Answered step by step

Verified Expert Solution

Question

1 Approved Answer

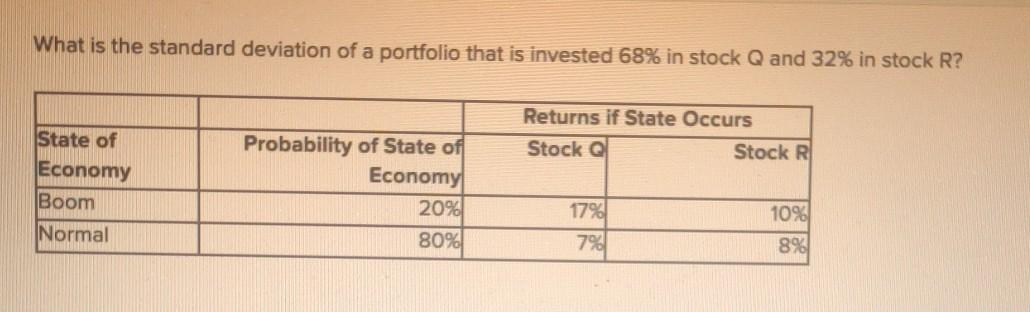

What is the standard deviation of a portfolio that is invested 68% in stock Q and 32% in stock R? Returns if State Occurs Stock

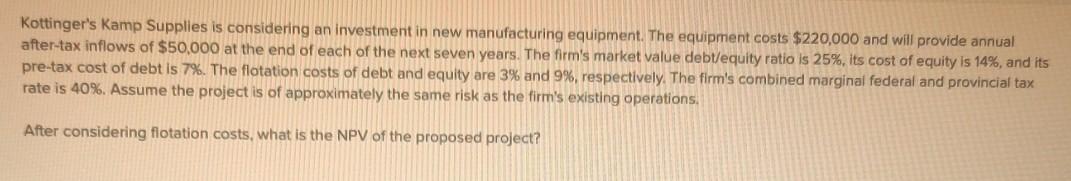

What is the standard deviation of a portfolio that is invested 68% in stock Q and 32% in stock R? Returns if State Occurs Stock Q Stock R State of Economy Boom Normal Probability of State of Economy 20% 80% 10% 17% 7% 8% Kottinger's kamp Supplies is considering an investment in new manufacturing equipment. The equipment costs $220,000 and will provide annual after-tax inflows of $50,000 at the end of each of the next seven years. The firm's market value debt/equity ratio is 25%, Its cost of equity is 14%, and its pre-tax cost of debt is 7%. The flotation costs of debt and equity are 3% and 9%, respectively. The firm's combined marginal federal and provincial tax rate is 40%. Assume the project is of approximately the same risk as the firm's existing operations, After considering flotation costs, what is the NPV of the proposed project? The greater the standard deviation, the lower the risk. True or False True False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started