Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Inventory) This problem is meant to help you understand the thought behind the elimination entries for intercompany inventory sales, when some the items are

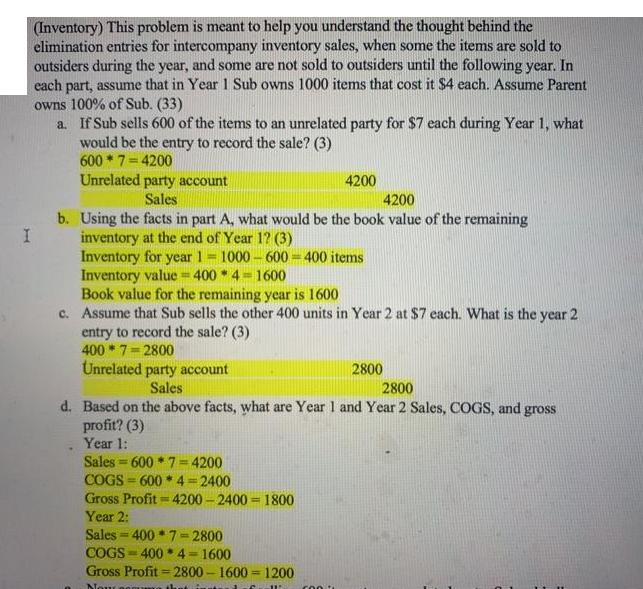

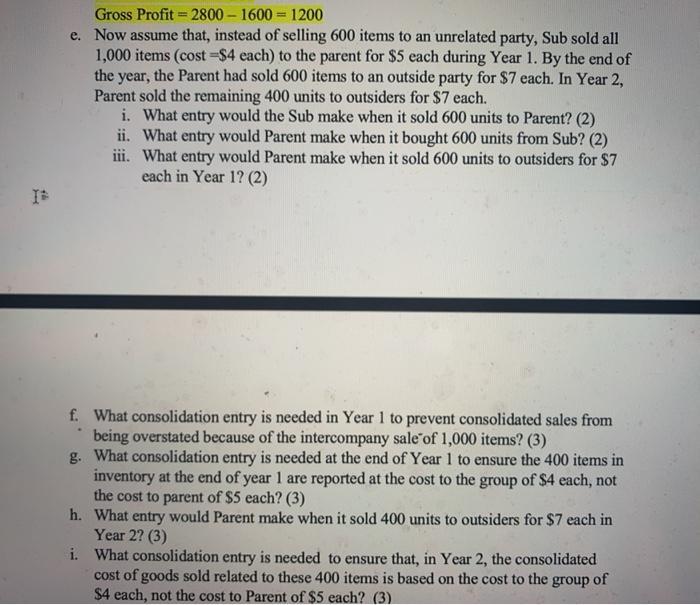

(Inventory) This problem is meant to help you understand the thought behind the elimination entries for intercompany inventory sales, when some the items are sold to outsiders during the year, and some are not sold to outsiders until the following year. In each part, assume that in Year 1 Sub owns 1000 items that cost it $4 each. Assume Parent owns 100% of Sub. (33) a. If Sub sells 600 of the items to an unrelated party for $7 each during Year 1, what would be the entry to record the sale? (3) 600*7=4200 Unrelated party account Sales 4200 b. Using the facts in part A, what would be the book value of the remaining I inventory at the end of Year 12 (3) Inventory for year 1= 1000-600-400 items Inventory value = 400*4=1600 Book value for the remaining year is 1600 c. Assume that Sub sells the other 400 units in Year 2 at $7 each. What is the year 2 entry to record the sale? (3) 400*7=2800 Unrelated party account Sales COGS 600*4 = 2400 Gross Profit=4200-2400-1800 2800 d. Based on the above facts, what are Year 1 and Year 2 Sales, COGS, and gross profit? (3) Year 1: Sales 600*7=4200 Year 2: Sales 400 7=2800 COGS 400*4=1600 Gross Profit=2800-1600-1200 Now som = 4200 15 500 2800 X th Gross Profit=2800-1600-1200 e. Now assume that, instead of selling 600 items to an unrelated party, Sub sold all 1,000 items (cost-$4 each) to the parent for $5 each during Year 1. By the end of the year, the Parent had sold 600 items to an outside party for $7 each. In Year 2, Parent sold the remaining 400 units to outsiders for $7 each. i. What entry would the Sub make when it sold 600 units to Parent? (2) ii. What entry would Parent make when it bought 600 units from Sub? (2) iii. What entry would Parent make when it sold 600 units to outsiders for $7 each in Year 1? (2) f. What consolidation entry is needed in Year 1 to prevent consolidated sales from being overstated because of the intercompany sale of 1,000 items? (3) g. What consolidation entry is needed at the end of Year 1 to ensure the 400 items in inventory at the end of year 1 are reported at the cost to the group of $4 each, not the cost to parent of $5 each? (3) h. What entry would Parent make when it sold 400 units to outsiders for $7 each in Year 2? (3) i. What consolidation entry is needed to ensure that, in Year 2, the consolidated cost of goods sold related to these 400 items is based on the cost to the group of $4 each, not the cost to Parent of $5 each? (3)

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Sales 5000 To cost of Goods sold 5000 b Sales 200...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started