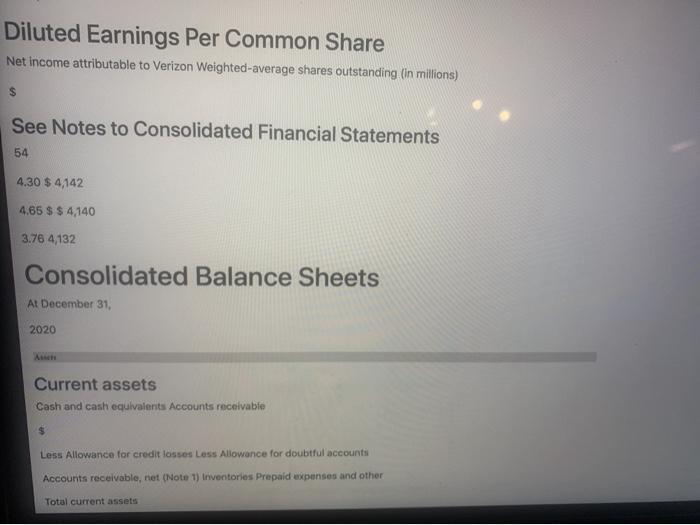

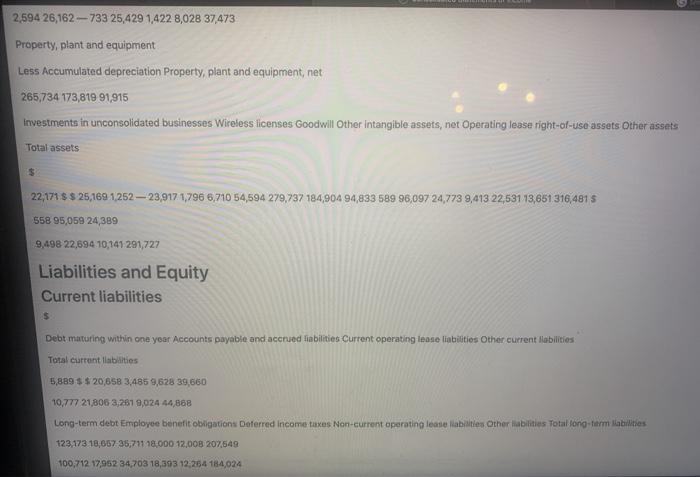

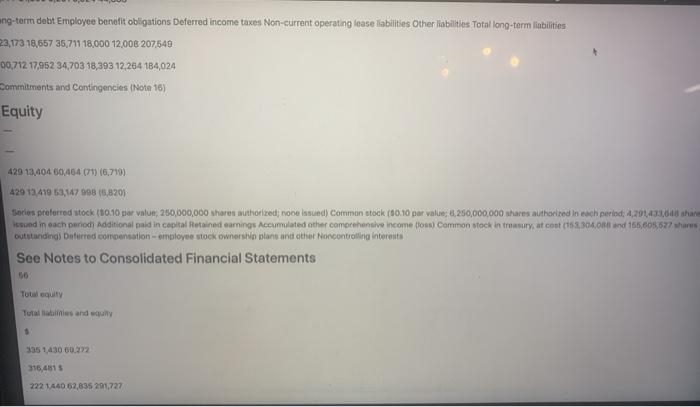

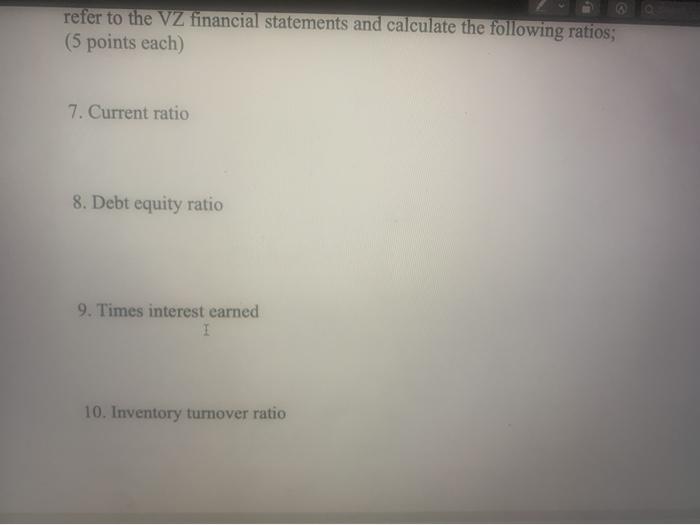

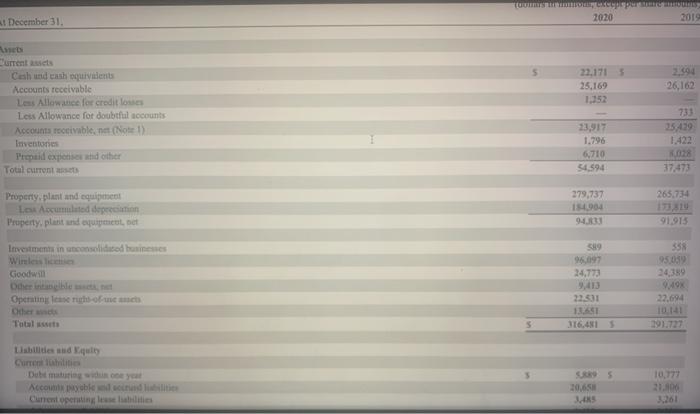

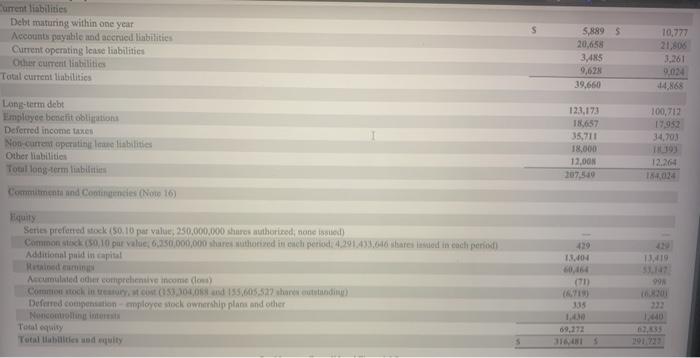

For questions 7-13, use the appropriate information given for questions 1-6. Also refer to the VZ financial statements and calculate the following ratios; (5 points each) 11. Return on equity (ROE) I 12. After tax (net) profit margin 13. Price Earnings Ratio Consolidated Statements of Income Years Ended December 31 2020 2019 $ Service revenues and other Wireless equipment revenues 109,872 $ 110,305 $ Total Operating Revenues 18,420 128,292 21,563 131,868 108,605 22,258 130,603 Cost of services exclusive of items shown below) Cost of wireless equipment Selling general and administrative expense Depreciation and amortization experie Media goc Total Operating Expenses 31,772 22,954 29,896 16,682 186 101,490 30,378 32,185 23,323 31083 Operating Income 22,278 Equity in losses of unconsolidated businesses Other income (expense), net interest expense Income Before Provision for Income Taxes Provision for income taxes Net Income (15) (2,900) (4,730) 22,733 (2,945) 19,788 $ $ (186) 2,364 (4,833) 19,623 (3,584) 16,039 Net income attributable to noncontrolling interests Net income attributable to Verizon Net Income $ Basic Earnings Per Common Share 523 $ $ 19,265 19,788 $ $ 511 15,528 16,039 $ Net income attributable to Verizon Weighted average shares outstanding in millions) 31.401 19,800 31,573 16,720 -90,404 28,798 (46) (539) (4, 247) 23,007 (6,610) 10,348 5 547 5 1780118,318 3 4305 4,140 Diluted Earnings Per Common Share Net income attributable to Verizon Weighted average shares outstanding (in millions) $ See Notes to Consolidated Financial Statements 54 4.30 $4,142 4.65 $ $ 4140 3.76 4,132 Consolidated Balance Sheets At December 31, 2020 Current assets Cash and cash equivalents Accounts receivable Less Allowance for credit losses Less Allowance for doubtful accounts Accounts receivable, net (Note 1) Inventories Prepaid expenses and other Total current assets ang-term debt Employee benefit obligations Deferred income taxes Non-current operating fease liabilities Other liabilities Total long-term liabilities 23.173 18,657 35,711 18,000 12,008 207,549 00,712 17,952 34,703 18,393 12,264 184,024 Commitments and Contingencies (Note 16) Equity 429 13.404 60464 (71) (6,719) 429 13419 53,147008 (6,820) series preferred stock (30.10 par value, 250,000,000 sharen nuthorized rono issued) Common stock (0.10 par value 8,250,000,000 shares authorized to each period, 420,43 har und in each periodi Additional and in capital Retained earnings Accumulated other componentive Income (fo) Common stock in tror, at cont (158.040 and 166,605,677 shares outstanding) Deferred compensation-employee stock owners plans and other Non controlling interest See Notes to Consolidated Financial Statements 56 Total equity Tutabilis and equi 335 1,430 60272 316,4615 2221440 62,635 201,727 refer to the VZ financial statements and calculate the following ratios; (5 points each) 7. Current ratio 8. Debt equity ratio 9. Times interest earned I 10. Inventory turnover ratio 2020 2019 At December 31 5 2594 26,162 25.169 1,352 urrentes Cash and cash equivalent Accounts receivable Less Allowance for credit losses Lets Allowance for doubtful accounts Accounts reivable.net (Note 1) Inventones Prepaid expenses other Total current 23,917 25419 1.422 08 37.473 6.710 54,594 265.734 Property, plant and equipment Lo Accumulated depen Property, plant and equipment, et 279,737 10004 91 915 358 Investments in consolidated businesses Wireless lice Goodwill Other tong blesse Operating light of me 24,773 95.03 24389 9.40X 22.694 22501 1361 Lisbites and ques 10,777 Coyle bir 20,65 ANS S Current liabilities Debt maturing within one year Accounts payable and accredibilities Current operating lese liabilities Other current libilities Tatal current liabilities 5,8895 20,658 3,485 9,628 39,660 10,777 21,806 3.261 9.024 14.868 Long-term debt Employee benefit obligation Deferred income taxe Nou current operating abilities Other libilities Total long-term bili Commitment and Contingencies (Non 16) 123,173 18,657 35,711 18.000 12.00 20740 100,712 17.952 34,703 12.264 Series preferred stock (50.10 par value, 250,000,000 shares authorized, none) Commons 50, 10 pur value 6,350,000,000 share their chi period: 4.291.435.646 shares o incoch period Additional paid in capital 13.419 13.04 0,164 998 201 Accumulated our comprehensive income Com toch in eos 53300 155.605322 hantutanding Deferred compensation-ployee stock ownership plans and other Noncontrolling Totally Total blessed equity 13 1.4 09.172 10 For questions 7-13, use the appropriate information given for questions 1-6. Also refer to the VZ financial statements and calculate the following ratios; (5 points each) 11. Return on equity (ROE) I 12. After tax (net) profit margin 13. Price Earnings Ratio Consolidated Statements of Income Years Ended December 31 2020 2019 $ Service revenues and other Wireless equipment revenues 109,872 $ 110,305 $ Total Operating Revenues 18,420 128,292 21,563 131,868 108,605 22,258 130,603 Cost of services exclusive of items shown below) Cost of wireless equipment Selling general and administrative expense Depreciation and amortization experie Media goc Total Operating Expenses 31,772 22,954 29,896 16,682 186 101,490 30,378 32,185 23,323 31083 Operating Income 22,278 Equity in losses of unconsolidated businesses Other income (expense), net interest expense Income Before Provision for Income Taxes Provision for income taxes Net Income (15) (2,900) (4,730) 22,733 (2,945) 19,788 $ $ (186) 2,364 (4,833) 19,623 (3,584) 16,039 Net income attributable to noncontrolling interests Net income attributable to Verizon Net Income $ Basic Earnings Per Common Share 523 $ $ 19,265 19,788 $ $ 511 15,528 16,039 $ Net income attributable to Verizon Weighted average shares outstanding in millions) 31.401 19,800 31,573 16,720 -90,404 28,798 (46) (539) (4, 247) 23,007 (6,610) 10,348 5 547 5 1780118,318 3 4305 4,140 Diluted Earnings Per Common Share Net income attributable to Verizon Weighted average shares outstanding (in millions) $ See Notes to Consolidated Financial Statements 54 4.30 $4,142 4.65 $ $ 4140 3.76 4,132 Consolidated Balance Sheets At December 31, 2020 Current assets Cash and cash equivalents Accounts receivable Less Allowance for credit losses Less Allowance for doubtful accounts Accounts receivable, net (Note 1) Inventories Prepaid expenses and other Total current assets ang-term debt Employee benefit obligations Deferred income taxes Non-current operating fease liabilities Other liabilities Total long-term liabilities 23.173 18,657 35,711 18,000 12,008 207,549 00,712 17,952 34,703 18,393 12,264 184,024 Commitments and Contingencies (Note 16) Equity 429 13.404 60464 (71) (6,719) 429 13419 53,147008 (6,820) series preferred stock (30.10 par value, 250,000,000 sharen nuthorized rono issued) Common stock (0.10 par value 8,250,000,000 shares authorized to each period, 420,43 har und in each periodi Additional and in capital Retained earnings Accumulated other componentive Income (fo) Common stock in tror, at cont (158.040 and 166,605,677 shares outstanding) Deferred compensation-employee stock owners plans and other Non controlling interest See Notes to Consolidated Financial Statements 56 Total equity Tutabilis and equi 335 1,430 60272 316,4615 2221440 62,635 201,727 refer to the VZ financial statements and calculate the following ratios; (5 points each) 7. Current ratio 8. Debt equity ratio 9. Times interest earned I 10. Inventory turnover ratio 2020 2019 At December 31 5 2594 26,162 25.169 1,352 urrentes Cash and cash equivalent Accounts receivable Less Allowance for credit losses Lets Allowance for doubtful accounts Accounts reivable.net (Note 1) Inventones Prepaid expenses other Total current 23,917 25419 1.422 08 37.473 6.710 54,594 265.734 Property, plant and equipment Lo Accumulated depen Property, plant and equipment, et 279,737 10004 91 915 358 Investments in consolidated businesses Wireless lice Goodwill Other tong blesse Operating light of me 24,773 95.03 24389 9.40X 22.694 22501 1361 Lisbites and ques 10,777 Coyle bir 20,65 ANS S Current liabilities Debt maturing within one year Accounts payable and accredibilities Current operating lese liabilities Other current libilities Tatal current liabilities 5,8895 20,658 3,485 9,628 39,660 10,777 21,806 3.261 9.024 14.868 Long-term debt Employee benefit obligation Deferred income taxe Nou current operating abilities Other libilities Total long-term bili Commitment and Contingencies (Non 16) 123,173 18,657 35,711 18.000 12.00 20740 100,712 17.952 34,703 12.264 Series preferred stock (50.10 par value, 250,000,000 shares authorized, none) Commons 50, 10 pur value 6,350,000,000 share their chi period: 4.291.435.646 shares o incoch period Additional paid in capital 13.419 13.04 0,164 998 201 Accumulated our comprehensive income Com toch in eos 53300 155.605322 hantutanding Deferred compensation-ployee stock ownership plans and other Noncontrolling Totally Total blessed equity 13 1.4 09.172 10