Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For the fourth discussion question of the quarter, we are going to examine a few bonds and determine which seems like the best investment

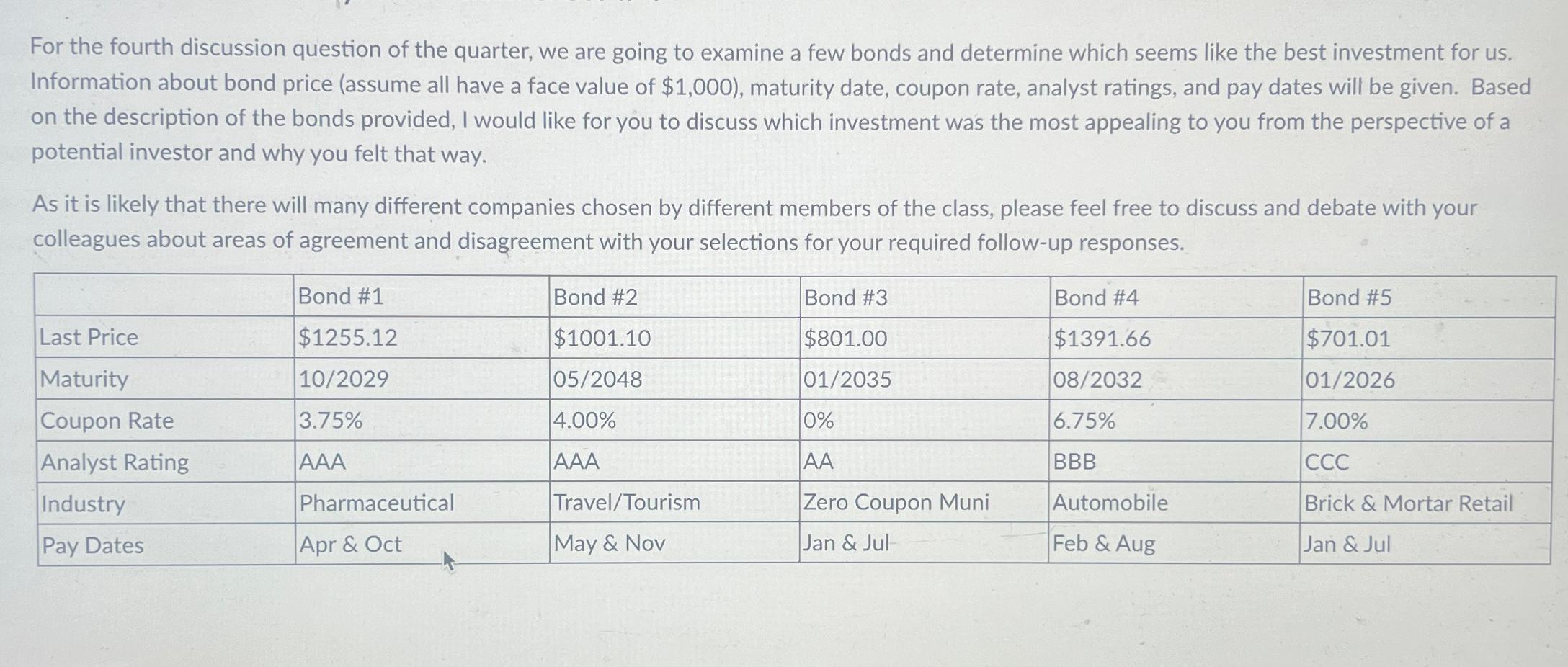

For the fourth discussion question of the quarter, we are going to examine a few bonds and determine which seems like the best investment for us. Information about bond price (assume all have a face value of $1,000), maturity date, coupon rate, analyst ratings, and pay dates will be given. Based on the description of the bonds provided, I would like for you to discuss which investment was the most appealing to you from the perspective of a potential investor and why you felt that way. As it is likely that there will many different companies chosen by different members of the class, please feel free to discuss and debate with your colleagues about areas of agreement and disagreement with your selections for your required follow-up responses. Bond #1 Bond #2 Last Price $1255.12 $1001.10 Bond #3 $801.00 Bond #4 $1391.66 Bond #5 $701.01 Maturity 10/2029 05/2048 01/2035 08/2032 01/2026 Coupon Rate 3.75% 4.00% 0% Analyst Rating AAA AAA AA 6.75% BBB 7.00% CCC Industry Pay Dates Pharmaceutical Apr & Oct Travel/Tourism Zero Coupon Muni Automobile Brick & Mortar Retail May & Nov Jan & Jul Feb & Aug Jan & Jul

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started