Question

For risk management purposes, Waad decided to undertake a strategy consisting of buying a call that has a strike price of $68 and selling

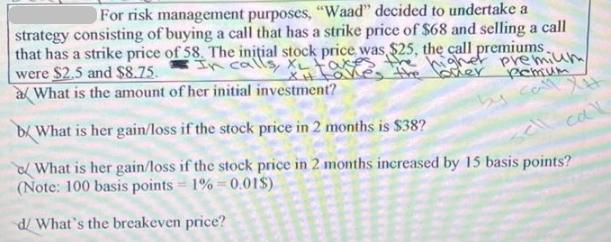

For risk management purposes, "Waad" decided to undertake a strategy consisting of buying a call that has a strike price of $68 and selling a call that has a strike price of 58. The initial stock price was $25, the call premiums. In calls, XL taxes were $2.5 and $8.75. XH takes the ghet premium Remum What is the amount of her initial investment? b/ What is her gain/loss if the stock price in 2 months is $38? ell call What is her gain/loss if the stock price in 2 months increased by 15 basis points? (Note: 100 basis points = 1% = 0.015) d/ What's the breakeven price?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets break down the information provided Buying a call with ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Finance With Monte Carlo

Authors: Ronald W. Shonkwiler

2013th Edition

146148510X, 978-1461485100

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App