Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Over the past 40 years, interest rates have varied widely. The rate for a 30-year mortgage reached a high of 14.75% in July 1984,

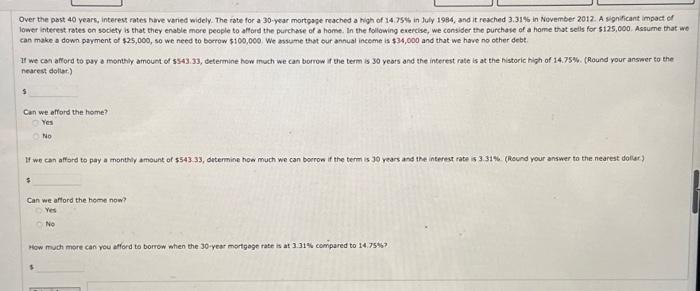

Over the past 40 years, interest rates have varied widely. The rate for a 30-year mortgage reached a high of 14.75% in July 1984, and it reached 3.31% in November 2012. A significant impact of lower interest rates on society is that they enable more people to afford the purchase of a home. In the following exercise, we consider the purchase of a home that sells for $125,000. Assume that we can make a down payment of $25,000, so we need to borrow $100,000. We assume that our annual income is $34,000 and that we have no other debt. If we can afford to pay a monthly amount of $543.33, determine how much we can borrow if the term is 30 years and the interest rate is at the historic high of 14.75%. (Round your answer to the nearest dollar) S Can we afford the home? Yes No If we can afford to pay a monthly amount of $543.33, determine how much we can borrow if the term is 30 years and the interest rate is 3.31% (Round your answer to the nearest dollar) $ Can we afford the home now? Yes No How much more can you afford to borrow when the 30-year mortgage rate is at 3.31% compared to 14.75%7

Step by Step Solution

★★★★★

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To determine how much you can borrow at a given interest rate term and monthly payment we can use a mortgage calculation formula The formula to calculate the loan amount is Loan Amount Monthl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started