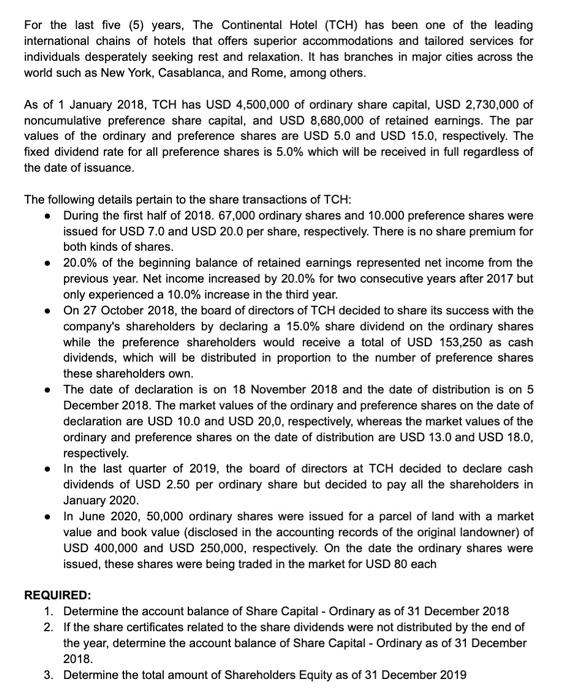

For the last five (5) years, The Continental Hotel (TCH) has been one of the leading international chains of hotels that offers superior accommodations and tailored services for individuals desperately seeking rest and relaxation. It has branches in major cities across the world such as New York, Casablanca, and Rome, among others. As of 1 January 2018, TCH has USD 4,500,000 of ordinary share capital, USD 2,730,000 of noncumulative preference share capital, and USD 8,680,000 of retained earnings. The par values of the ordinary and preference shares are USD 5.0 and USD 15.0, respectively. The fixed dividend rate for all preference shares is 5.0% which will be received in full regardless of the date of issuance. The following details pertain to the share transactions of TCH: During the first half of 2018. 67,000 ordinary shares and 10.000 preference shares were issued for USD 7.0 and USD 20.0 per share, respectively. There is no share premium for both kinds of shares. 20.0% of the beginning balance of retained earnings represented net income from the previous year. Net income increased by 20.0% for two consecutive years after 2017 but only experienced a 10.0% increase in the third year. On 27 October 2018, the board of directors of TCH decided to share its success with the company's shareholders by declaring a 15.0% share dividend on the ordinary shares while the preference shareholders would receive a total of USD 153,250 as cash dividends, which will be distributed in proportion to the number of preference shares these shareholders own. The date of declaration is on 18 November 2018 and the date of distribution is on 5 December 2018. The market values of the ordinary and preference shares on the date of declaration are USD 10.0 and USD 20,0, respectively, whereas the market values of the ordinary and preference shares on the date of distribution are USD 13.0 and USD 18.0, respectively. In the last quarter of 2019, the board of directors at TCH decided to declare cash dividends of USD 2.50 per ordinary share but decided to pay all the shareholders in January 2020. In June 2020, 50,000 ordinary shares were issued for a parcel of land with a market value and book value (disclosed in the accounting records of the original landowner) of USD 400,000 and USD 250,000, respectively. On the date the ordinary shares were issued, these shares were being traded in the market for USD 80 each REQUIRED: 1. Determine the account balance of Share Capital - Ordinary as of 31 December 2018 2. If the share certificates related to the share dividends were not distributed by the end of the year, determine the account balance of Share Capital - Ordinary as of 31 December 2018. 3. Determine the total amount of Shareholders Equity as of 31 December 2019