Answered step by step

Verified Expert Solution

Question

1 Approved Answer

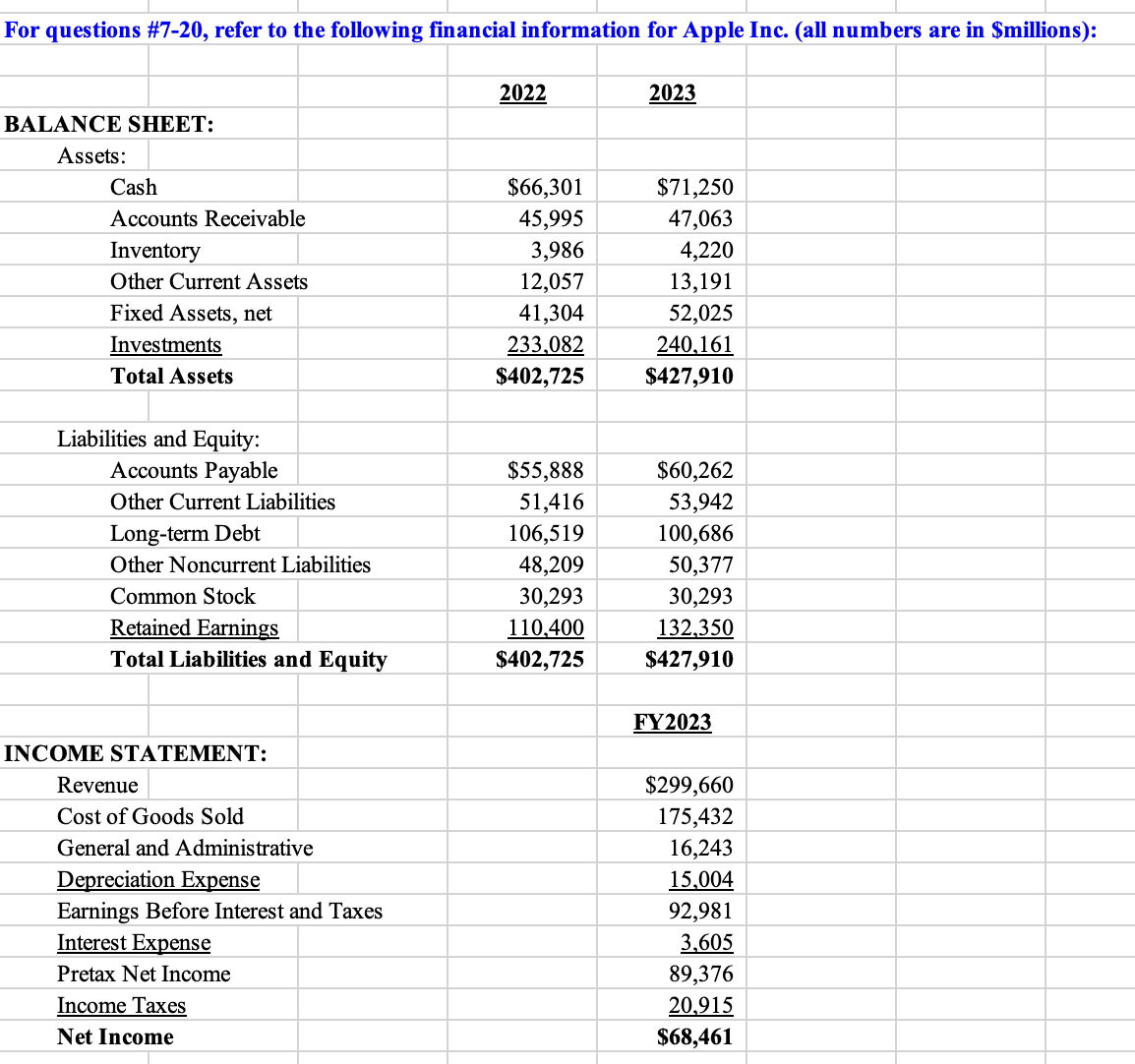

For questions #7-20, refer to the following financial information for Apple Inc. (all numbers are in $millions): YOU MUST USE EXCEL'S FUNCTIONALITY TO PERFORM ALL

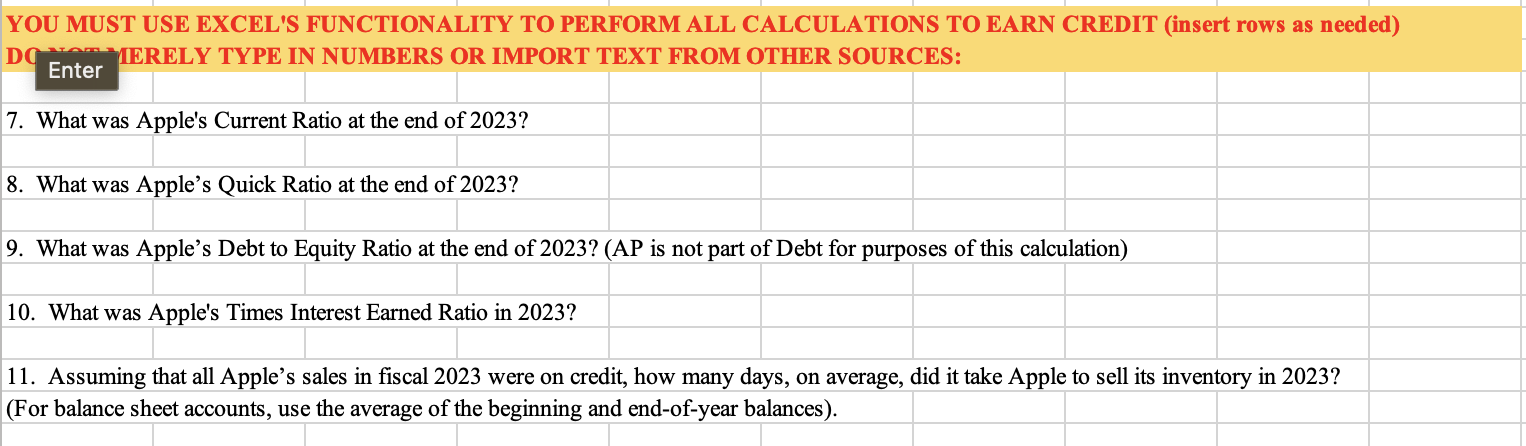

For questions \#7-20, refer to the following financial information for Apple Inc. (all numbers are in \$millions): YOU MUST USE EXCEL'S FUNCTIONALITY TO PERFORM ALL CALCULATIONS TO EARN CREDIT (insert rows as needed) Enter 7. What was Apple's Current Ratio at the end of 2023 ? 8. What was Apple's Quick Ratio at the end of 2023? 9. What was Apple's Debt to Equity Ratio at the end of 2023? (AP is not part of Debt for purposes of this calculation) 10. What was Apple's Times Interest Earned Ratio in 2023? 11. Assuming that all Apple's sales in fiscal 2023 were on credit, how many days, on average, did it take Apple to sell its inventory in 2023 ? (For balance sheet accounts, use the average of the beginning and end-of-year balances)

For questions \#7-20, refer to the following financial information for Apple Inc. (all numbers are in \$millions): YOU MUST USE EXCEL'S FUNCTIONALITY TO PERFORM ALL CALCULATIONS TO EARN CREDIT (insert rows as needed) Enter 7. What was Apple's Current Ratio at the end of 2023 ? 8. What was Apple's Quick Ratio at the end of 2023? 9. What was Apple's Debt to Equity Ratio at the end of 2023? (AP is not part of Debt for purposes of this calculation) 10. What was Apple's Times Interest Earned Ratio in 2023? 11. Assuming that all Apple's sales in fiscal 2023 were on credit, how many days, on average, did it take Apple to sell its inventory in 2023 ? (For balance sheet accounts, use the average of the beginning and end-of-year balances) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started