Answered step by step

Verified Expert Solution

Question

1 Approved Answer

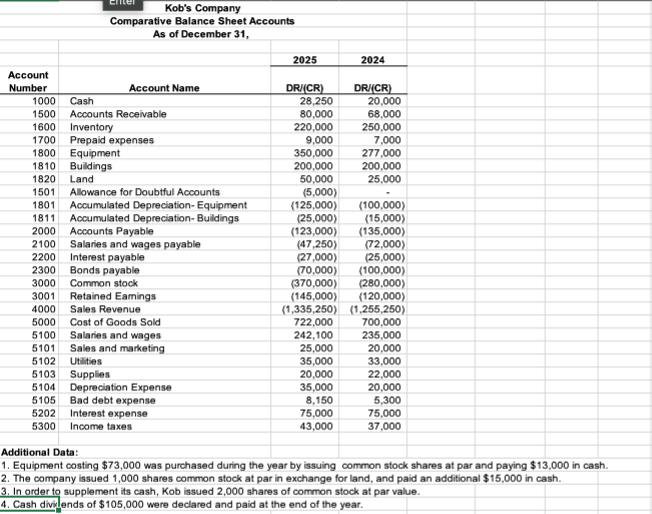

For the following problem: 1. Create balance sheet 2. Create cash flow worksheet and cash flow statement Account Number criter Kob's Company Comparative Balance Sheet

For the following problem:

1. Create balance sheet

2. Create cash flow worksheet and cash flow statement

Account Number criter Kob's Company Comparative Balance Sheet Accounts As of December 31, Account Name 1000 Cash 1500 Accounts Receivable 1600 Inventory 1700 Prepaid expenses 1800 Equipment 1810 Buildings 1820 Land 1501 Allowance for Doubtful Accounts 1801 Accumulated Depreciation- Equipment 1811 Accumulated Depreciation-Buildings 2000 Accounts Payable 2100 Salaries and wages payable 2200 Interest payable 2300 Bonds payable 3000 Common stock 3001 Retained Earnings 4000 Sales Revenue 5000 Cost of Goods Sold 5100 Salaries and wages 5101 Sales and marketing 5102 5103 5104 5105 5202 5300 Utilities Supplies Depreciation Expense Bad debt expense Interest expense Income taxes 2025 DR/(CR) 28,250 80,000 220,000 9,000 350,000 200,000 50,000 2024 35,000 8,150 DR/(CR) (5,000) (125,000) (25,000) (123,000) (135,000) (47,250) (72,000) (27,000) (25,000) (70,000) (100,000) (370,000) (280,000) (145,000) 75,000 43,000 20,000 68,000 250,000 7,000 277,000 200,000 25,000 (120,000) (1,335,250) (1,255,250) 722,000 242,100 25,000 35,000 20,000 (100,000) (15,000) 700,000 235,000 20,000 33,000 22,000 20,000 5,300 75,000 37,000 Additional Data: 1. Equipment costing $73,000 was purchased during the year by issuing common stock shares at par and paying $13,000 in cash. 2. The company issued 1,000 shares common stock at par in exchange for land, and paid an additional $15,000 in cash. 3. In order to supplement its cash, Kob issued 2,000 shares of common stock at par value. 4. Cash dividends of $105,000 were declared and paid at the end of the year.

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Here is a possible balance sheet for Robs Company as of December 31 2024 and 2025 based on the comparative balance sheet accounts and the additional data Account 2024 2025 Assets Cash and cash equival...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started