Answered step by step

Verified Expert Solution

Question

1 Approved Answer

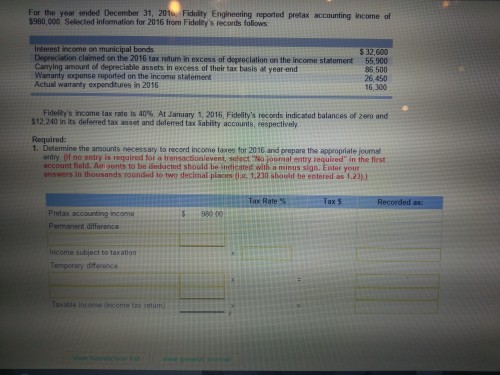

For the year ended December 31, 201u Engineering reported pretax accounting income of $980,000 Selected information for 2016 from Fidelity's folows interest income on municipal

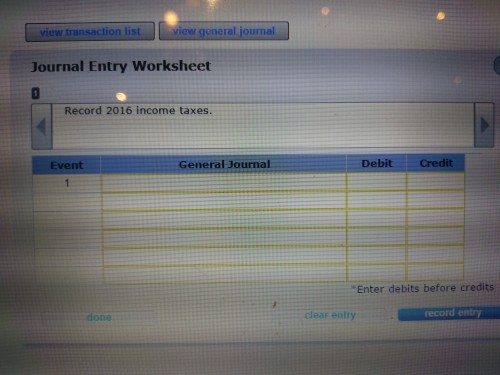

For the year ended December 31, 201u Engineering reported pretax accounting income of $980,000 Selected information for 2016 from Fidelity's folows interest income on municipal bonds $32,600 Deprecialion claimed on the 2016 tax return in excess of depreciation on the income statement 55,900 Carrying amount of depreciable assets in excess of their tax basis at year-end Warranty the Actual warranty expenditures in 2016 16,300 Fidelity's income tax rate is 40%. At January 1, 2016, Fidelity's records indicated balances of zero and $12.240 in its deferred tax asset and deferred tax sabilty accounts, respectively. Required: 1. Determine the amounts necessary to record income taxes 2016 and prepare the appropriate journal no entry is required fo event, 'No journal entry required in the first account field. Aamounts to be deducted should be indicated with a minus sign. Enter your answers in thousands rounded two decimal places (i 1.230 should be entered as 1.23N Rate Income subject to taxation Temporar dmerence Ta inton e income retum)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started