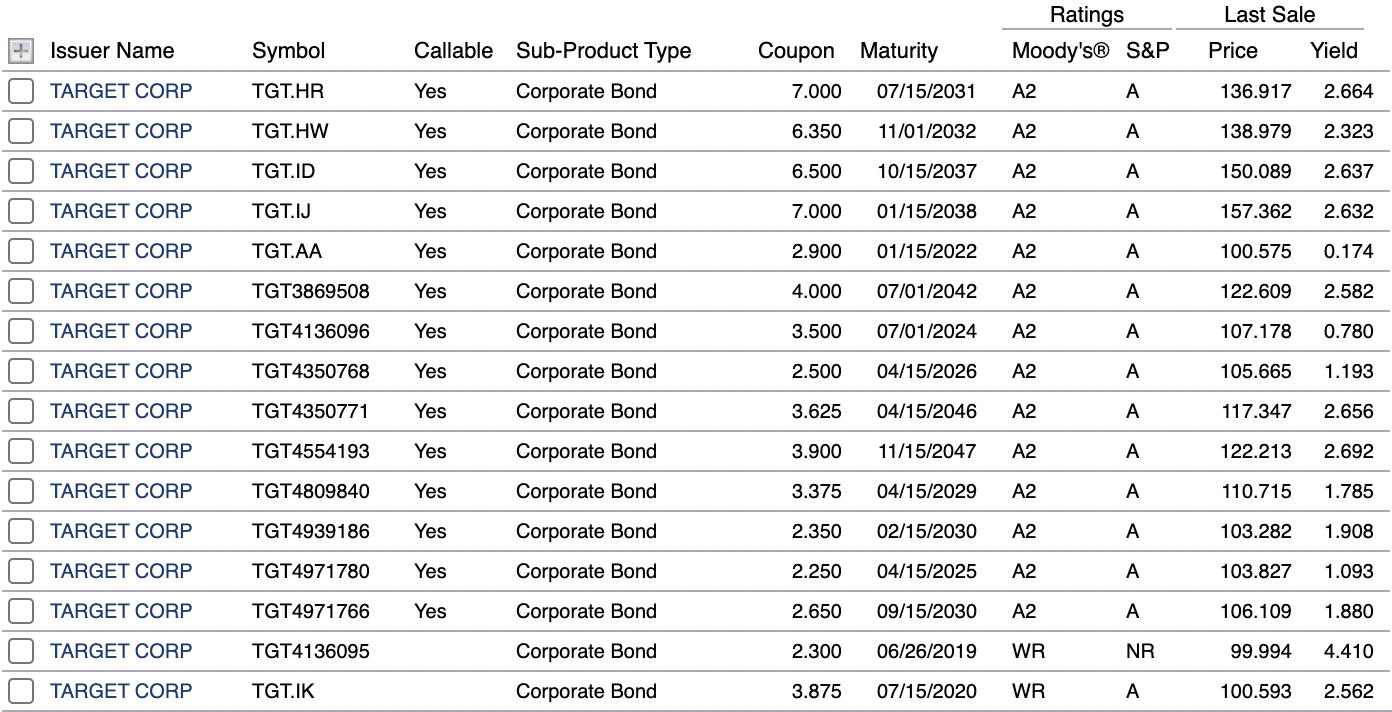

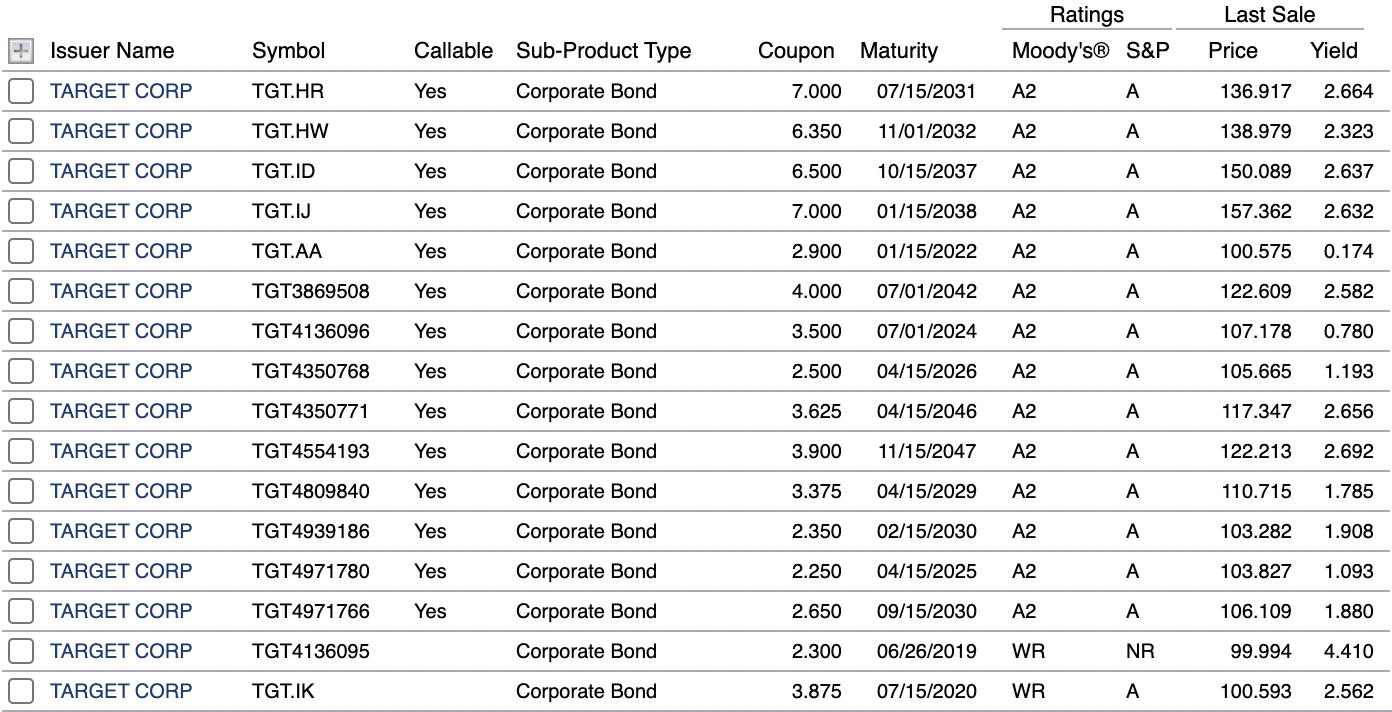

For this section, collect information on all of TGT's outstanding bond issues. Specifically, for each issue currently outstanding: collect current data on the YTM, par value in dollars outstanding, and market value in dollars outstanding. Based on this data, and any other data you deem relevant, what is your estimate of TGT's cost of debt, Rd?

Last Sale Ratings Moody's S&P Issuer Name Symbol Callable Sub-Product Type Coupon Maturity Price Yield TARGET CORP TGT.HR Yes Corporate Bond 7.000 07/15/2031 A2 136.917 2.664 TARGET CORP TGT.HW Yes Corporate Bond 6.350 11/01/2032 A2 A 138.979 2.323 TARGET CORP TGT.ID Yes Corporate Bond 6.500 10/15/2037 A2 A 150.089 2.637 TARGET CORP TGT.IJ Yes Corporate Bond 7.000 01/15/2038 A2 A 157.362 2.632 TARGET CORP TGT.AA Yes Corporate Bond 2.900 01/15/2022 A2 A 100.575 0.174 TARGET CORP TGT3869508 Yes Corporate Bond 4.000 07/01/2042 A2 A 122.609 2.582 TARGET CORP TGT4136096 Yes Corporate Bond 3.500 07/01/2024 A2 A 107.178 0.780 TARGET CORP TGT4350768 Yes Corporate Bond 2.500 04/15/2026 A2 A 105.665 1.193 TARGET CORP TGT4350771 Yes Corporate Bond 3.625 04/15/2046 A2 A 117.347 2.656 TARGET CORP TGT4554193 Yes 3.900 11/15/2047 A2 A 122.213 2.692 TARGET CORP TGT4809840 Yes 3.375 04/15/2029 A2 A 110.715 1.785 TARGET CORP TGT4939186 Yes 2.350 02/15/2030 A2 A 103.282 1.908 TARGET CORP TGT4971780 Yes Corporate Bond Corporate Bond Corporate Bond Corporate Bond Corporate Bond Corporate Bond Corporate Bond 2.250 04/15/2025 A2 A 103.827 1.093 TARGET CORP TGT4971766 Yes 2.650 09/15/2030 A2 . 106.109 1.880 TARGET CORP TGT4136095 2.300 06/26/2019 WR NR 99.994 4.410 TARGET CORP TGT.IK 3.875 07/15/2020 WR A 100.593 2.562 Last Sale Ratings Moody's S&P Issuer Name Symbol Callable Sub-Product Type Coupon Maturity Price Yield TARGET CORP TGT.HR Yes Corporate Bond 7.000 07/15/2031 A2 136.917 2.664 TARGET CORP TGT.HW Yes Corporate Bond 6.350 11/01/2032 A2 A 138.979 2.323 TARGET CORP TGT.ID Yes Corporate Bond 6.500 10/15/2037 A2 A 150.089 2.637 TARGET CORP TGT.IJ Yes Corporate Bond 7.000 01/15/2038 A2 A 157.362 2.632 TARGET CORP TGT.AA Yes Corporate Bond 2.900 01/15/2022 A2 A 100.575 0.174 TARGET CORP TGT3869508 Yes Corporate Bond 4.000 07/01/2042 A2 A 122.609 2.582 TARGET CORP TGT4136096 Yes Corporate Bond 3.500 07/01/2024 A2 A 107.178 0.780 TARGET CORP TGT4350768 Yes Corporate Bond 2.500 04/15/2026 A2 A 105.665 1.193 TARGET CORP TGT4350771 Yes Corporate Bond 3.625 04/15/2046 A2 A 117.347 2.656 TARGET CORP TGT4554193 Yes 3.900 11/15/2047 A2 A 122.213 2.692 TARGET CORP TGT4809840 Yes 3.375 04/15/2029 A2 A 110.715 1.785 TARGET CORP TGT4939186 Yes 2.350 02/15/2030 A2 A 103.282 1.908 TARGET CORP TGT4971780 Yes Corporate Bond Corporate Bond Corporate Bond Corporate Bond Corporate Bond Corporate Bond Corporate Bond 2.250 04/15/2025 A2 A 103.827 1.093 TARGET CORP TGT4971766 Yes 2.650 09/15/2030 A2 . 106.109 1.880 TARGET CORP TGT4136095 2.300 06/26/2019 WR NR 99.994 4.410 TARGET CORP TGT.IK 3.875 07/15/2020 WR A 100.593 2.562