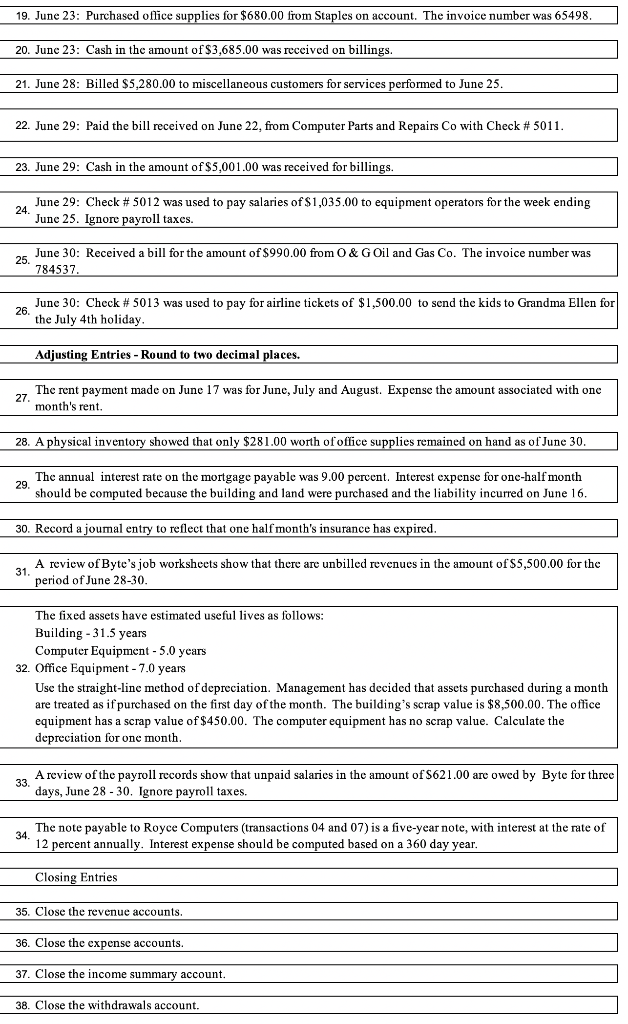

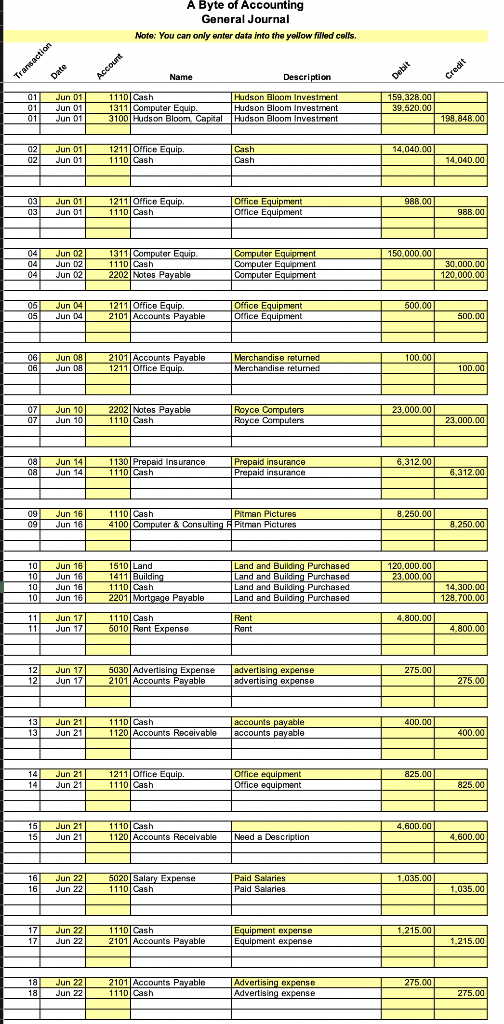

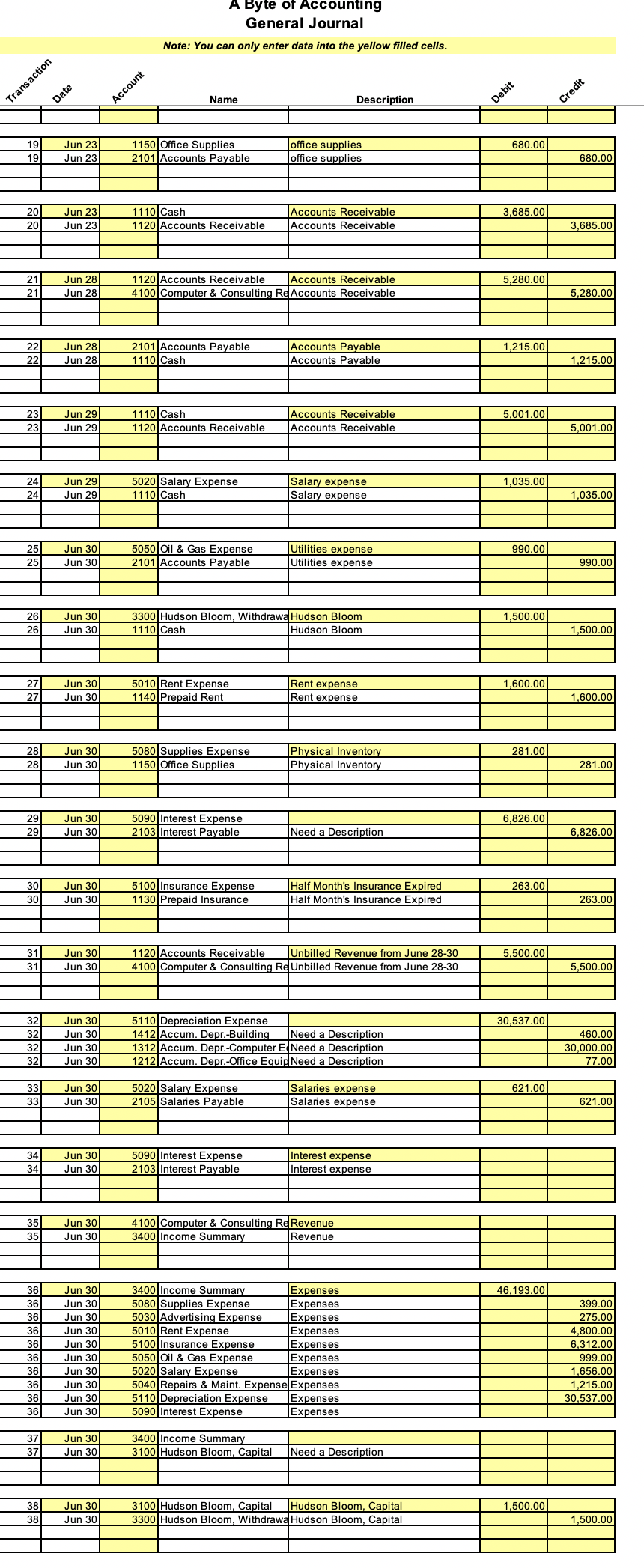

For the general journal, the transactions that I have entered for lines 2,11,13,15,17,22,28,29,32,34,35,36, and 37 have errors. Attached are the transactions and the journal answers I entered. Can you please show me what the errors are and how to correct them? (If unable to assist with all errors, if you could please focus on #32, #34, and #36 I have calculated several times and keep returning errors if you could provide the calculations)

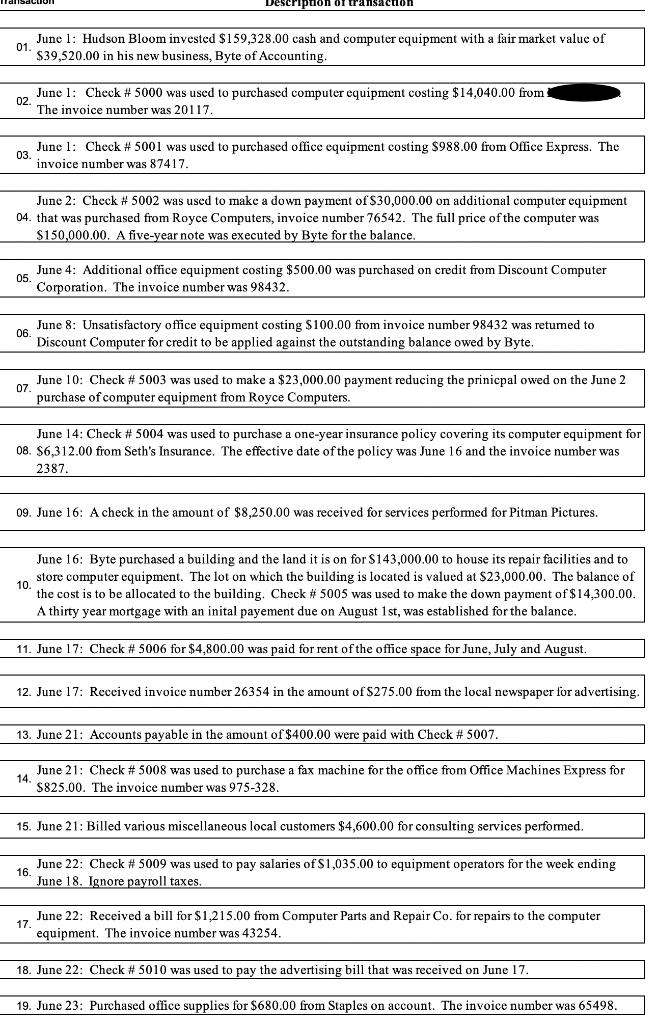

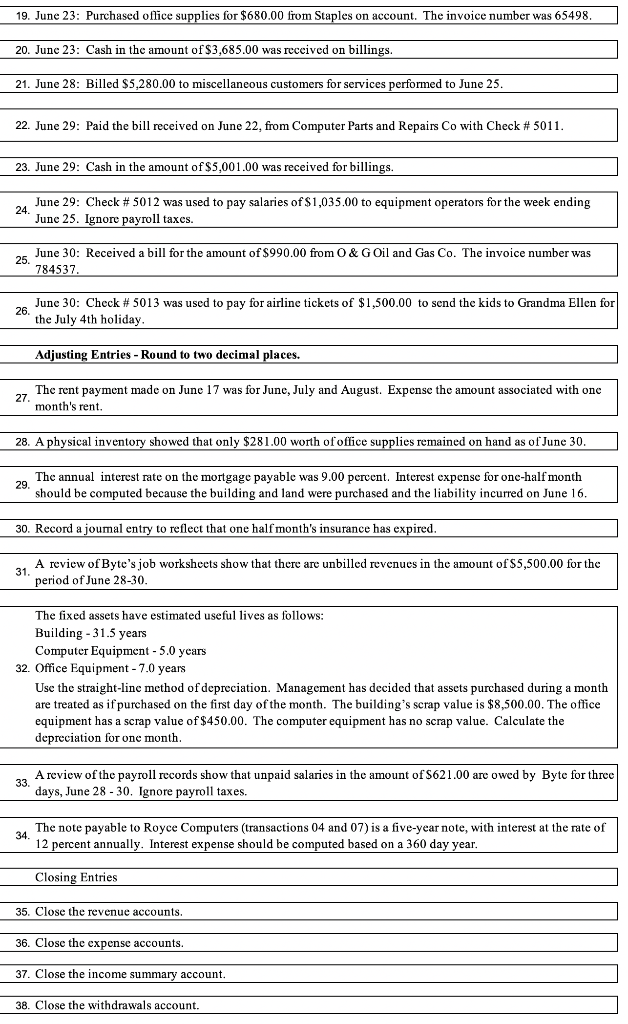

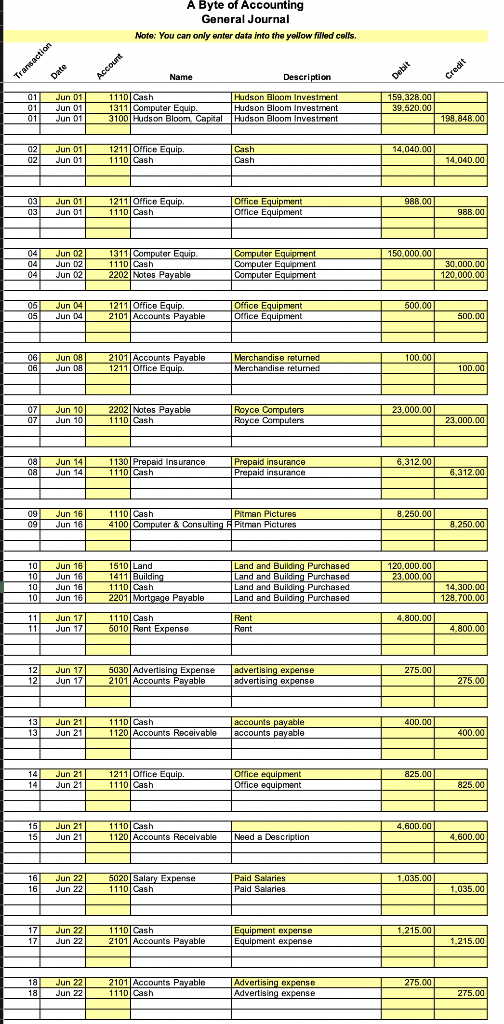

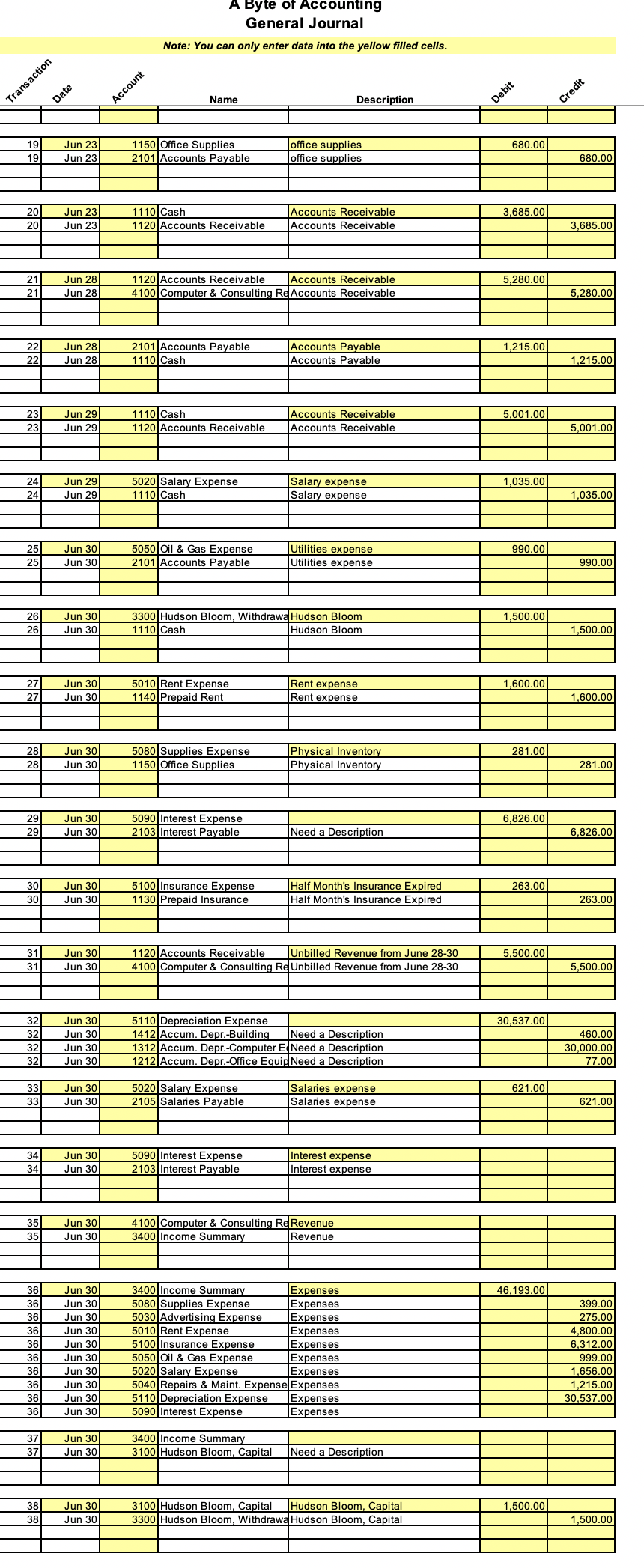

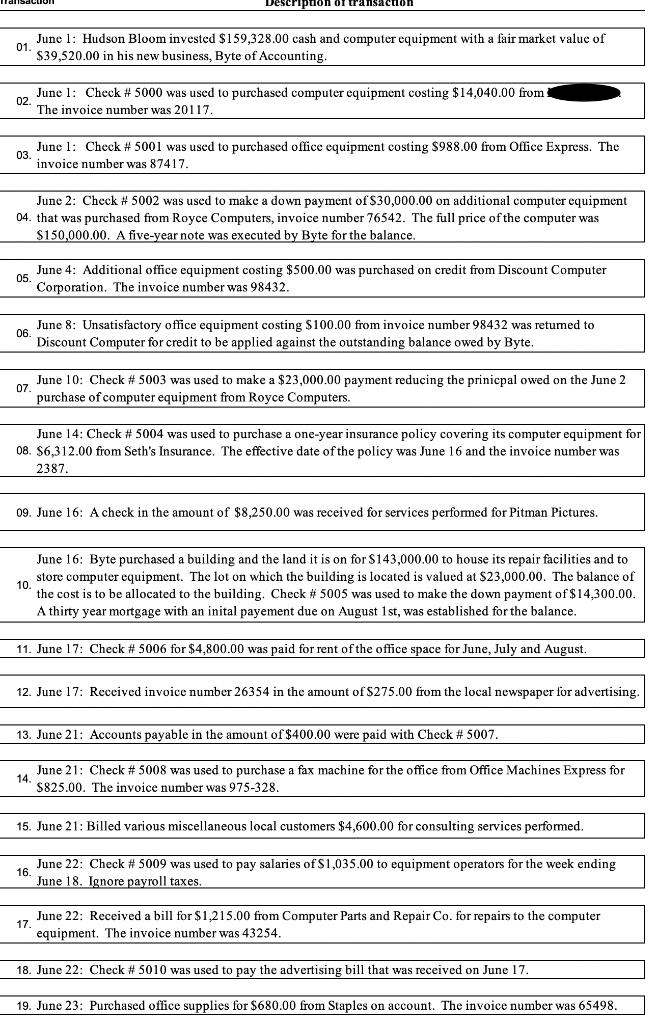

Description 0f transactin June 1 Hudson Bloom invested $159,328.00 cash and computer equipment with a fair market value of 01 $39,520.00 in his new business, Byte of Accounting. Check # 5000 was used to purchased computer equipment costing $14,040.00 from June 1 02 The invoice number was 20117 Check # 5001 was used to purchased office equipment costing $988.00 from Office Express. The June 1 03. invoice number was 87417. June 2: Check # 5002 was used to make a down payment of $30,000.00 on additional computer equipment 04. that was purchased from Royce Computers, invoice number 76542. The full price ofthe computer was $150,000.00. A five-year note was executed by Byte for the balance. June 4: Additional office equipment costing $500.00 was purchased on credit from Discount Computer 05. Corporation. The invoice number was 98432. June 8: Unsatisfactory office equipment costing $100.00 from invoice number 98432 was retumed to 06. Discount Computer for credit to be applied against the outstanding balance owed by Byte. June 10: Check # 5003 was used to make a $23,000.00 payment reducing the prinicpal owed on the June 2 07. purchase of computer equipment from Royce Computers. June 14: Check # 5004 was used to purchase a one-year insurance policy covering its computer equipment for 08. $6,312.00 from Seth's Insurance. The effective date ofthe policy was June 16 and the invoice number was 2387 09. June 16: A check in the amount of $8,250.00 was received for services performed for Pitman Pictures. June 16: Byte purchased a building and the land it is on for $143,000.00 to house its repair facilities and to store computer equipment. The lot on which the building is located is valued at S23,000.00. The balance of 10 the cost is to be allocated to the building. Check # 5005 was used to make the down payment of $14,300.00. A thirty year mortgage with an inital payement due on August 1st, was established for the balance 11. June 17: Check # 5006 for $4,800.00 was paid for rent of the office space for June, July and August. 12. June 17: Received invoice number 26354 in the amount of $275.00 from the local newspaper for advertising 13. June 21: Accounts payable in the amount of$400.00 were paid with Check # 5007 June 21: Check # 5008 was used to purchase a fax machine for the office from Office Machines Express for 14 $825,00. The invoice number was 975-328 15. June 21: Billed various miscellaneous local customers $4,600.00 for consulting services perfomed. June 22: Check # 5009 was used to pay salaries of $1,035.00 to equipment operators for the week ending 16. June 18. Ignore payroll taxes. June 22: Received a bill for $1,215.00 from Computer Parts and Repair Co. for repairs to the computer 17. equipment. The invoice number was 43254 18. June 22: Check # 5010 was used to pay the advertising bill that was received on June 17. 19. June 23: Purchased office supplies for $680.00 from Staples on account. The invoice number was 65498. 19. June 23: Purchased oflice supplies for $680.00 from Staples on account. The invoice number was 65498. 20. Junc 23: Cash in the amount of $3,685.00 was received on billings. 21. June 28: Billed $5,280.00 to miscellaneous customers for services performed to June 25 22. June 29: Paid the bill received on June 22, from Computer Parts and Repairs Co with Check # 5011 23. June 29: Cash in the amount of $5,00 1.00 was received for billings June 29: Check # 5012 was used to pay salaries of $1,035.00 to equipment operators for the week ending 24 June 25. Ignore payroll taxes June 30: Received a bill for the amount of $990.00 from O & G Oil and Gas Co. The invoice number was 25. 784537 June 30: Check # 5013 was used to pay for airline tickets of $1,500.00 to send the kids to Grandma Ellen for 26. the July 4th holiday Adjusting Entries - Round to two decimal places. The rent payment made on June 17 was for June, July and August. Expensc the amount associated with one 27. month's rent 28. A physical inventory showed that only $281.00 worth of office supplies remained on hand as of June 30 The annual interest rate on the mortgage payable was 9.00 pcrcent. Interest expensc for onc-halfmonth 29. should be computed because the building and land were purchased and the liability incurred on June 16. 30. Record a joumal entry to reflect that one half month's insurance has expired A review of Byte's job worksheets show that there are unbilled revenues in the amount of S5,500.00 for the 31 period of June 28-30. The fixed assets have estimated useful lives as follows: Building 31.5 years Computer Equipment - 5.0 years 32. Office Equipment 7.0 years Use the straight-linc method of depreciation. Managcment has decided that assets purchascd during a month are treated as ifpurchased on the first day of the month. The building's scrap value is $8,500.00. The office equipment has a scrap value of $450.00. The computer equipment has no scrap value. Calculate the depreciation for one month Arevicw of the payroll records show that unpaid salarics in the amount of $621.00 arc owed by Byte for threc 33. days, June 28 - 30. Ignore payroll taxes The note payable to Royce Computers (transactions 04 and 07) is a five-year note, with interest at the rate of 34. 12 percent annually. Interest expense should be computed based on a 360 day year Closing Entries 35. Close the revenue accounts. 36. Close the expense accounts 37. Close the income summary account 38. Close the withdrawals account A Byte of Accounting General Journal Note: You can only enter data into the yellow filled cells. Transaction Date Name Description Account 1110 Cash 1311 Computer Equip. 3100 Hudson Bloom. Capital Hudson Bloom Investment 159,328.00] 39,520.00 01 01 Jun 01 Jun 01 Hudson Bloom Investment Hudson Bloom Investment 01 Jun 01 198,848.00 1211 Office Equip 1110 Cash 14,040.00 02 Cash Cash Jun 01 14,040.00 02 Jun 01 GBB.00 1211 Office Equip 111D Cash Office Equipment Office Equipment Jun 01 Jun 01 03 988.00 03 988.00 1311 Computer Equip. 04 Jun 02 Jun 02 Jun 02 Computer Equipment Computer Equipment Computer Equipment 150,000.00 04 04 111D Cash 30,00D.00 120,000.00 2202 Notes Payable Office Equipment Office Equipment 1211 Office Equip 2101 Accounts Payable 05 Jun 04 Jun 04 500,00 05 500,00 Jun 08 Jun 08 2101 Accounts Payable 1211 Office Equip. Marchandise returned Merchandise returned 06 06 100.00 100.00 2202 Notes Payable 1110 Cash Royce Computers Rayce Computers 07 Jun 10 23.000,00 07 Jun 10 23,000.00 08 08 1130 Prepaid Insurance 1110 Cash Jun 14 Prepaid insurance Prepaid insurance 6,312.00 Jun 14 6,312.00 8,250.00 1110 Cash 4100 Computer & Consulting E Pitman Pictures Pitman Pictures 09 09 Jun 16 Jun 16 8.250.00 1510 Land 1411 Building 1110 Cash 2201 Mortgage Payable Land and Building Purchased Land and Building Purchased Land and Building Purchased Land and Building Purchased Jun 16 120.000.00 10 10 Jun 16 23,000.00 10 Jun 16 14,300.00 10 Jun 16 128.700.00 1110 Cash 5010 Rent Expense Rent Rent 11 Jun 17 4,800.00 Jun 17 11 4,800.00 advertising expense advertising expense 5030 Advertising Expense 2101 Accounts Payable 275.00 12 Jun 17 12 Jun 17 275.00 13 Jun 21 13 Jun 21 111D Cash 1120 Accounts Receivable |accounts payable accounts pavable 400.00 400.00 1211 Office Equip. 1110 Cash Office equipment Office equipment 14 Jun 21 825.00 Jun 21 14 825.00 Jun 21 Jun 21 111D Cash 1120 Accounts Receivable 15 4,600.00 Naed a Description 4,600.00 15 5020 Salary Expense 1110 Cash 16 Jun 22 Jun 22 Paid Salaries Paid Salaries 1,035.00 16 1,035.00 17 Jun 22 1,215.00 1110 Cash 2101 Accounts Payable Equipment expense Equipment expense 17 Jun 22 1,215.00 Jun 22 2101 Accounts Payable 111D Cash 275.00 Advertising expense Advertising expense. 18 18 Jun 22 275.00 Credit A Byte of Accounting General Journal Note: You can only enter data into the yellow filled cells. Name Description Transaction Account Debit Credit 1150 Office Supplies 2101 Accounts Payable office supplies office supplies 19 Jun 23 680.00 19 Jun 23 680.00 1110 Cash 3,685.00 20 Jun 23 Accounts Receivable 1120 Accounts Receivable 3,685.00 Accounts Receivable 20 Jun 23 5,280.00 1120 Accounts Receivable 4100 Computer & Consulting Re Accounts Receivable Jun 28 21 Accounts Receivable Jun 28 21 5,280.00 Jun 28 Accounts Payable Accounts Payable unts Payable 22 210 1,215.00 1110 Cash 22 Jun 28 1,215.00 Jun 29 1110 Cash 1120 Accounts Receivable Accounts Receivable Accounts Receivable 23 5,001.00 23 Jun 29 5,001.00 5020 Salary Expense 1110 Cash 24 Salary expense Salary expense Jun 29 1,035.00 Jun 29 1,035.00 24 Jun 30 Jun 30 Utilities expense Utilities expense 5050 Oil & Gas Expense 2101 Accounts Payable 25 990.00 25 990.00 Jun 30 Jun 30 3300 Hudson Bloom, Withdrawa Hudson Bloom 1110 Cash 26 1,500.00 Hudson Bloom 26 1,500.00 5010 Rent Expense 1140 Prepaid Rent Rent expense Rent expense Jun 30 27 1,600.00 Jun 30 27 1,600.00 5080 Supplies Expense 1150 Office Supplies Physical Inventory Physical Inventory Jun 30 Jun 30 28 281.00 28 281.00 5090 Interest Expense Jun 30 29 6,826.00 Need a Description 2103 Interest Payable 29 Jun 30 6,826.00 30 5100 Insurance Expense 1130 Prepaid Insurance Half Month's Insurance Expired Half Month's Insurance Expired Jun 30 263.00 30 Jun 30 263.00 1120 Accounts Receivable 4100 Computer & Consulting ReUnbilled Revenue from June 28-30 Unbilled Revenue from June 28-30 Jun 30 31 5.500.00 5,500.00 31 Jun 30 5110 Depreciation Expense 1412 Accum. Depr.-Building 1312 Accum. Depr.-Computer E Need a Description 1212 Accum. Depr.-Office Equip Need a Description 32 Jun 30 30,537.00 Need a Description Jun 30 32 460.00 32 Jun 30 30,000.00 Jun 30 32 77.00 5020 Salary Expense 2105 Salaries Payable Salaries expense Salaries expense 621.00 33 Jun 30 33 Jun 30 621.00 5090 Interest Expense Interest expense Interest expense Jun 30 Jun 30 34 2103 Interest Payable 34 4100 Computer & Consulting Re Revenue 3400 Income Summary Jun 30 Jun 30 35 Revenue 35 Jun 30 Jun 30 3400 Income Summary 5080 Supplies Expense 5030 Advertising Expense Expenses Expenses Expenses Expenses 46,193.00 36 36 399.00 36 Jun 30 275.00 4,800.00 6,312.00 Jun 30 5010 Rent Expense 5100 Insurance Expense 36 36 Jun 30 Expenses Jun 30 5050 Oil & Gas Expense 36 Expenses 999.00 5020 Salary Expense 5040 Repairs & Maint. Expense Expenses 5110 Depreciation Expense 5090 Interest Expense Jun 30 Expenses 1,656.00 36 36 Jun 30 1,215.00 30,537.00 Jun 30 Jun 30 Expenses Expenses 36 36 Jun 30 Jun 30 3400 Income Summary 37 3100 Hudson Bloom, Capital Need a Description 37 Jun 30 3100 Hudson Bloom, Capital 3300 Hudson Bloom, Withdrawa Hudson Bloom, Capital Hudson Bloom, Capital 1,500.00 38 Jun 30 38 1,500.00 Date Description 0f transactin June 1 Hudson Bloom invested $159,328.00 cash and computer equipment with a fair market value of 01 $39,520.00 in his new business, Byte of Accounting. Check # 5000 was used to purchased computer equipment costing $14,040.00 from June 1 02 The invoice number was 20117 Check # 5001 was used to purchased office equipment costing $988.00 from Office Express. The June 1 03. invoice number was 87417. June 2: Check # 5002 was used to make a down payment of $30,000.00 on additional computer equipment 04. that was purchased from Royce Computers, invoice number 76542. The full price ofthe computer was $150,000.00. A five-year note was executed by Byte for the balance. June 4: Additional office equipment costing $500.00 was purchased on credit from Discount Computer 05. Corporation. The invoice number was 98432. June 8: Unsatisfactory office equipment costing $100.00 from invoice number 98432 was retumed to 06. Discount Computer for credit to be applied against the outstanding balance owed by Byte. June 10: Check # 5003 was used to make a $23,000.00 payment reducing the prinicpal owed on the June 2 07. purchase of computer equipment from Royce Computers. June 14: Check # 5004 was used to purchase a one-year insurance policy covering its computer equipment for 08. $6,312.00 from Seth's Insurance. The effective date ofthe policy was June 16 and the invoice number was 2387 09. June 16: A check in the amount of $8,250.00 was received for services performed for Pitman Pictures. June 16: Byte purchased a building and the land it is on for $143,000.00 to house its repair facilities and to store computer equipment. The lot on which the building is located is valued at S23,000.00. The balance of 10 the cost is to be allocated to the building. Check # 5005 was used to make the down payment of $14,300.00. A thirty year mortgage with an inital payement due on August 1st, was established for the balance 11. June 17: Check # 5006 for $4,800.00 was paid for rent of the office space for June, July and August. 12. June 17: Received invoice number 26354 in the amount of $275.00 from the local newspaper for advertising 13. June 21: Accounts payable in the amount of$400.00 were paid with Check # 5007 June 21: Check # 5008 was used to purchase a fax machine for the office from Office Machines Express for 14 $825,00. The invoice number was 975-328 15. June 21: Billed various miscellaneous local customers $4,600.00 for consulting services perfomed. June 22: Check # 5009 was used to pay salaries of $1,035.00 to equipment operators for the week ending 16. June 18. Ignore payroll taxes. June 22: Received a bill for $1,215.00 from Computer Parts and Repair Co. for repairs to the computer 17. equipment. The invoice number was 43254 18. June 22: Check # 5010 was used to pay the advertising bill that was received on June 17. 19. June 23: Purchased office supplies for $680.00 from Staples on account. The invoice number was 65498. 19. June 23: Purchased oflice supplies for $680.00 from Staples on account. The invoice number was 65498. 20. Junc 23: Cash in the amount of $3,685.00 was received on billings. 21. June 28: Billed $5,280.00 to miscellaneous customers for services performed to June 25 22. June 29: Paid the bill received on June 22, from Computer Parts and Repairs Co with Check # 5011 23. June 29: Cash in the amount of $5,00 1.00 was received for billings June 29: Check # 5012 was used to pay salaries of $1,035.00 to equipment operators for the week ending 24 June 25. Ignore payroll taxes June 30: Received a bill for the amount of $990.00 from O & G Oil and Gas Co. The invoice number was 25. 784537 June 30: Check # 5013 was used to pay for airline tickets of $1,500.00 to send the kids to Grandma Ellen for 26. the July 4th holiday Adjusting Entries - Round to two decimal places. The rent payment made on June 17 was for June, July and August. Expensc the amount associated with one 27. month's rent 28. A physical inventory showed that only $281.00 worth of office supplies remained on hand as of June 30 The annual interest rate on the mortgage payable was 9.00 pcrcent. Interest expensc for onc-halfmonth 29. should be computed because the building and land were purchased and the liability incurred on June 16. 30. Record a joumal entry to reflect that one half month's insurance has expired A review of Byte's job worksheets show that there are unbilled revenues in the amount of S5,500.00 for the 31 period of June 28-30. The fixed assets have estimated useful lives as follows: Building 31.5 years Computer Equipment - 5.0 years 32. Office Equipment 7.0 years Use the straight-linc method of depreciation. Managcment has decided that assets purchascd during a month are treated as ifpurchased on the first day of the month. The building's scrap value is $8,500.00. The office equipment has a scrap value of $450.00. The computer equipment has no scrap value. Calculate the depreciation for one month Arevicw of the payroll records show that unpaid salarics in the amount of $621.00 arc owed by Byte for threc 33. days, June 28 - 30. Ignore payroll taxes The note payable to Royce Computers (transactions 04 and 07) is a five-year note, with interest at the rate of 34. 12 percent annually. Interest expense should be computed based on a 360 day year Closing Entries 35. Close the revenue accounts. 36. Close the expense accounts 37. Close the income summary account 38. Close the withdrawals account A Byte of Accounting General Journal Note: You can only enter data into the yellow filled cells. Transaction Date Name Description Account 1110 Cash 1311 Computer Equip. 3100 Hudson Bloom. Capital Hudson Bloom Investment 159,328.00] 39,520.00 01 01 Jun 01 Jun 01 Hudson Bloom Investment Hudson Bloom Investment 01 Jun 01 198,848.00 1211 Office Equip 1110 Cash 14,040.00 02 Cash Cash Jun 01 14,040.00 02 Jun 01 GBB.00 1211 Office Equip 111D Cash Office Equipment Office Equipment Jun 01 Jun 01 03 988.00 03 988.00 1311 Computer Equip. 04 Jun 02 Jun 02 Jun 02 Computer Equipment Computer Equipment Computer Equipment 150,000.00 04 04 111D Cash 30,00D.00 120,000.00 2202 Notes Payable Office Equipment Office Equipment 1211 Office Equip 2101 Accounts Payable 05 Jun 04 Jun 04 500,00 05 500,00 Jun 08 Jun 08 2101 Accounts Payable 1211 Office Equip. Marchandise returned Merchandise returned 06 06 100.00 100.00 2202 Notes Payable 1110 Cash Royce Computers Rayce Computers 07 Jun 10 23.000,00 07 Jun 10 23,000.00 08 08 1130 Prepaid Insurance 1110 Cash Jun 14 Prepaid insurance Prepaid insurance 6,312.00 Jun 14 6,312.00 8,250.00 1110 Cash 4100 Computer & Consulting E Pitman Pictures Pitman Pictures 09 09 Jun 16 Jun 16 8.250.00 1510 Land 1411 Building 1110 Cash 2201 Mortgage Payable Land and Building Purchased Land and Building Purchased Land and Building Purchased Land and Building Purchased Jun 16 120.000.00 10 10 Jun 16 23,000.00 10 Jun 16 14,300.00 10 Jun 16 128.700.00 1110 Cash 5010 Rent Expense Rent Rent 11 Jun 17 4,800.00 Jun 17 11 4,800.00 advertising expense advertising expense 5030 Advertising Expense 2101 Accounts Payable 275.00 12 Jun 17 12 Jun 17 275.00 13 Jun 21 13 Jun 21 111D Cash 1120 Accounts Receivable |accounts payable accounts pavable 400.00 400.00 1211 Office Equip. 1110 Cash Office equipment Office equipment 14 Jun 21 825.00 Jun 21 14 825.00 Jun 21 Jun 21 111D Cash 1120 Accounts Receivable 15 4,600.00 Naed a Description 4,600.00 15 5020 Salary Expense 1110 Cash 16 Jun 22 Jun 22 Paid Salaries Paid Salaries 1,035.00 16 1,035.00 17 Jun 22 1,215.00 1110 Cash 2101 Accounts Payable Equipment expense Equipment expense 17 Jun 22 1,215.00 Jun 22 2101 Accounts Payable 111D Cash 275.00 Advertising expense Advertising expense. 18 18 Jun 22 275.00 Credit A Byte of Accounting General Journal Note: You can only enter data into the yellow filled cells. Name Description Transaction Account Debit Credit 1150 Office Supplies 2101 Accounts Payable office supplies office supplies 19 Jun 23 680.00 19 Jun 23 680.00 1110 Cash 3,685.00 20 Jun 23 Accounts Receivable 1120 Accounts Receivable 3,685.00 Accounts Receivable 20 Jun 23 5,280.00 1120 Accounts Receivable 4100 Computer & Consulting Re Accounts Receivable Jun 28 21 Accounts Receivable Jun 28 21 5,280.00 Jun 28 Accounts Payable Accounts Payable unts Payable 22 210 1,215.00 1110 Cash 22 Jun 28 1,215.00 Jun 29 1110 Cash 1120 Accounts Receivable Accounts Receivable Accounts Receivable 23 5,001.00 23 Jun 29 5,001.00 5020 Salary Expense 1110 Cash 24 Salary expense Salary expense Jun 29 1,035.00 Jun 29 1,035.00 24 Jun 30 Jun 30 Utilities expense Utilities expense 5050 Oil & Gas Expense 2101 Accounts Payable 25 990.00 25 990.00 Jun 30 Jun 30 3300 Hudson Bloom, Withdrawa Hudson Bloom 1110 Cash 26 1,500.00 Hudson Bloom 26 1,500.00 5010 Rent Expense 1140 Prepaid Rent Rent expense Rent expense Jun 30 27 1,600.00 Jun 30 27 1,600.00 5080 Supplies Expense 1150 Office Supplies Physical Inventory Physical Inventory Jun 30 Jun 30 28 281.00 28 281.00 5090 Interest Expense Jun 30 29 6,826.00 Need a Description 2103 Interest Payable 29 Jun 30 6,826.00 30 5100 Insurance Expense 1130 Prepaid Insurance Half Month's Insurance Expired Half Month's Insurance Expired Jun 30 263.00 30 Jun 30 263.00 1120 Accounts Receivable 4100 Computer & Consulting ReUnbilled Revenue from June 28-30 Unbilled Revenue from June 28-30 Jun 30 31 5.500.00 5,500.00 31 Jun 30 5110 Depreciation Expense 1412 Accum. Depr.-Building 1312 Accum. Depr.-Computer E Need a Description 1212 Accum. Depr.-Office Equip Need a Description 32 Jun 30 30,537.00 Need a Description Jun 30 32 460.00 32 Jun 30 30,000.00 Jun 30 32 77.00 5020 Salary Expense 2105 Salaries Payable Salaries expense Salaries expense 621.00 33 Jun 30 33 Jun 30 621.00 5090 Interest Expense Interest expense Interest expense Jun 30 Jun 30 34 2103 Interest Payable 34 4100 Computer & Consulting Re Revenue 3400 Income Summary Jun 30 Jun 30 35 Revenue 35 Jun 30 Jun 30 3400 Income Summary 5080 Supplies Expense 5030 Advertising Expense Expenses Expenses Expenses Expenses 46,193.00 36 36 399.00 36 Jun 30 275.00 4,800.00 6,312.00 Jun 30 5010 Rent Expense 5100 Insurance Expense 36 36 Jun 30 Expenses Jun 30 5050 Oil & Gas Expense 36 Expenses 999.00 5020 Salary Expense 5040 Repairs & Maint. Expense Expenses 5110 Depreciation Expense 5090 Interest Expense Jun 30 Expenses 1,656.00 36 36 Jun 30 1,215.00 30,537.00 Jun 30 Jun 30 Expenses Expenses 36 36 Jun 30 Jun 30 3400 Income Summary 37 3100 Hudson Bloom, Capital Need a Description 37 Jun 30 3100 Hudson Bloom, Capital 3300 Hudson Bloom, Withdrawa Hudson Bloom, Capital Hudson Bloom, Capital 1,500.00 38 Jun 30 38 1,500.00 Date