Answered step by step

Verified Expert Solution

Question

1 Approved Answer

for the tax year, ABC partnership reported a $68000 ordinary loss and a $30000 increase in recourse liabilities for which the partners are liable. A,

for the tax year, ABC partnership reported a $68000 ordinary loss and a $30000 increase in recourse liabilities for which the partners are liable. A, a50%partner, had an adjusted basis of $20000 at the beginning of the year. what is As allowable loss and her adjusted basis in ABC at the end of the year?

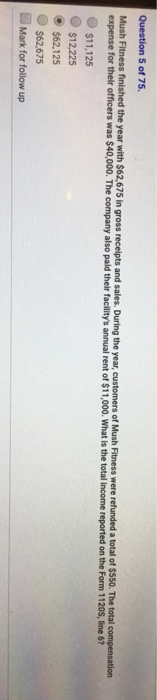

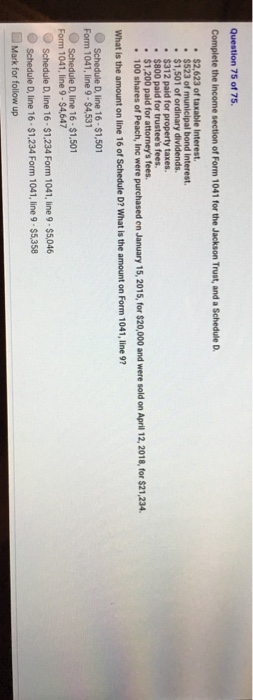

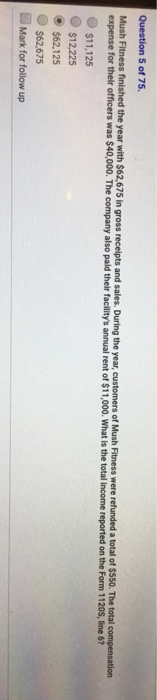

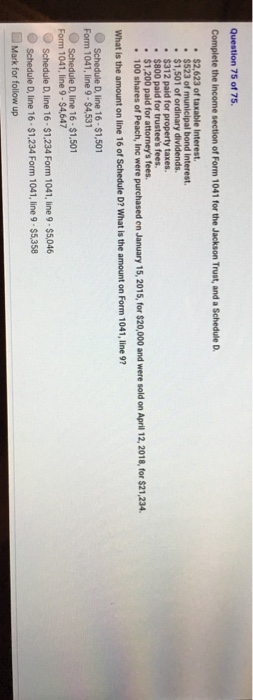

Question 5 of 75. Mush Fitness finished the year with $62,675 in gross receipts and sales. During the year, customers of Mush Fitness were refunded a total of $550. The total compensation expense for their officers was $40,000. The company also paid their facility's annual rent of $11,000. What is the total income reported on the Form 1120S, line 6? $11,125 $12,225 $62,125 $62,675 Mark for follow up Question 75 of 75. Complete the income section of Form 1041 for the Jackson Trust, and a Schedule D. $2,623 of taxable Interest. $523 of municipal bond interest $1,501 of ordinary dividends. $312 paid for property taxes. $800 paid for trustee's fees. $1,200 paid for attorney's fees 100 shares of Peach, Inc were purchased en January 15, 2015, for $20,000 and were sold on April 12, 2018, for $21,234. What is the amount on line 16 of Schedule D? What is the amount on Form 1041, line 97 Schedule D, line 16-$1,501 Form 1041, line 9-$4,531 Schedule D, line 16-$1,501 Form 1041, line 9-$4,647 Schedule D, line 16-$1,234 Form 1041, line 9-$5,046 Schedule D, line 16-$1,234 Form 1041, line 9-$5,358 Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started