Question

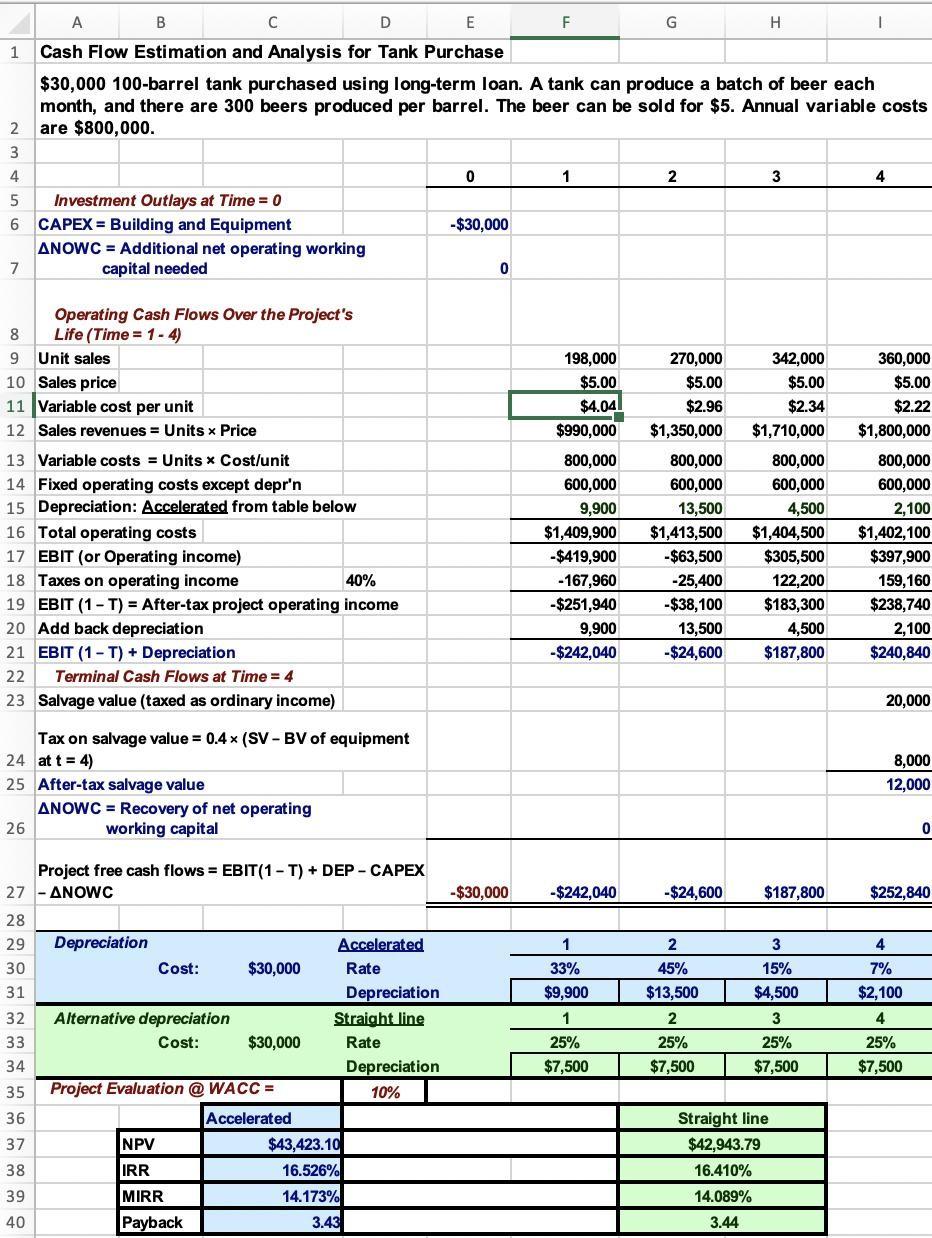

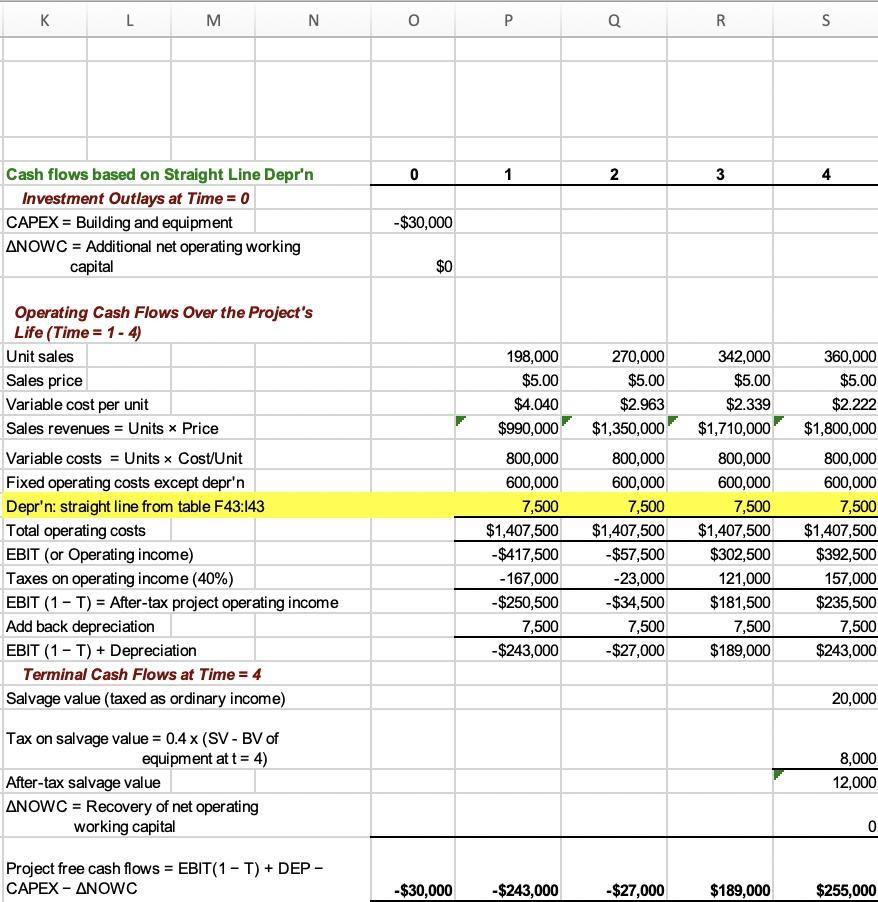

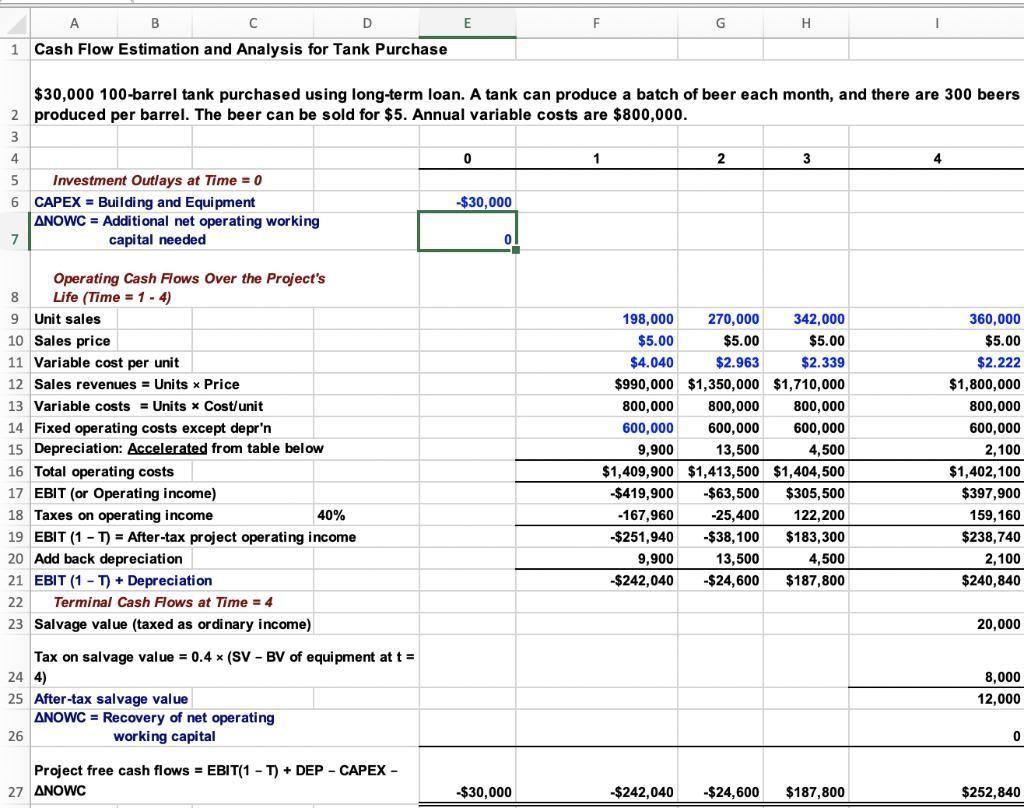

For this assignment, you will analyze a second project and compare it to the Brewery Expansion project. This second potential project is described below. Suppose

For this assignment, you will analyze a second project and compare it to the "Brewery Expansion" project. This second potential project is described below.

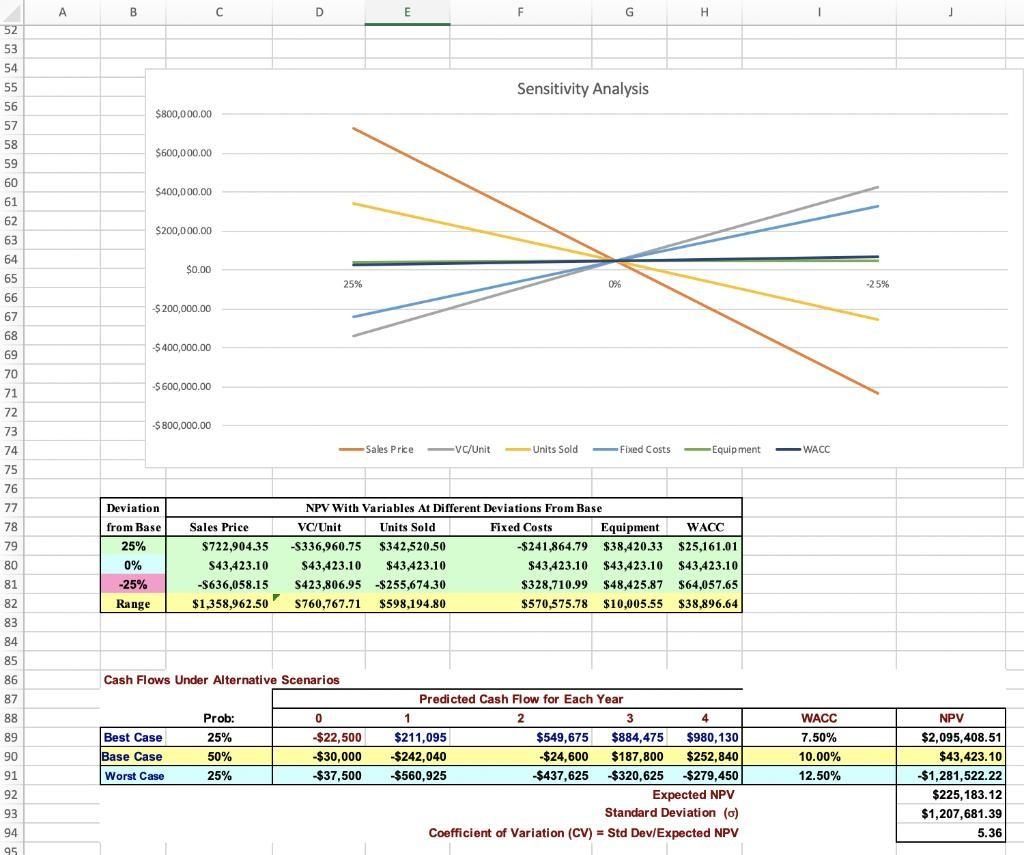

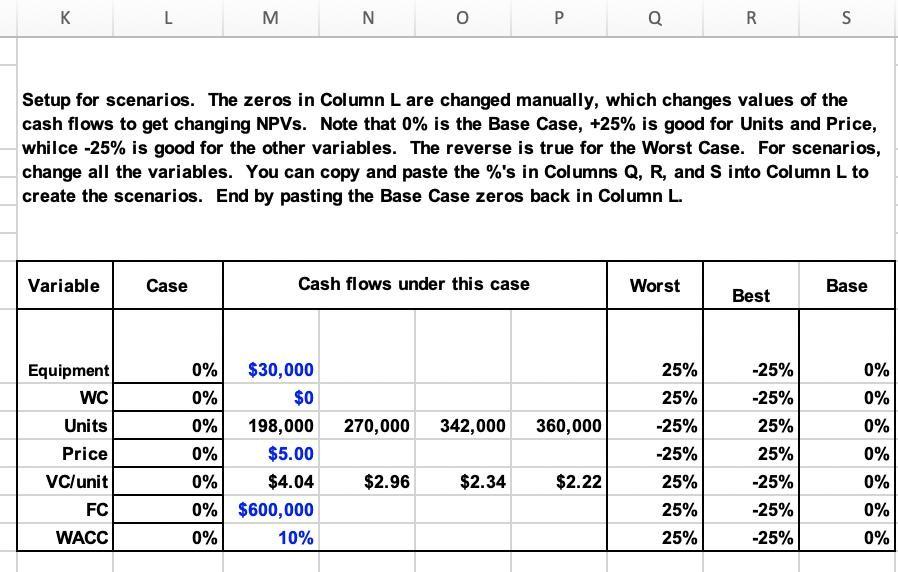

Suppose the same brewery is evaluating an additional option. The brewery is considering purchasing oak barrels to produce high-end, barrel-aged, beers. The relevant input information and project details are described below. Adjustments for sensitivity and scenario analysis are listed in parentheses following the base case information as (best case, worst case).

The brewery plans to purchase 50 barrels at an expected cost of $200 per barrel. However, there is a chance they may receive the barrels for free from a winery, and there is a chance they may have to pay $300/barrel if there is a shortage. There is no salvage value for the barrels.

Cost of oak barrel: $200/barrel (-100%, +50%)

Unlike the tank, which can produce a monthly lot of beer, beer now needs to be aged for likely a year. However, some beers may mature in as little as 6 months or as long as 2 years. There are 300 beers produced per batch per barrel. (Also assume, as is the case in the original brewery expansion, 55%, 75%, 95%, and 100% of production capacity is realized as actual sales in years 1-4; see F9:I9.)

Production time for oak barrel: 1 year (-50%, +100%)

The barrel-aged beers are premium products that are expected to sell for $10 per bottle (the same size as beers from a tank). If the beer turns out worse than expected, the brewery will have to slash the price to $5 per bottle. However, if the beer turns out better than expected, the brewery may be able to charge $20 per bottle.

Market price: $10 (+100%, -50%)

Variable costs, fixed costs, and WACC have little uncertainty and only fluctuate by 10%.

Annual variable cost: $90,000, VC/unit (-10%, +10%)

Annual fixed cost: $30,000 (-10%, +10%)

WACC: 10% (-10%, +10%)

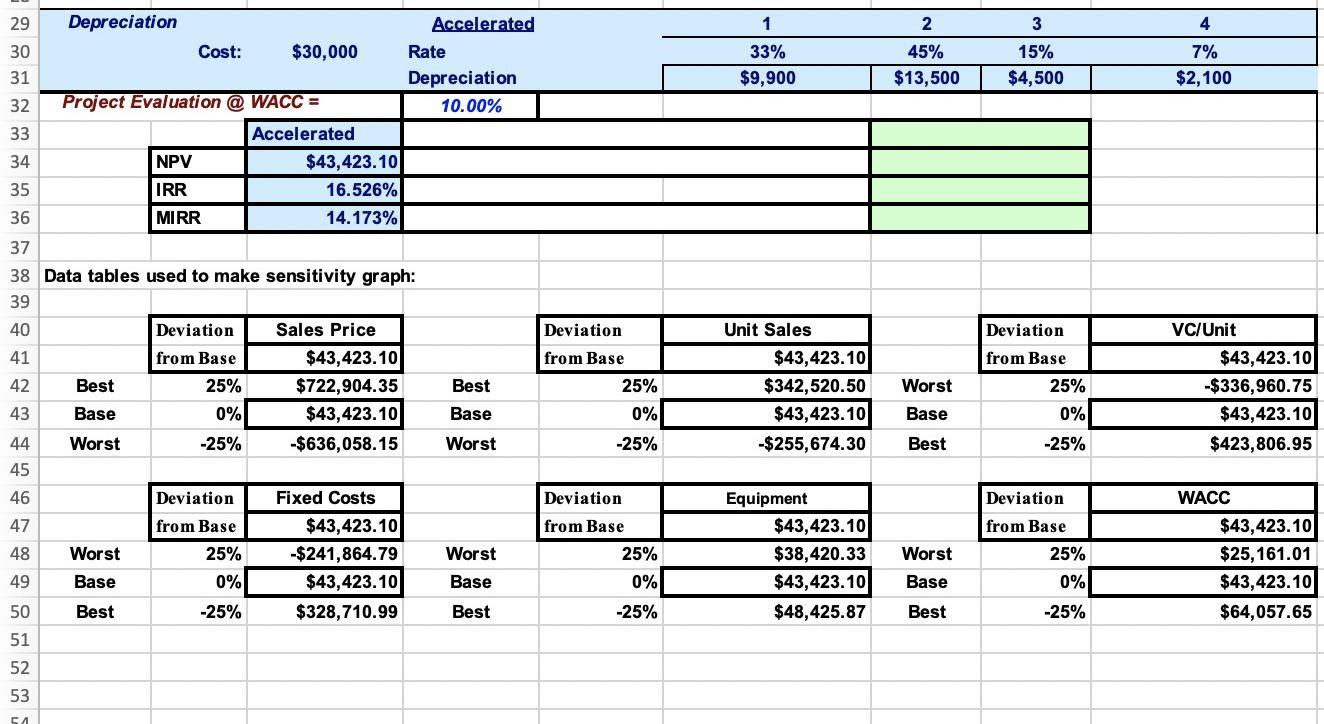

Repeat all analyses (project analysis, sensitivity analysis, scenario analysis) performed in the original Brewery Expansion project for the new barrel-aging project. In 1-2 paragraphs, summarize your findings and compare the projects.

Suppose there is a 2% chance the barrel-aging program catches the attention of a large brewery, leading to a $10,000,000 investment from the large brewery at the end of the project.

In a new sheet, recalculate and report the NPV of the barrel-aging expansion project (at base case values, no sensitivity analysis). Compare this value with the NPV of the original expansion project.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started