Answered step by step

Verified Expert Solution

Question

1 Approved Answer

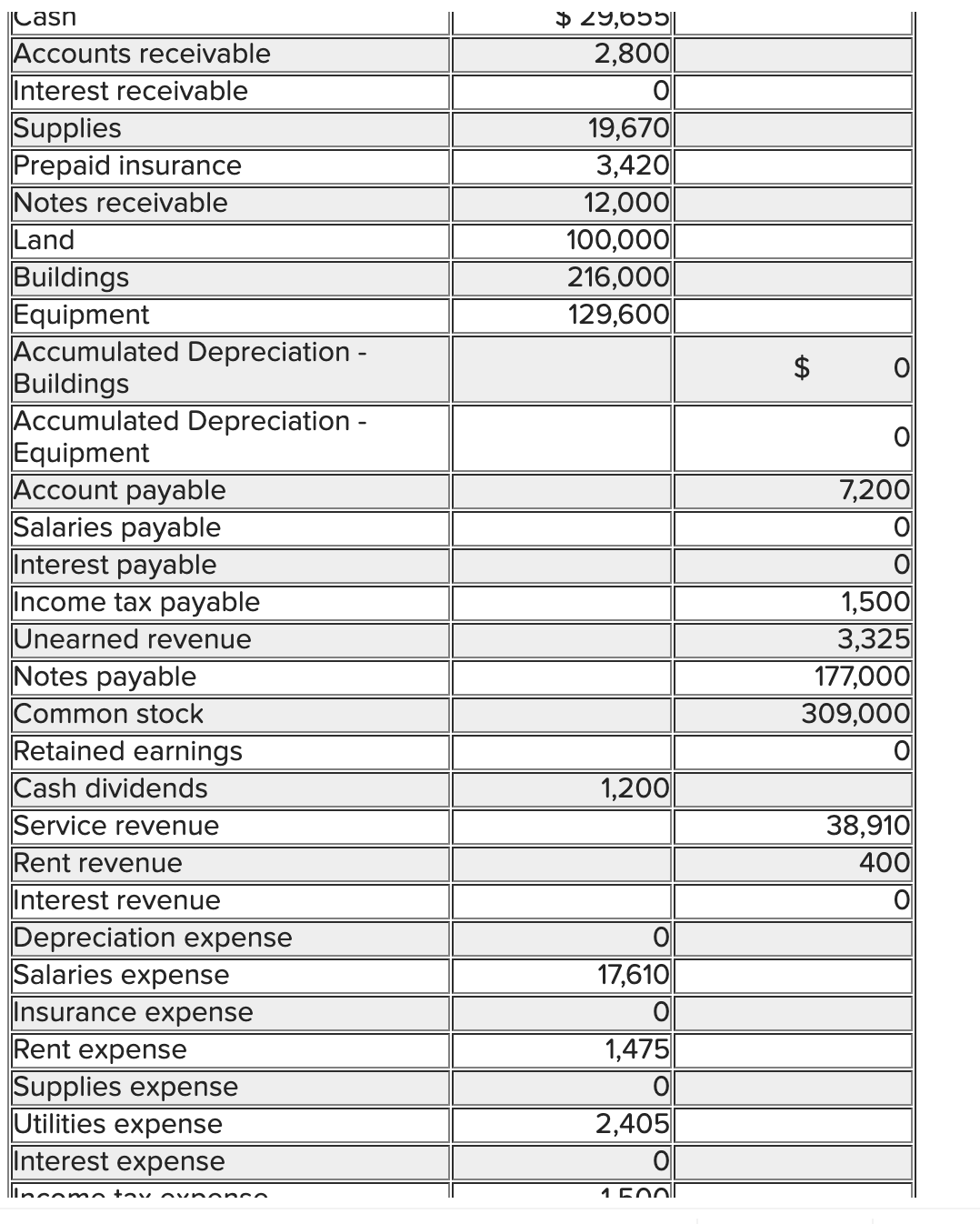

For The DR Consulting Company you are given the following Unadjusted Trial Balance at the end of December, the second month of business. You are

For The DR Consulting Company you are given the following Unadjusted Trial Balance at the end of December, the second month of business. You are also given the information for adjusting entries. Prepare the necessary adjusting entries at the end of the second month presuming no adjusting entries were done at the end of November. If additional information does not require an adjusting entry, input No transaction needed" in the first line of the journal entry.table CashAccounts receivable,Interest receivable,SuppliesPrepaid insurance,Notes receivable,LandBuildingsEquipmenttableAccumulated Depreciation BuildingstabletableAccumulated Depreciation EquipmentAccount payable,,Salaries payable,,income tax expense, Interest payable,, Record the entries from these numbers. Additional information:

DR Consulting determined that the prepaid insurance was paid at the beginning of November and is for months of insurance benefits that began at the beginning of November.

DR Consulting determined there are $ of supplies remaining at the end of December.

The equipment has been owned by the company since November and is depreciated using the straightline method of depreciation over a year period and is estimated to be worth $ at the end of the ten years.

The building has been owned by the company since November and is depreciated using the straightline method of depreciation over a year period and is estimated to be worth $ at the end of the years.

The company has agreed to provide consulting services for Timmy Carter for $ Timmy will pay DR Consulting when the services are completed. As of December the company has provided of the services, but has not billed or recorded the services already provided.

The note receivable for $ was obtained by providing services to a customer. The services were completed December The customer agreed to pay the principal and interest of the note in months on February

DR Consulting has agreed to complete consulting work for Lonny Kennedy starting in January. Lonny has agreed to pay DR Consulting $ for the services that will be provided.

A client paid DR Consulting $ for consulting services to be provided during the months of DecemberFebruary. As of the end of December DR has provided of those services.

The company has an employee they have agreed to pay $day The employee worked days at the end of December for which the employee has not been paid, and the salary has not been recorded.

The note payable for $ with an interest rate was obtained on November to purchase the Land & Building. The company is required to make annual payments of $ every October The company has not done any accruals for this note.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started