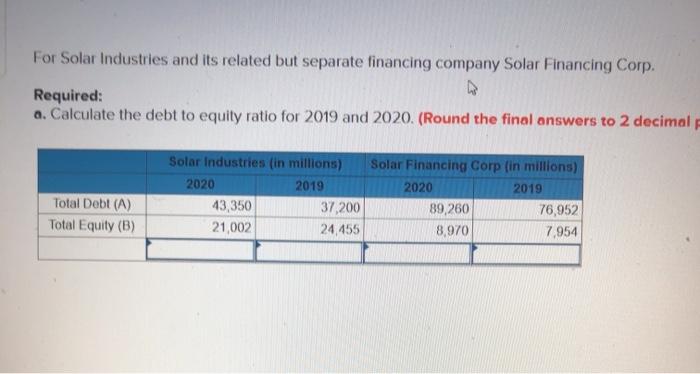

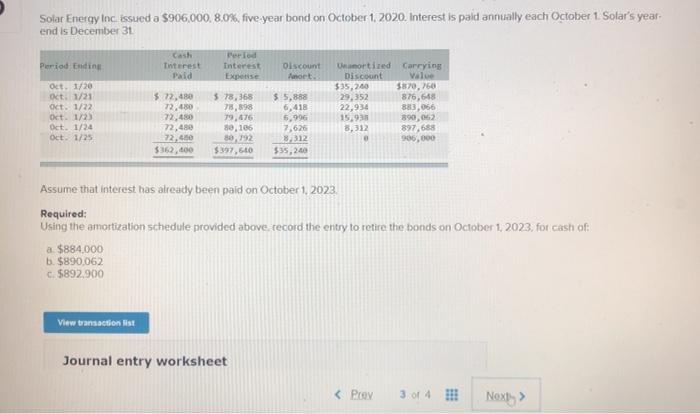

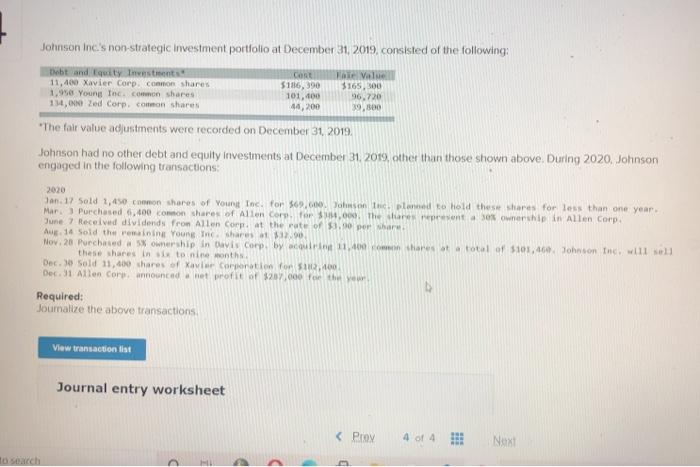

For Solar Industries and its related but separate financing company Solar Financing Corp. Required: a. Calculate the debt to equity ratio for 2019 and 2020. (Round the final answers to 2 decimal Solar Industries (in millions) 2020 2019 43,350 37,200 21,002 24,455 Total Debt (A) Total Equity (B) Solar Financing Corp (in millions) 2020 2019 89,260 76,952 3.970 7,954 Solar Energy Inc issued a $906,000. 8.0%, five year bond on October 1, 2020. Interest is paid annually each October 1. Solar's year end is December 31 Period Ending Tnterest Paid Period Interest Experise Discount Amort. $ 5,888 Oct. 1/20 Oct. 1/21 oct. 1/22 Oct. 1/2) Oct. 1/24 Oct. 1/25 $ 22,480 72.480 72,480 72,480 72,480 $362,600 $ 78,368 785,898 79,476 30,106 89,192 $397,640 Un amortized Carrying Discount Value $35,200 5870,760 29,352 876,645 22,934 883,066 15.935 390,062 3,312 897,688 96,000 5,996 2.626 8.312 $35,240 Assume that interest has already been paid on October 1, 2023 Required: Using the amortization schedule provided above record the entry to retire the bonds on October 1, 2023, for cash of a $884.000 b. $890,062 C.5892.900 View transaction is Journal entry worksheet Johnson Inc.'s non-strategic investment portfolio at December 31, 2019, consisted of the following: Debt and Equity Investments 11,400 Xavier Corp. common shares 1.90 Young Inc. common shares 134, ONN Zed Corp. common shares Cont 5186,390 101, 100 40,200 Face Value $165,00 96.720 39,500 "The fair value adjustments were recorded on December 31, 2019, Johnson had no other debt and equity investments at December 31, 2019, other than those shown above. During 2020, Johnson engaged in the following transactions: Jan. 17 Sold 1,450 common shares of Young Inc. for $69.000 oson Inc planned to hold these shares for less than one year Mar Purchased 6.400 common shares of Allen Corn for 3.000 The aponta 30% ownership in Allen Corp June received dividends from Allen Corp. at the rate of $1.00 per har Aug 14 Sold the remaining Young Me shares $12.00 Nov. 20 Purchased ownership in Davis Corp by acou 11,400 shares a total of 101,46 Johnson he will sell these shares in to nine months Dec. Sold 11,400 shares of Xavier Corporation for $13.400 Dec. 31 Allen Core announced a net profit of $20,000 for the Required: Journalize the above transactions View transaction that Journal entry worksheet Proy 4 of 4 Next to search Analysis Component: Assume the Allen Corp. shares were sold on January 16, 2021, for $378,000. Calculate the investment income or loss and select whether it is unrealized/realized?