Question

When the bonds mature at the end of Year 4, what amount of principal will Olive pay investors? How much cash was received on the

When the bonds mature at the end of Year 4, what amount of principal will Olive pay investors?

How much cash was received on the day the bonds were issued (sold)?

Were the bonds issued at a premium or a discount? If so, what was the amount of the premium or discount?

How much cash will be disbursed for interest each period and in total over the life of the bonds?

What is the coupon rate? (Enter your answer as a percentage rounded to 1 decimal place (i.e. 0.123 should be entered as 12.3).)

What was the annual market rate of interest on the date the bonds were issued? (Enter your answer as a percentage rounded to 1 decimal place (i.e. 0.123 should be entered as 12.3).)

What amount of interest expense will be reported on the income statement for Year 2 and Year 3? (Round your final answers to nearest whole dollar amount.)

What amount will be reported on the balance sheet at the end of Year 2 and Year 3?

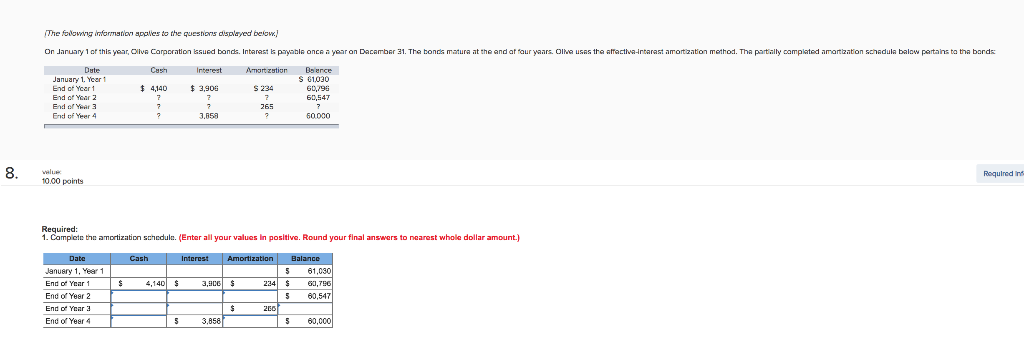

The folowing informshon apales to the queshons dispayed below Dute January 1. Yeer Cush Inberestmarstion Baence S 1030 60,547 60000 4,140 3,90 i $ 234 60,9 End of Yeer 4 3,65 Roquired Int 0.00 points Required: 1. Camp ctn the amortization schedul. (Enter all your values In positive. Round your final answers to nearest whole dollar amount.) Janusry 1, Year 1 5 61,030 End of Yeer 2 5 60,547 End of Year 4 5 3.858Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started