Ford motors company manufactures cars and trucks. managers

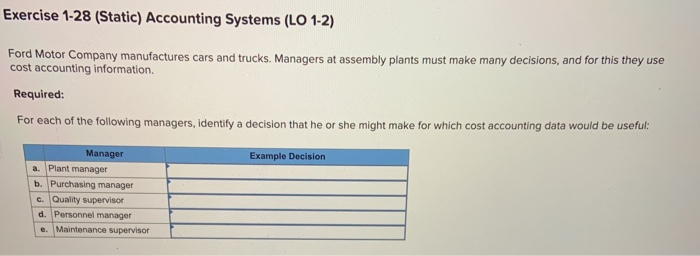

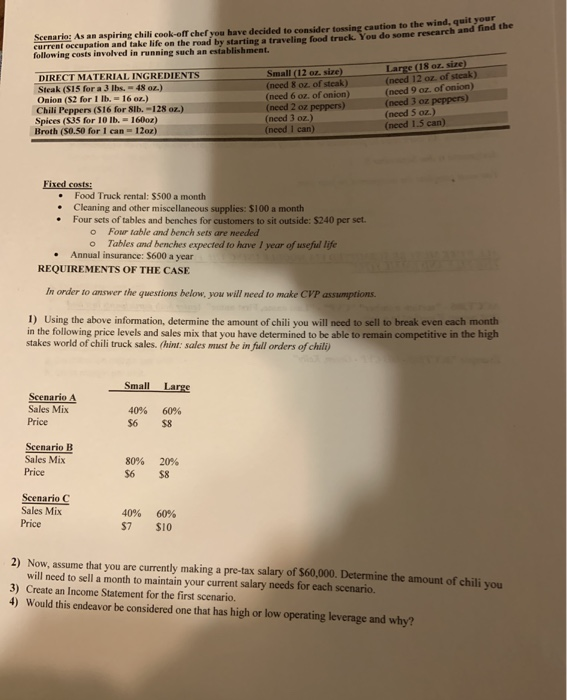

Exercise 1-28 (Static) Accounting Systems (LO 1-2) Ford Motor Company manufactures cars and trucks. Managers at assembly plants must make many decisions, and for this they use cost accounting information Required: For each of the following managers, identify a decision that he or she might make for which cost accounting data would be useful: Example Decision Manager a. Plant manager b. Purchasing manager c. Quality supervisor d. Personnel manager e. Maintenance supervisor Scenario: As an aspiring chili cook-off chef you have decided to consider tossing caution to the wind, quit your current occupation and take life on the road by starting a traveling food truck. You do some research and find the following costs involved in running such an establishment DIRECT MATERIAL INGREDIENTS Steak (S15 for a 3 lbs. - 48 oz.) Onion (S2 for 1 lb. - 16 or.) Chili Peppers (516 for Stb. -128 oz.) Spices (SJ5 for 10 lb. = 160oz) Broth (S0.50 for 1 can 12oz) Small (12 oz. size) (need 8 oz. of steak) (need 6 oz. of onion) (need 2 oz peppers) (need 3 oz.) (need I can) Large (18 oz. size) (need 12 oz. of steak) (need 9 oz. of onion) (need 3 oz peppers) (need 5 oz.) (need 1.5 can) Fixed costs: Food Truck rental: $500 a month Cleaning and other miscellaneous supplies: $100 a month Four sets of tables and benches for customers to sit outside: $240 per set. Four table and bench sets are needed Tables and benches expected to have / year of useful life Annual insurance: $600 a year REQUIREMENTS OF THE CASE In order to answer the questions below, you will need to make CVP assumptions 1) Using the above information, determine the amount of chili you will need to sell to break even each month in the following price levels and sales mix that you have determined to be able to remain competitive in the high stakes world of chili truck sales. (hint: sales must be in full orders of chili) Small Large Scenario A Sales Mix Price 40% $6 60% S8 Scenario B Sales Mix Price 80% $6 20% $8 Scenario C Sales Mix Price 40% $7 60% $10 2) Now, assume that you are currently making a pre-tax salary of $60,000. Determine the amount of chili you will need to sell a month to maintain your current salary needs for each scenario. 3) Create an Income Statement for the first scenario. 4) Would this endeavor be considered one that has high or low operating leverage and why? Exercise 1-28 (Static) Accounting Systems (LO 1-2) Ford Motor Company manufactures cars and trucks. Managers at assembly plants must make many decisions, and for this they use cost accounting information Required: For each of the following managers, identify a decision that he or she might make for which cost accounting data would be useful: Example Decision Manager a. Plant manager b. Purchasing manager c. Quality supervisor d. Personnel manager e. Maintenance supervisor Scenario: As an aspiring chili cook-off chef you have decided to consider tossing caution to the wind, quit your current occupation and take life on the road by starting a traveling food truck. You do some research and find the following costs involved in running such an establishment DIRECT MATERIAL INGREDIENTS Steak (S15 for a 3 lbs. - 48 oz.) Onion (S2 for 1 lb. - 16 or.) Chili Peppers (516 for Stb. -128 oz.) Spices (SJ5 for 10 lb. = 160oz) Broth (S0.50 for 1 can 12oz) Small (12 oz. size) (need 8 oz. of steak) (need 6 oz. of onion) (need 2 oz peppers) (need 3 oz.) (need I can) Large (18 oz. size) (need 12 oz. of steak) (need 9 oz. of onion) (need 3 oz peppers) (need 5 oz.) (need 1.5 can) Fixed costs: Food Truck rental: $500 a month Cleaning and other miscellaneous supplies: $100 a month Four sets of tables and benches for customers to sit outside: $240 per set. Four table and bench sets are needed Tables and benches expected to have / year of useful life Annual insurance: $600 a year REQUIREMENTS OF THE CASE In order to answer the questions below, you will need to make CVP assumptions 1) Using the above information, determine the amount of chili you will need to sell to break even each month in the following price levels and sales mix that you have determined to be able to remain competitive in the high stakes world of chili truck sales. (hint: sales must be in full orders of chili) Small Large Scenario A Sales Mix Price 40% $6 60% S8 Scenario B Sales Mix Price 80% $6 20% $8 Scenario C Sales Mix Price 40% $7 60% $10 2) Now, assume that you are currently making a pre-tax salary of $60,000. Determine the amount of chili you will need to sell a month to maintain your current salary needs for each scenario. 3) Create an Income Statement for the first scenario. 4) Would this endeavor be considered one that has high or low operating leverage and why