Answered step by step

Verified Expert Solution

Question

1 Approved Answer

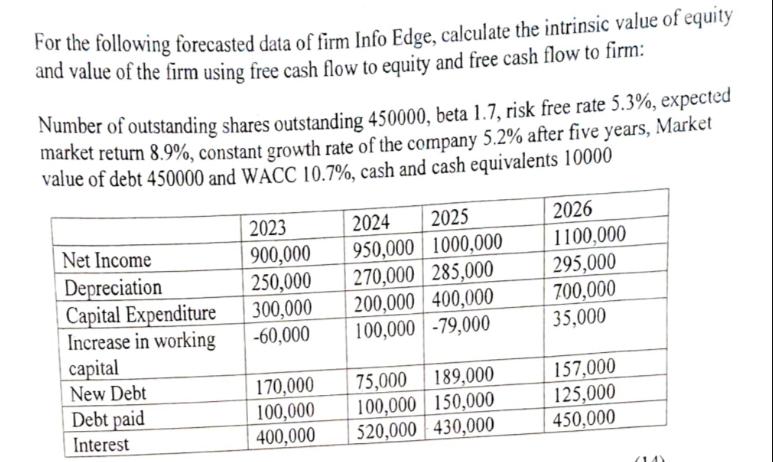

For the following forecasted data of firm Info Edge, calculate the intrinsic value of equity and value of the firm using free cash flow

For the following forecasted data of firm Info Edge, calculate the intrinsic value of equity and value of the firm using free cash flow to equity and free cash flow to firm: Number of outstanding shares outstanding 450000, beta 1.7, risk free rate 5.3%, expected market return 8.9%, constant growth rate of the company 5.2% after five years, Market value of debt 450000 and WACC 10.7%, cash and cash equivalents 10000 Net Income Depreciation Capital Expenditure Increase in working capital New Debt Debt paid Interest 2023 900,000 250,000 300,000 -60,000 2024 2025 950,000 1000,000 270,000 285,000 200,000 400,000 100,000 -79,000 75,000 189,000 100,000 150,000 430,000 170,000 100,000 400,000 $20,000 2026 1100,000 295,000 700,000 35,000 157,000 125,000 450,000

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

For the following forecasted data of firm Info Edgecalculate the intrinsic value of equity and value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started