Answered step by step

Verified Expert Solution

Question

1 Approved Answer

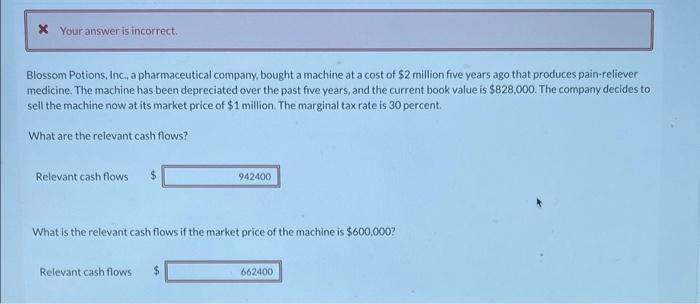

Blossom Potions, Inc., a pharmaceutical company, bought a machine at a cost of $2 million five years ago that produces pain-reliever medicine. The machine has

Blossom Potions, Inc., a pharmaceutical company, bought a machine at a cost of $2 million five years ago that produces pain-reliever medicine. The machine has been depreciated over the past five years, and the current book value is $828,000. The company decides to sell the machine now at its market price of $1 million. The marginal tax rate is 30 percent.

What are the relevant cash flows?

Relevant cash flows

942400

What is the relevant cash flows if the market price of the machine is $600,000?

Relevant cash flows

662400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started