Answered step by step

Verified Expert Solution

Question

1 Approved Answer

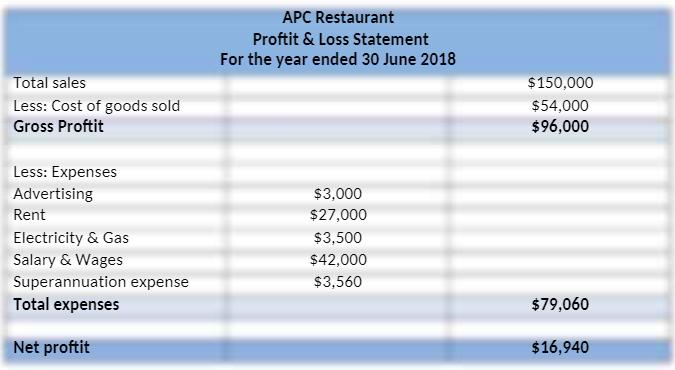

For the year ended 30 June 2018, the business income and expenses for APC Restaurant are shown in the following Profit & Loss Statement that

For the year ended 30 June 2018, the business income and expenses for APC Restaurant are shown in the following Profit & Loss Statement that was prepared under cash basis:

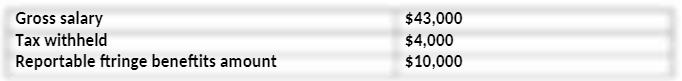

Peter also provides you the following information for his tax return purpose. Besides his own business, Peter is also working as a kitchen hands in another restaurant. His PAYG Summary (previously known as group certificate) shows the following information:

Peter has the following other receipts:

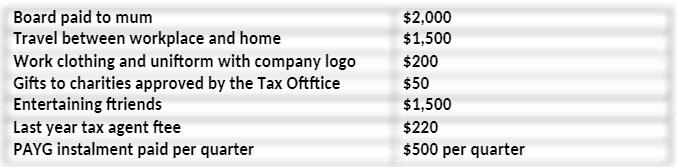

The following table shows the information about expenses and payments:

Peter, single is a resident for tax purpose. He does not have any private hospital insurance.

APC Restaurant Proftit & Loss Statement For the year ended 30 June 2018 Total sales $150,000 Less: Cost of goods sold Gross Proftit $54,000 $96,000 Less: Expenses Advertising $3,000 Rent $27,000 Electricity & Gas $3,500 Salary & Wages Superannuation expense Total expenses $42,000 $3,560 $79,060 Net proftit $16,940

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A APC Restaurant should not pay tax for the year ende...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635deeafa4450_180087.pdf

180 KBs PDF File

635deeafa4450_180087.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started