Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You were appointed the manager of Storage solutions section ( S 3 ) at M lbank lechnologies, a manutacturer ot mobile computing parts and accessories

You were appointed the manager of Storage solutions section at Mlbank lechnologies, a manutacturer ot mobile computing parts and accessories late last year. S manufactures a drive assembly for the company's most popular product. Your bonus is determined as a percentage of your division's operating profits before taxes.

One of your first major investment decisions was to invest $ million in automated testing equipment for device testing. The equipment was installed and in operation on January of this year.

This morning, the assistant manager of the division told you about an offer by Joliet Systems. Joliet wants to rent to S a new testing machine that could be installed on December only two weeks from now for an annual rental charge of $ The new equipment would enable you to increase your division's annual revenue by percent. This new, more efficient machine would also decrease fixed cash expenditures by percent.

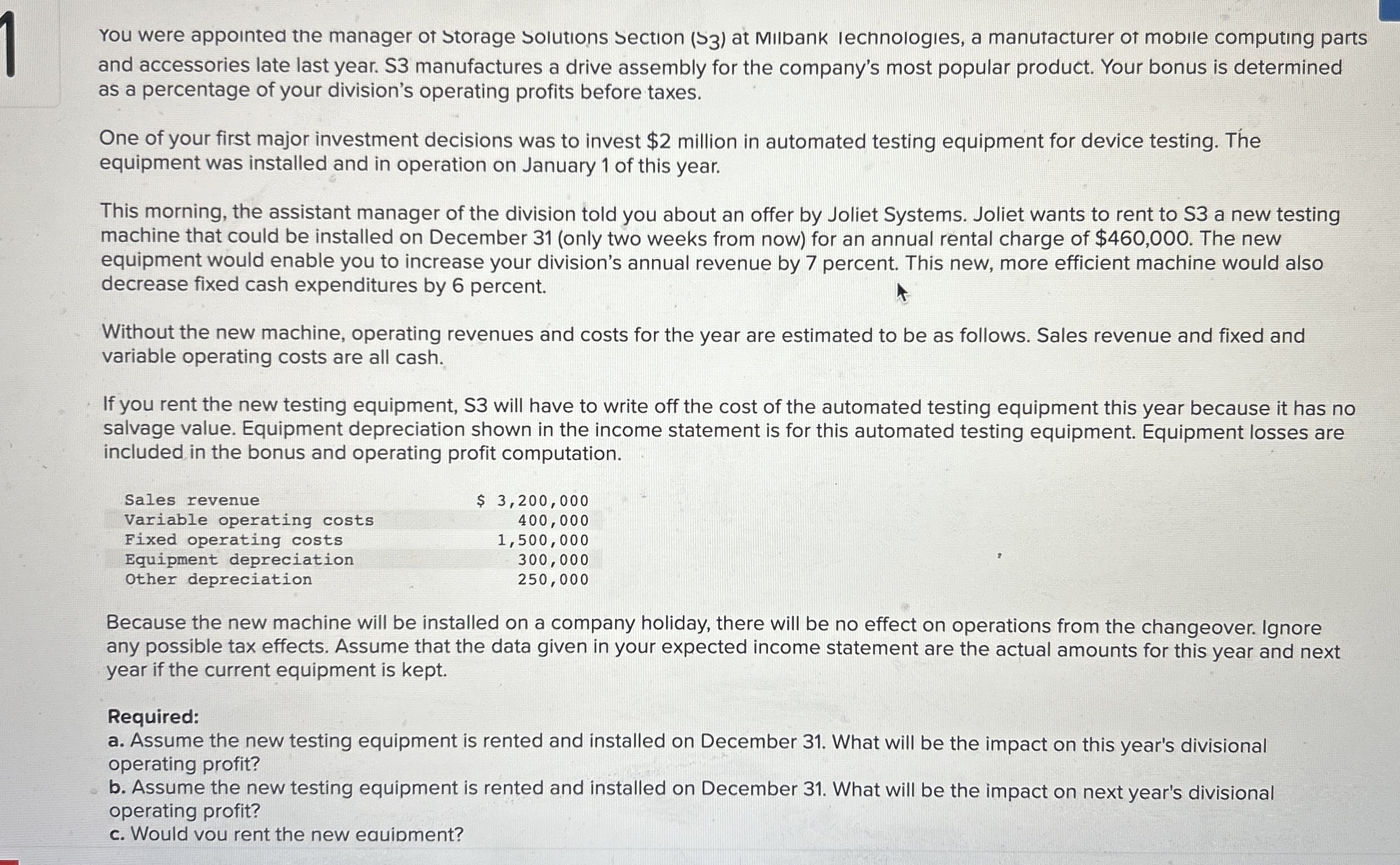

Without the new machine, operating revenues and costs for the year are estimated to be as follows. Sales revenue and fixed and variable operating costs are all cash.

If you rent the new testing equipment, S will have to write off the cost of the automated testing equipment this year because it has no salvage value. Equipment depreciation shown in the income statement is for this automated testing equipment. Equipment losses are included in the bonus and operating profit computation.

tableSales revenue,$

You were appointed the manager of Storage solutions section at Mlbank lechnologies, a manutacturer ot mobile computing parts and accessories late last year. S manufactures a drive assembly for the company's most popular product. Your bonus is determined as a percentage of your division's operating profits before taxes.

One of your first major investment decisions was to invest $ million in automated testing equipment for device testing. The equipment was installed and in operation on January of this year.

This morning, the assistant manager of the division told you about an offer by Joliet Systems. Joliet wants to rent to S a new testing machine that could be installed on December only two weeks from now for an annual rental charge of $ The new equipment would enable you to increase your division's annual revenue by percent. This new, more efficient machine would also decrease fixed cash expenditures by percent.

Without the new machine, operating revenues and costs for the year are estimated to be as follows. Sales revenue and fixed and variable operating costs are all cash.

If you rent the new testing equipment, S will have to write off the cost of the automated testing equipment this year because it has no salvage value. Equipment depreciation shown in the income statement is for this automated testing equipment. Equipment losses are included in the bonus and operating profit computation.

tableSales revenue,$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started