Question

For this assignment I have to analyze each line item in the first chart and figure out whether it is recognized as book income/tax income,

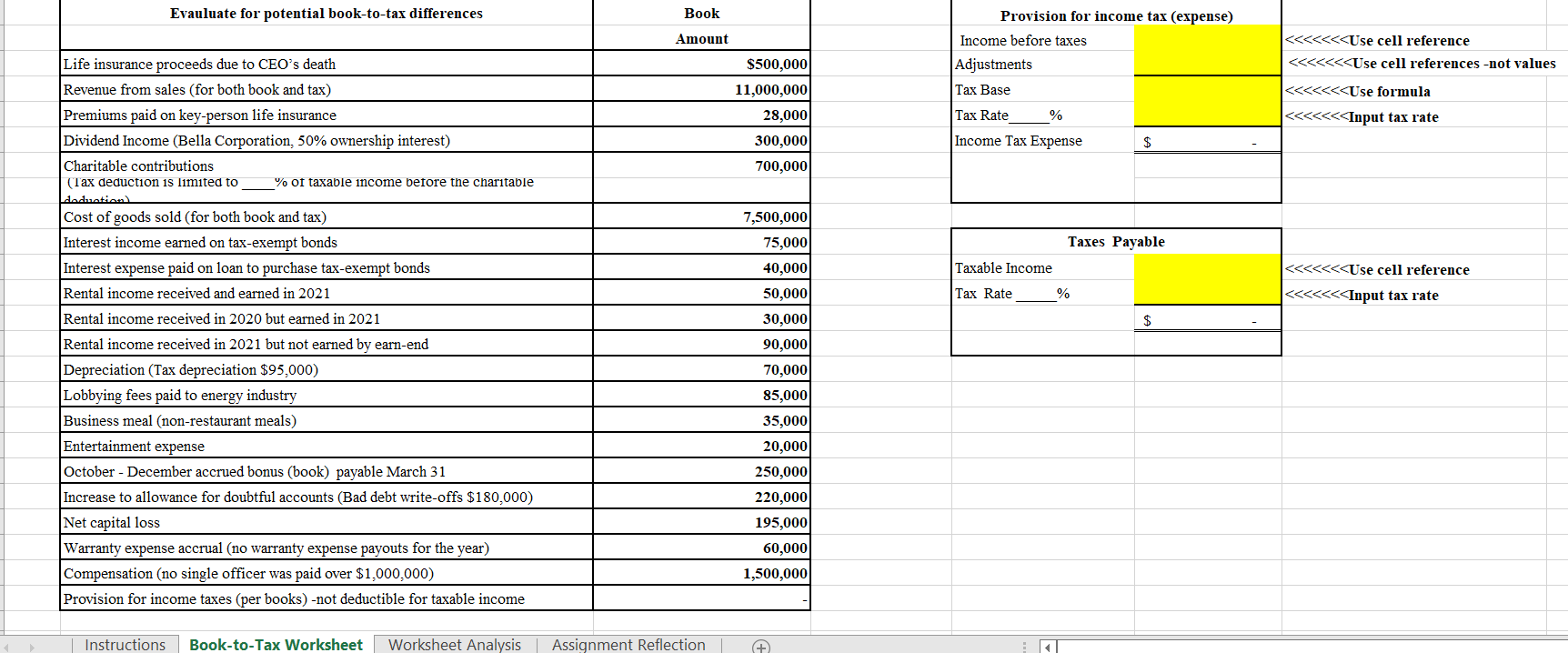

For this assignment I have to analyze each line item in the first chart and figure out whether it is recognized as book income/tax income, favorable/unfavorable, and permanent/temporary

The second chart is the reference point listing each "book amount". The professor has thrown a couple of curveballs like (Oct-Dec accrued bonus (book) payable March 31 and business meal (non-restaurant meals). I then have to take the information and crunch numbers for income tax expense and taxes payable, and then convert all the information onto the M1.

Any help or guidance would be beneficial!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started