Answered step by step

Verified Expert Solution

Question

1 Approved Answer

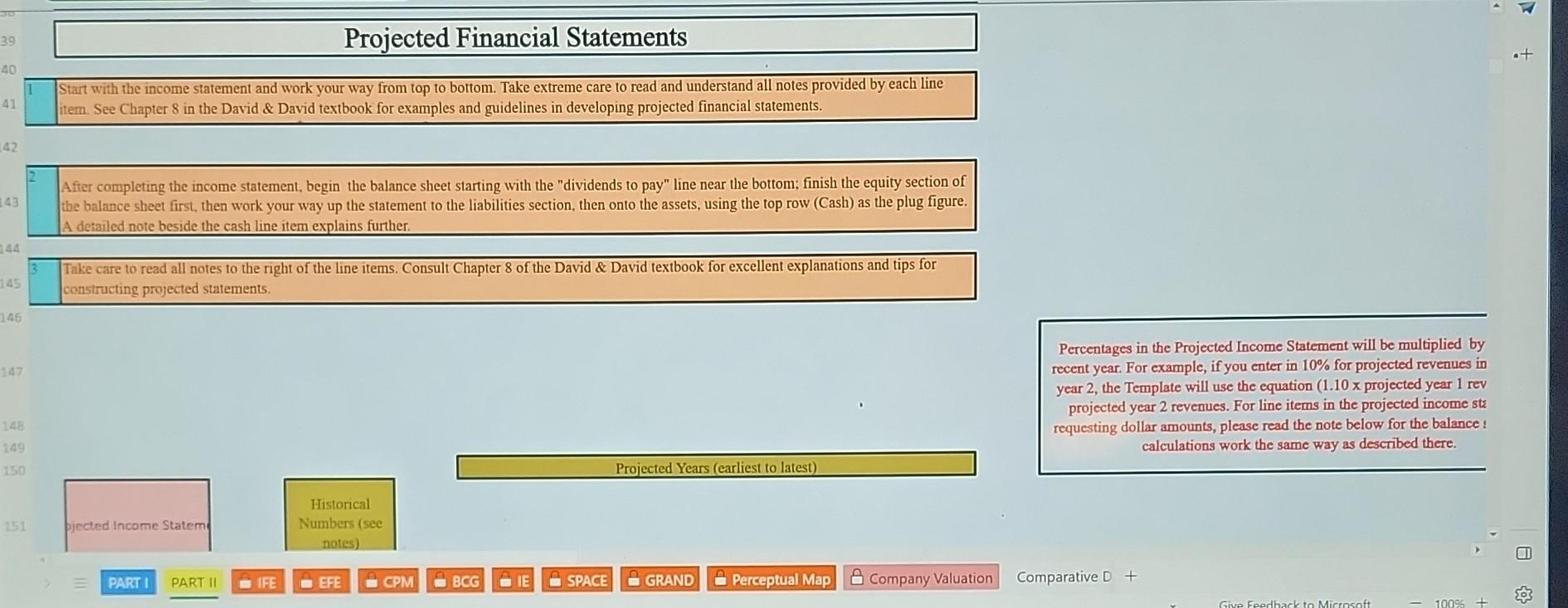

For the company Nike. Projected Financial Statements Start with the income statement and work your way from top to bottom. Take extreme care to read

For the company Nike.

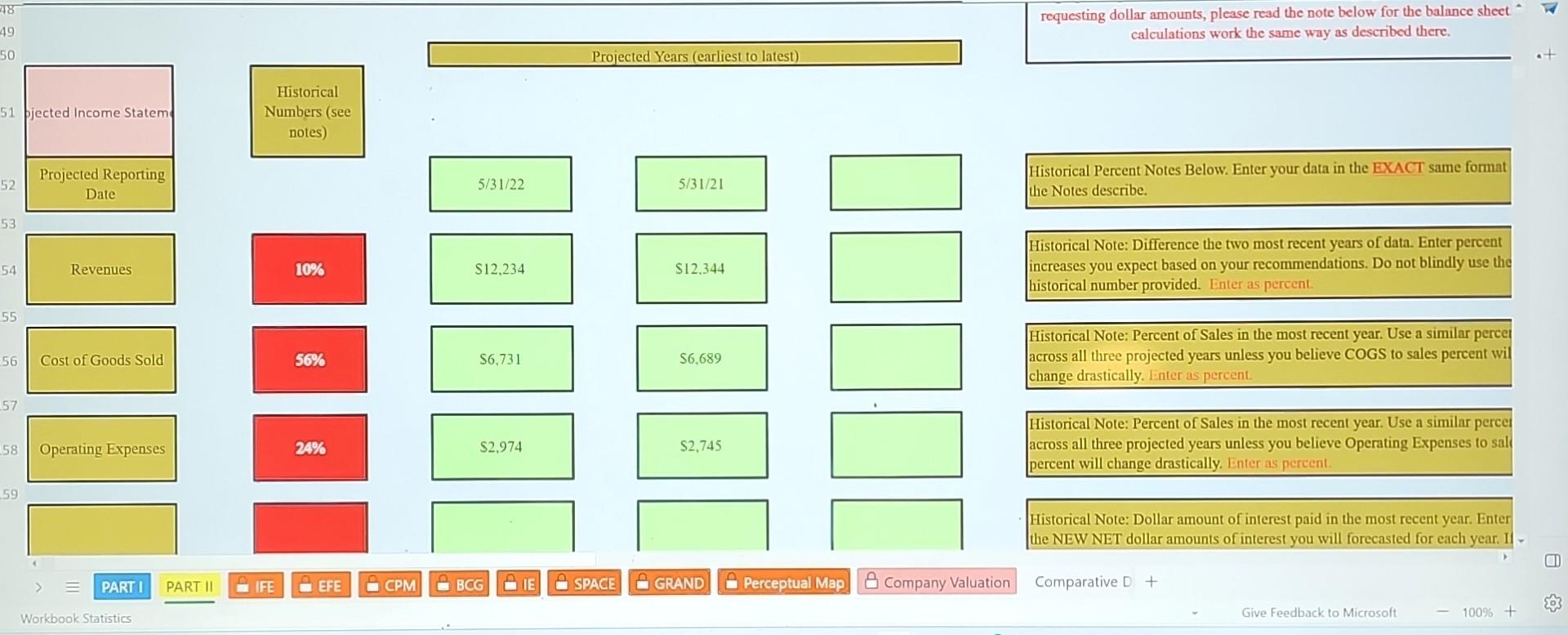

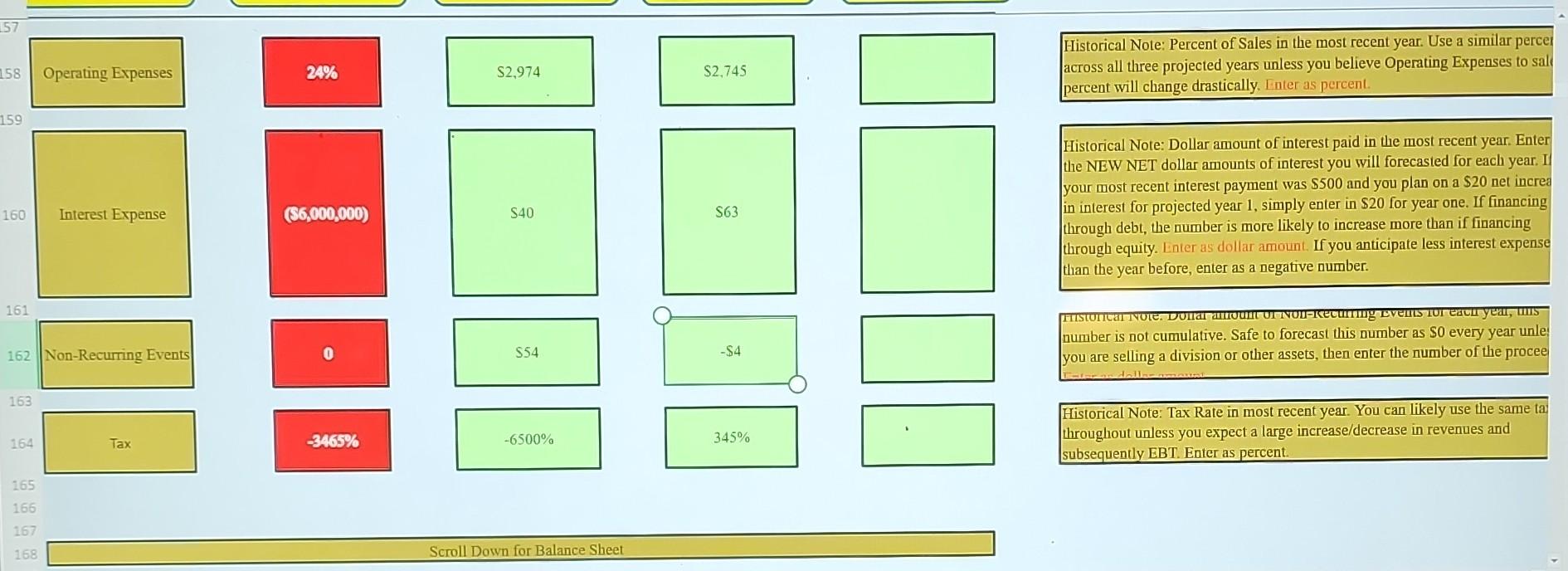

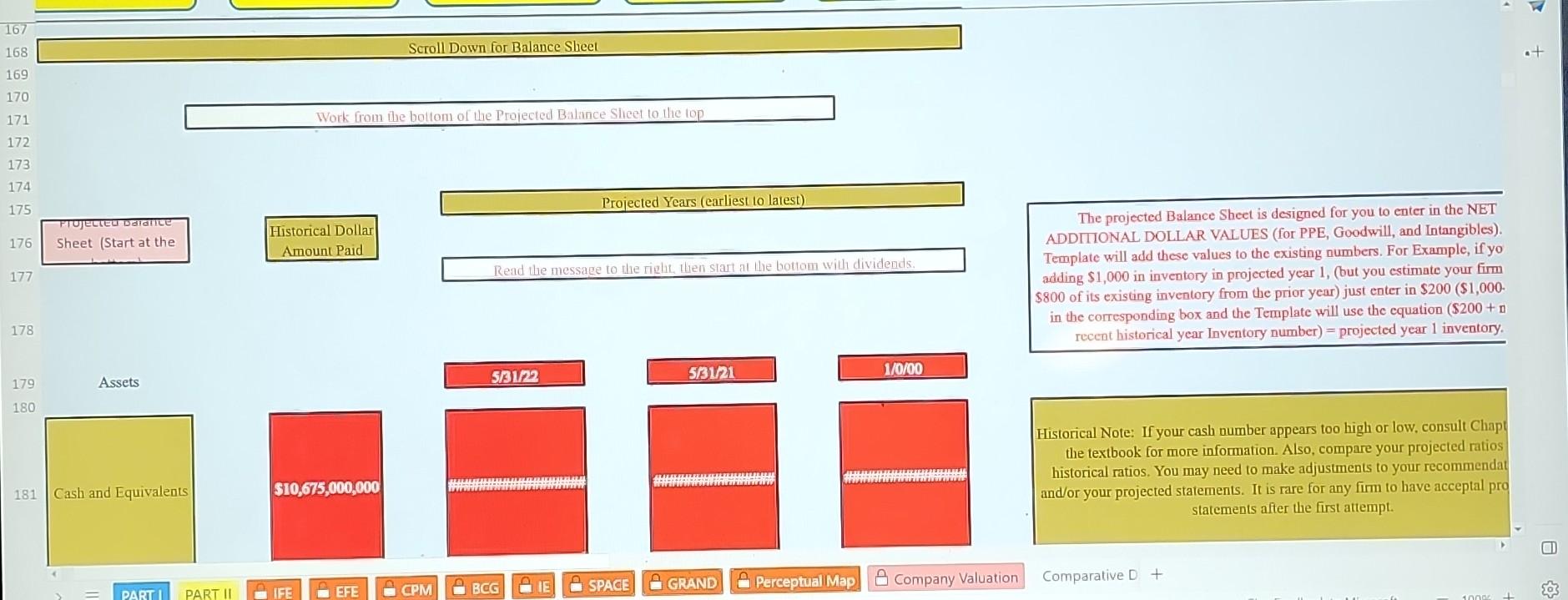

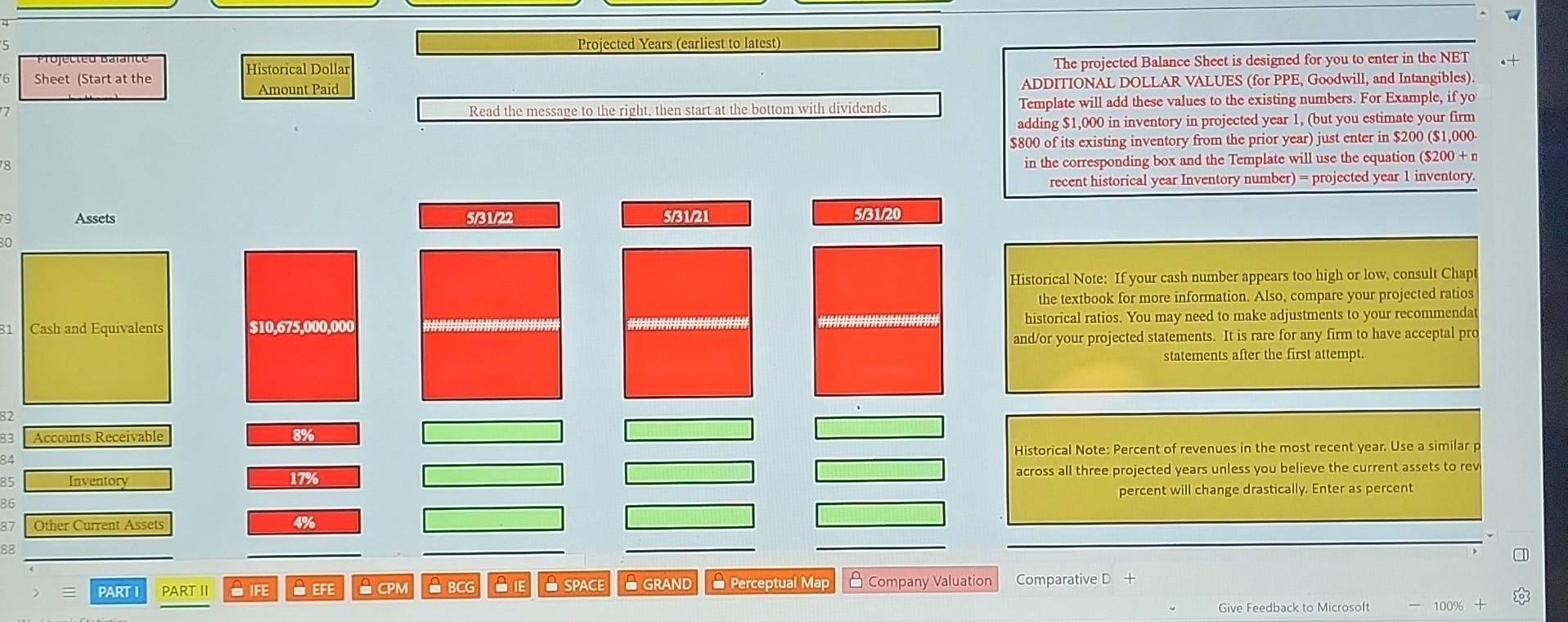

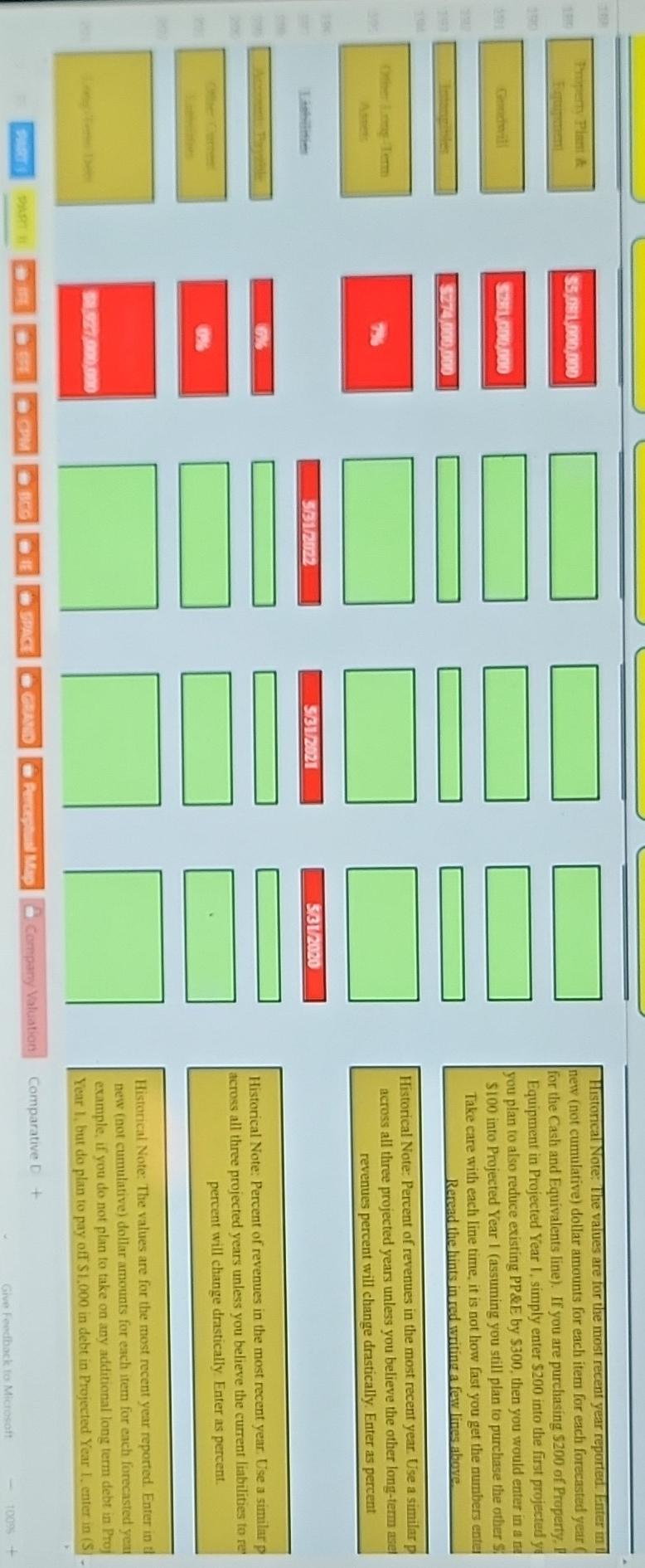

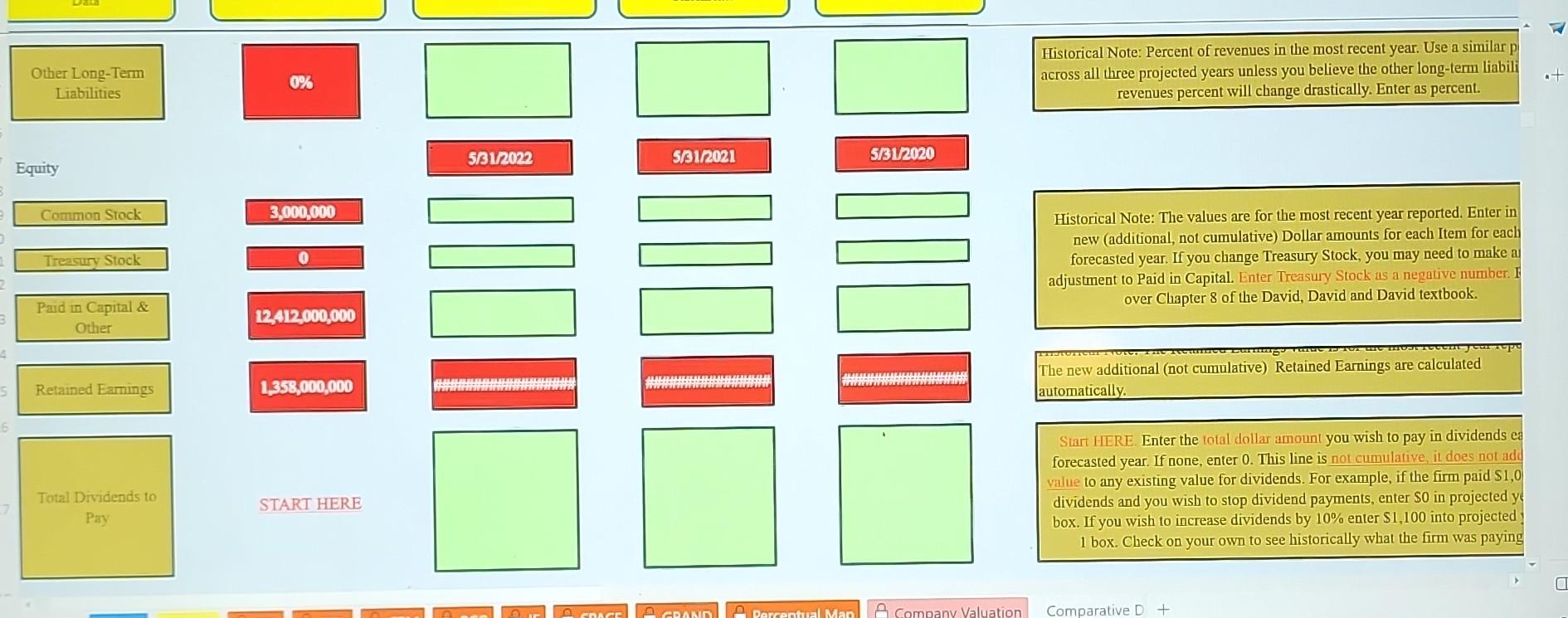

Projected Financial Statements Start with the income statement and work your way from top to bottom. Take extreme care to read and understand all notes provided by each line item. See Chapter 8 in the David \& David textbook for examples and guidelines in developing projected financial statements. After completing the income statement, begin the balance sheet starting with the "dividends to pay" line near the bottom; finish the equity section of A detailed note beside the cash line item explains further. Take care to read all notes to the right of the line items. Consult Chapter 8 of the David \& David textbook for excellent explanations and tips for structing projected statements. Percentages in the Projected Income Statement will be multiplied by recent year. For example, if you enter in 10% for projected revenues in year 2 , the Template will use the equation (1.10x projected year 1 rev projected year 2 revenues. For line items in the projected income st requesting dollar amounts, please read the note below for the balance calculations work the same way as described there. calculations work the same way as described there. Projected Years (earliest to latest) PART I PART B IFE BEFE BCPMBBCGBB SPACE B GRAND B Perceptual Map A company Valuation Comparative D \begin{tabular}{|c|c|c|c|c|} \hline Operating Expenses & 24% & $2,974 & $2,745 & \begin{tabular}{l} Historical Note: Percent of Sales in the most recent year. Use a similar perceel \\ across all three projected years unless you believe Operating Expenses to sall \\ percent will change drastically. Finter as percent. \end{tabular} \\ \hline Interest Expense & (85,000,000) & $40 & $63 & \\ \hline Non-Recurring Events & 0 & $54 & $4 & \\ \hline Tax & 3465% & 6500% & 345% & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline & & & & & \\ \hline & & solione & \begin{tabular}{|l|l|} salaneal \\ \end{tabular} & \begin{tabular}{|l|l|} SBS120200 \\ \end{tabular} & \\ \hline Carmon Sioct & 3000000 & & & & \\ \hline sary sock & 0 & & & & \\ \hline & & & & & \\ \hline & & + & & & \\ \hline & START HERR & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started