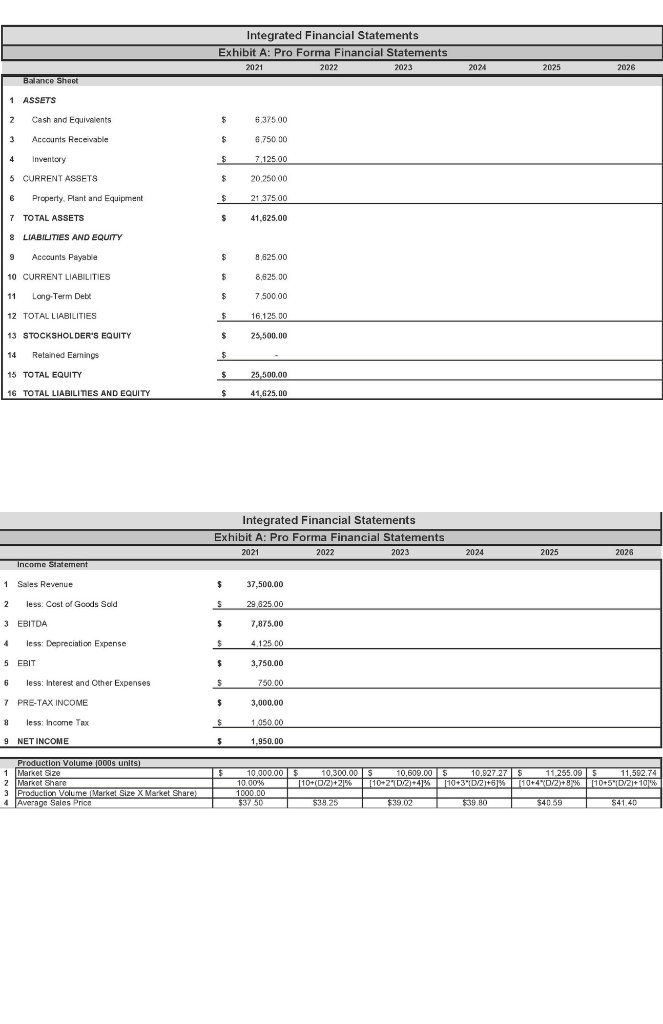

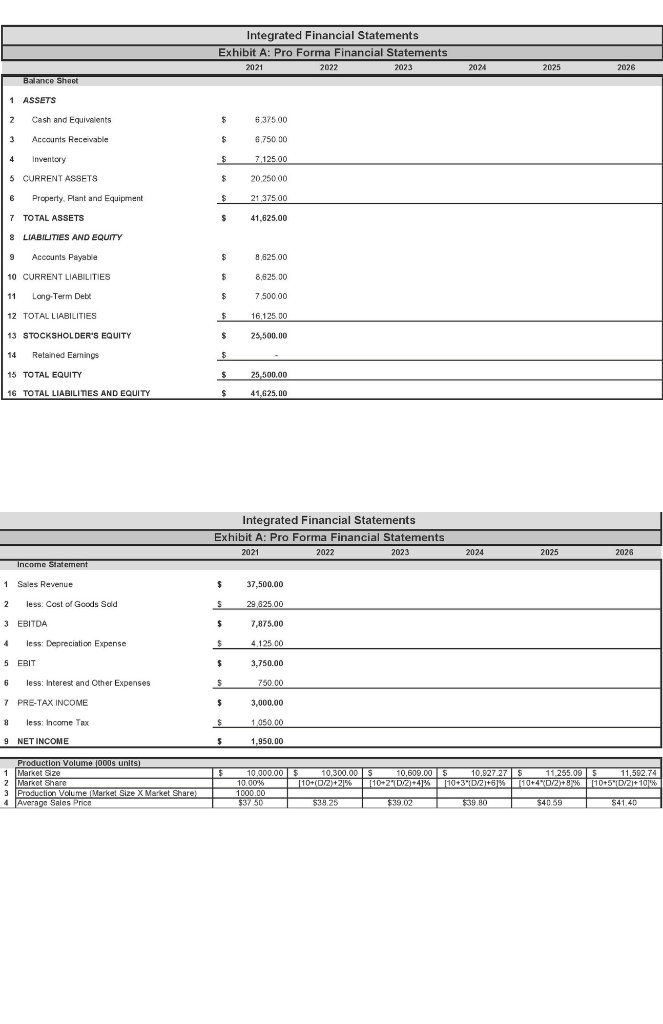

For the following problems, use Exhibit A. For exhibit A, the amount of sales depends on the production volume shown below. The dividend policy is to pay 29% in dividends. Construct the Production volume table based on your student ID number as per the instructions shown below

- What will be the accounts payable for 2024?

Integrated Financial Statements Exhibit A: Pro Forma Financial Statements 2021 2022 2023 2024 2025 2026 Balance Sheet 1 ASSETS 2 Cash and Equivalents $ 6.375 00 3 Accounts Receivable $ 6.750 00 4 4 Inventory $ 7,125.00 5 CURRENT ASSETS $ 20.250 00 6 Property. Plant and Equipment $ 21 375.00 7 TOTAL ASSETS $ 41,625.00 8 LIABILITIES AND EQUITY $ 8.625.00 Accounts Payable 10 CURRENT LIABILITIES $ 8,625.00 11 Long-Term Debe $ $ 7,500.00 16.125.00 12 TOTAL LIABILITIES 13 STOCKSHOLDER'S EQUITY $ 25.500,00 14 Retained Earnings $ 15 TOTAL EQUITY $ 25,500.00 16 TOTAL LIABILITIES AND EQUITY $ 41,625.00 Integrated Financial Statements Exhibit A: Pro Forma Financial Statements 2021 2022 2023 2024 2025 2026 Income Statement 1 Sales Revenue $ 37,500.00 2 less. Cost of Goods Sold 5 29 625.00 3 EBITDA $ 7,875.00 $ 4.125.00 4 less: Depreciation Expense 5 EBIT $ 3,750.00 6 less: Interest and Other Expenses 5 750.00 7 PRE-TAX INCOME $ $ 3,000.00 8 less: Income Tax $ 1.050 oC 9 NET INCOME $ 1,950.00 Production Volume 1000s units) 1 Market Size 2 Market Share 3 Production Volume (Market Size X Market Share) 4 Average Sales Prion 10.000.00 $ 10,300.00 S 10,609.00 $ 10.827 275 11.255.095 11,592.74 10.00% [+ 10+(0/2+21% 110-2D2+4% 10+3 10/21+63% 119+490/2+9% 10+5 10/21+10% 6% 10)9941106T12% 1000.00 $37.50 $38.25 539.02 $39.80 $40.59 S41.40 Integrated Financial Statements Exhibit A: Pro Forma Financial Statements 2021 2022 2023 2024 2025 2026 Balance Sheet 1 ASSETS 2 Cash and Equivalents $ 6.375 00 3 Accounts Receivable $ 6.750 00 4 4 Inventory $ 7,125.00 5 CURRENT ASSETS $ 20.250 00 6 Property. Plant and Equipment $ 21 375.00 7 TOTAL ASSETS $ 41,625.00 8 LIABILITIES AND EQUITY $ 8.625.00 Accounts Payable 10 CURRENT LIABILITIES $ 8,625.00 11 Long-Term Debe $ $ 7,500.00 16.125.00 12 TOTAL LIABILITIES 13 STOCKSHOLDER'S EQUITY $ 25.500,00 14 Retained Earnings $ 15 TOTAL EQUITY $ 25,500.00 16 TOTAL LIABILITIES AND EQUITY $ 41,625.00 Integrated Financial Statements Exhibit A: Pro Forma Financial Statements 2021 2022 2023 2024 2025 2026 Income Statement 1 Sales Revenue $ 37,500.00 2 less. Cost of Goods Sold 5 29 625.00 3 EBITDA $ 7,875.00 $ 4.125.00 4 less: Depreciation Expense 5 EBIT $ 3,750.00 6 less: Interest and Other Expenses 5 750.00 7 PRE-TAX INCOME $ $ 3,000.00 8 less: Income Tax $ 1.050 oC 9 NET INCOME $ 1,950.00 Production Volume 1000s units) 1 Market Size 2 Market Share 3 Production Volume (Market Size X Market Share) 4 Average Sales Prion 10.000.00 $ 10,300.00 S 10,609.00 $ 10.827 275 11.255.095 11,592.74 10.00% [+ 10+(0/2+21% 110-2D2+4% 10+3 10/21+63% 119+490/2+9% 10+5 10/21+10% 6% 10)9941106T12% 1000.00 $37.50 $38.25 539.02 $39.80 $40.59 S41.40