a. 9,900,000 b. 9,700,000 c. 9,550,000 d. 9,750,000 The following accounts appear from the trial balance of RAIN Inc. as of December 31, 2019: Petty

a. 9,900,000

b. 9,700,000

c. 9,550,000

d. 9,750,000

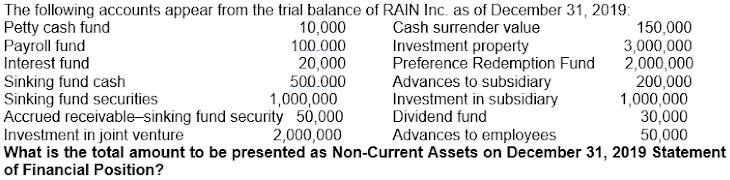

The following accounts appear from the trial balance of RAIN Inc. as of December 31, 2019: Petty cash fund 10,000 Cash surrender value 100.000 20,000 500.000 Payroll fund Interest fund Sinking fund cash Sinking fund securities 1,000,000 Accrued receivable-sinking fund security 50,000 Investment property Preference Redemption Fund Advances to subsidiary Investment in subsidiary Dividend fund Advances to employees 150,000 3,000,000 2,000,000 200,000 1,000,000 30,000 50,000 Investment in joint venture 2,000,000 What is the total amount to be presented as Non-Current Assets on December 31, 2019 Statement of Financial Position?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

c 9550000 Working notes Computation of NonCurrent Asstes on December 312019 Particulars Amount Sin...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started