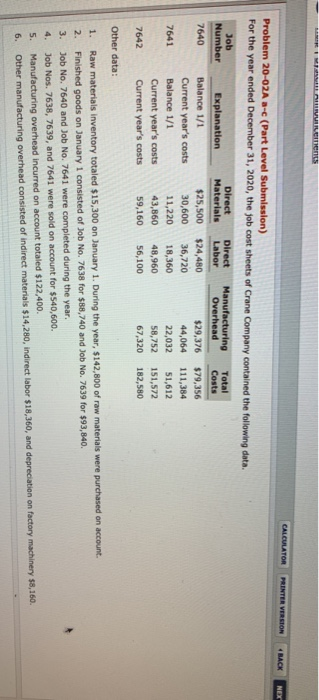

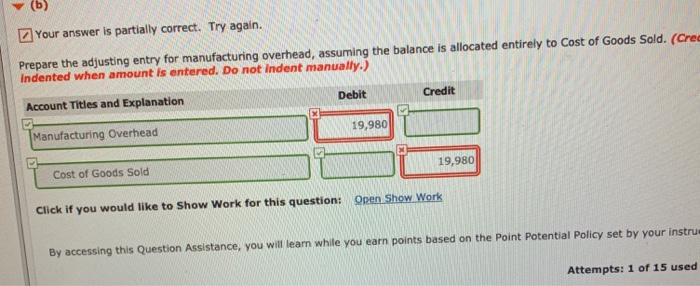

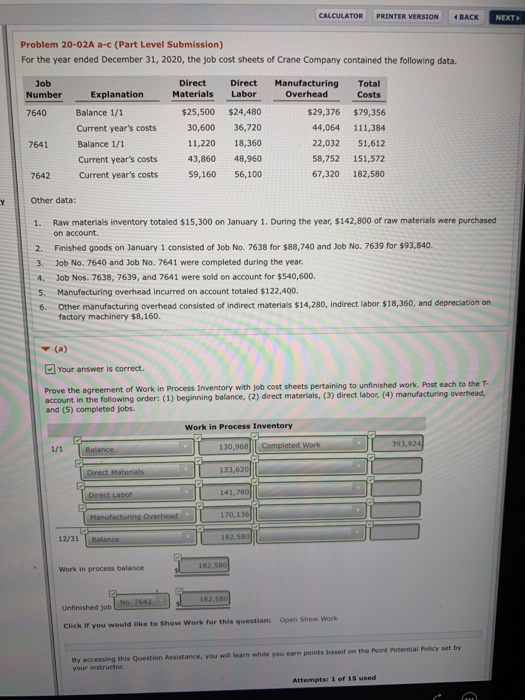

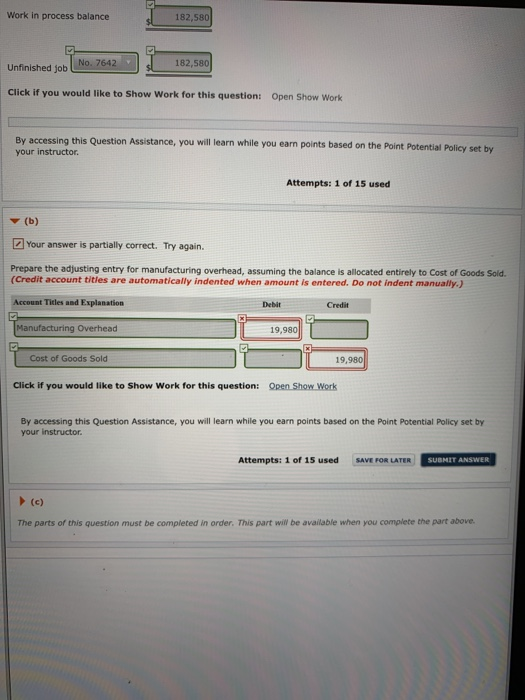

For the year ended December 31, 2020, the job cost sheets of Crane Company contained the following data Job Number Explanation Materials Labor Overhead Costs 7640 Direct Direct Manufacturing Total Balance 1/1 Current year's costs30,600 Balance 1/1 Current year's costs 43,860 Current year's costs 36,720 11,220 18,360 48,960 59,160 56,100 $29,376 $79,356 44,064 111,384 22,032 51,612 58,752 151,572 67,320 182,580 7641 7642 Other data: 1. Raw materials inventory totaled $15.300 on January 1. During the year, $142,800 of raw materials were purchased on account 2. Finished goods on January 1 consisted of Job No. 7638 for $88,740 and Job No. 7639 for $93,840. 3. Job No. 7640 and Job No. 7641 were completed during the year 4. Job Nos. 7638, 7639, and 7641 were sold on account for $540,600. 5. Manufacturing overhead incurred on account totaled $122,400. on factory machinery $8,160 overhead consisted of indirect materials $14.280, indirect labor $18,360, and depreciation on 6. Other manufacturing o (b) Your answer is partially correct. Try again. Prepare the adjusting entry for manufacturing overhead, assuming the balance is allocated entirely to Cost of Goods Sold. (Cre indented when amount is entered. Do not indent manually,) Account Titles and Explanation Debit Credit Manufacturing Overhead 19,980 Cost of Goods Sold 19,980 Click if you would like to Show Work for this question: Open Show Work By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instru Attempts: 1 of 15 used CALCULATOR PRINTER VERSION BACK NEXT Problem 20-02A a-c (Part Level Submission) For the year ended December 31, 2020, the job cost sheets of Crane Company contained the following data Job Number Direct Direct Manufacturing Total Costs Explanation Materials Labor Overhead Balance 1/1 Current year's costs Balance 1/1 Current years costs 7640 $25,500 $24,480 30,600 36,720 11,220 18,360 43,860 48,960 59,160 56,100 $29,376 $79,356 44,064 111,384 22,032 51,612 58,752 151,572 67,320 182,580 7641 7642 Current year's costs Other data: 1. Raw materials inventory totaled $15,300 on January 1. During the year, $142,800 of raw materials were purchased on account. 2. Finished goods on January 1 consisted of Job No. 7638 for $88,740 and Job No. 7639 for $93,840 3. Job No. 7640 and Job No. 7641 were completed during the year 4. Job Nos. 7638, 7639, and 7641 were sold on account for $540,600. 5. Manufacturing overhead incurred on account totaled $122,400 6. Other manufacturing overhead consisted of indirect materials $14,280, indirect labor $18,360, and depreciation on factory machinery $8,160. E] Your answer is correct. Prove the agreement of Work in Process Inventory with job cost sheets pertaining to unfinished work. Post each to the T account in the following order: (1) beginning balance, (2) direct materials, (3) direct labor, (4) manufacturing overhead and (5) completed jobs. Work in Process Inventory 393,924 130,968 Completed Work 13 141, 170,136 12/31 182,580 Work in process balance Unfinished job Click if you would like to Show Work for this question: Open Show Work ay accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by Attemptsi 1 of 15 used Work in process balance 182,580 No. 7642 182,580 unfinished job Click if you would like to Show Work for this question: Open Show Work By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor. Attempts: 1 of 15 used Your answer is partially correct. Try again. Prepare the adjusting entry for manufacturing overhead, assuming the balance is allocated entirely to Cost of Goods Sold. (Credit account tities are automatically indented when amount is entered. Do not indent manually.) Account Ticles and Explanation Debit Credit Overhead 19,980 Cost of Goods Sold 19,980 Click if you would like to Show Work for this question: Open Show Work By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor Attempts: 1 of 15 used SAVE FOR LATERSUBRTT ANS WER T ANSWER The parts of this question must be completed in order. This part wil be available when you complete the part above