Question

1. You are interested in how investors react to announcement that a firm will issue new debt. Your colleague thinks that these events are uninformativethat

1. You are interested in how investors react to announcement that a firm will issue new debt. Your colleague thinks that these events are uninformative—that they do not elicit any market reactions. You, on the other hand, believe that investors see debt issuance as good news, and thus reactions to this type of announcement should be positive. You think that way because debt is cheaper than equity, and the company may be in a better shape being funded by cheap capital.

You proceed to contrast your colleague’s story against yours. You collect a random sample of 167 announcements of debt issuance. Each data point i in the sample is a firm F and a date t such that F announces on day t that it will issue new debt. Then, for each announcement, you compute the abnormal return, ARi, of the firm over the announcement day. Abnormal return is defined as firm return minus market return. Recall the notion of abnormal return: if nothing else is going on, the abnormal return should be equal to zero. Your analysis reveals that the average of the ARi measures over all data points was +1.03%, while the standard deviation of the AR measures was 7.30%.

Use the data above to formally analyze your idea that such announcements are informative. Treat your colleague’s story as the null hypothesis and your story as the alternative hypothesis.

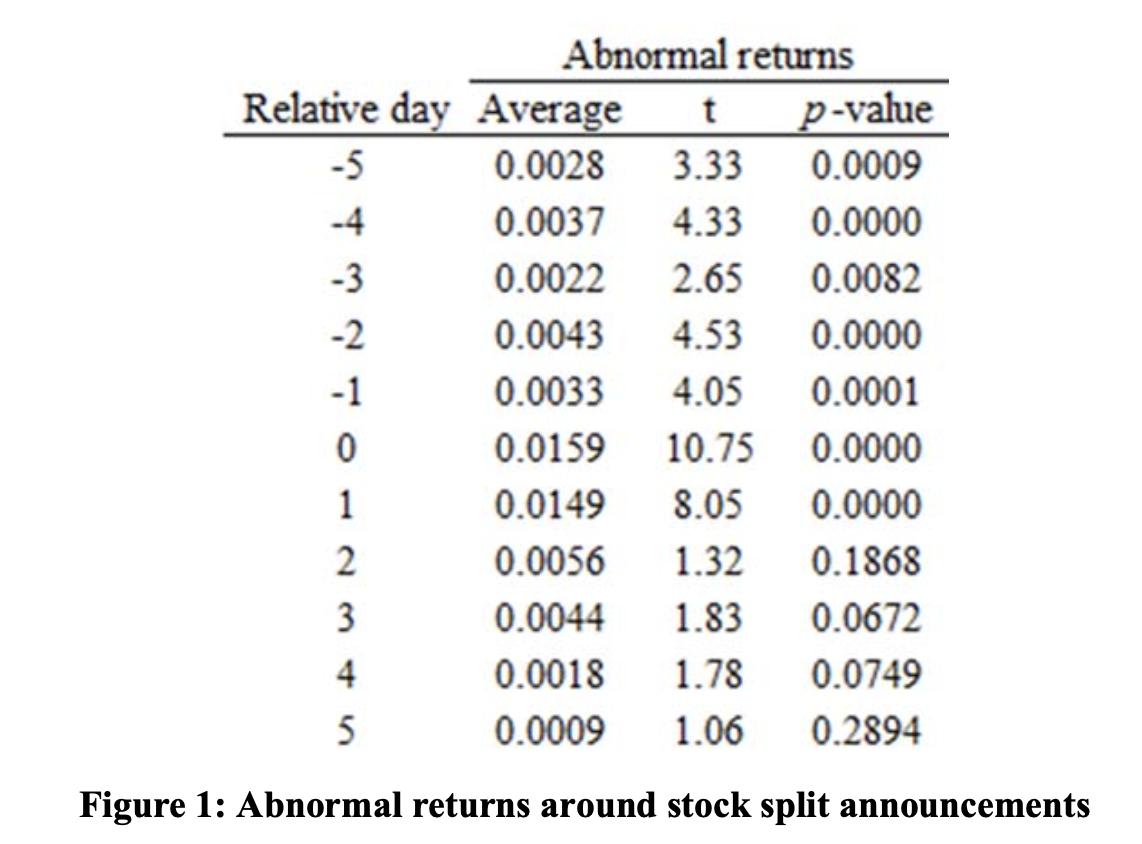

2. Apple announced last year that it was splitting its stock 7-to-1. That means each stock eventually broken into seven stocks. Consequently, the price of the new stock should be the old price divided by seven. As expressed by the Wall Street Journal, “splits don’t change anything fundamentally about a company or its valuation.” Thus, announcing a stock split should not matter for firm valuation. Let’s analyze this.

An event study tracks what happens when firms announce that they will split their stock. The sample consists of 1,117 such announcements (the announcement by Apple is not included in this study). The pattern appears in Figure 1. Take the first row of the table, for example: it states that average abnormal returns across firms announcing a stock split for the 5th trading day preceding the announcement is +28 basis points, or 0.28%.

Discuss whether announcing a stock split conveys good news, bad news or no news for the firm. Analyze whether there is leakage of the announcement. You can assume that some announcements happen after trading hours.

Abnormal returns Relative day Average t p-value -5 0.0028 3.33 0.0009 0.0037 4.33 0.0000 -3 0.0022 2.65 0.0082 -2 0.0043 4.53 0.0000 -1 0.0033 4.05 0.0001 0 0.0159 10.75 0.0000 1 0.0149 8.05 0.0000 2 0.0056 1.32 0.1868 3 0.0044 1.83 0.0672 4 0.0018 1.78 0.0749 5 0.0009 1.06 0.2894 Figure 1: Abnormal returns around stock split announcements

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

A stock split happens when a company increases the number of its shares to boost the stocks liquidity Although the number of shares outstanding increases by a specific multiple the total dollar value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started