Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Forecasted earnings per share for 2023 = $0.53 Forecasted earnings per share for 2024 = $1.87 Five-year forecasted earnings growth rate = 3.16% Intel's cost

Forecasted earnings per share for 2023 = $0.53

Forecasted earnings per share for 2024 = $1.87

Five-year forecasted earnings growth rate = 3.16%

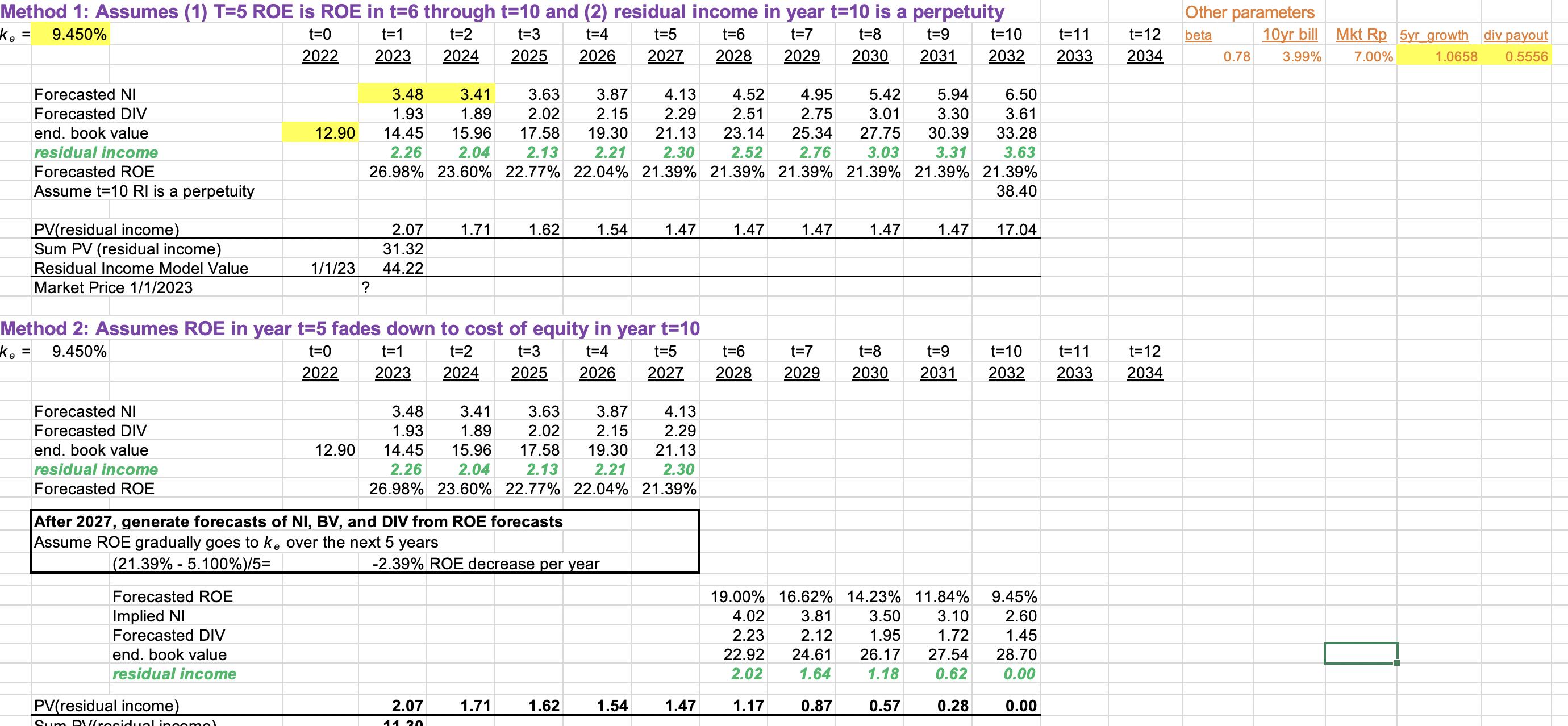

Intel's cost of equity = 9.45% (I've already set this parameter)

Intel's book value per share at the start of 2022 = $24.52

Intel's dividend payout ratio = 30%

1. Compute Intel's residual income valuation using the three methods in the attached spreadsheet.

2. Compare the residual income values to Intel's current market price.

Is the current price higher or lower than the current book value (shareholders' equity) per share?

Is this relation expected based on the valuation spreadsheets?

Forecasted earnings per share for 2024 = $1.87

Five-year forecasted earnings growth rate = 3.16%

Intel's cost of equity = 9.45% (I've already set this parameter)

Intel's book value per share at the start of 2022 = $24.52

Intel's dividend payout ratio = 30%

1. Compute Intel's residual income valuation using the three methods in the attached spreadsheet.

2. Compare the residual income values to Intel's current market price.

Is the current price higher or lower than the current book value (shareholders' equity) per share?

Is this relation expected based on the valuation spreadsheets?

Method 1: Assumes (1) T=5 ROE is ROE in t=6 through t=10 and (2) residual income in year t=10 is a perpetuity Ke = 9.450% t=0 t=1 t=2 t=5 t=6 t=7 t=8 t=3 t=4 2025 2026 t=9 t=10 2030 2031 2032 2022 2023 2024 2027 2028 2029 Forecasted NI Forecasted DIV end. book value residual income Forecasted ROE Assume t=10 RI is a perpetuity ke PV(residual income) Sum PV (residual income) Residual Income Model Value Market Price 1/1/2023 Forecasted NI Forecasted DIV end. book value residual income Forecasted ROE Forecasted ROE Implied NI Forecasted DIV end. book value residual income 3.48 3.41 1.89 3.63 3.87 4.13 4.52 4.95 5.42 5.94 6.50 1.93 2.02 2.15 2.29 2.51 2.75 3.01 3.30 3.61 12.90 14.45 15.96 17.58 19.30 21.13 23.14 25.34 27.75 30.39 33.28 2.26 2.04 2.13 2.21 2.30 2.52 2.76 3.03 3.31 3.63 26.98% 23.60% 22.77% 22.04% 21.39% 21.39% 21.39% 21.39% 21.39% 21.39% 38.40 PV(residual income) 1/1/23 Sum DVrosidual incomal ? Method 2: Assumes ROE in year t=5 fades down to cost of equity in year t=10 = 9.450% t=2 t=5 t=0 t=1 2022 2023 t=3 t=4 2025 2026 2024 2027 12.90 2.07 31.32 44.22 1.71 After 2027, generate forecasts of NI, BV, and DIV from ROE forecasts Assume ROE gradually goes to ke over the next 5 years (21.39% - 5.100%)/5= -2.39% ROE decrease per year 1.62 2.07 11. 20 3.63 3.87 3.48 1.93 3.41 1.89 2.02 2.15 15.96 17.58 19.30 2.26 2.04 2.13 2.21 26.98% 23.60% 22.77% 22.04% 14.45 1.54 1.71 1.62 1.47 1.54 4.13 2.29 21.13 2.30 21.39% 1.47 1.47 t=6 2028 1.47 1.47 1.47 17.04 t=7 t=8 t=9 2029 2030 2031 t=11 2033 t=10 t=11 2032 2033 19.00% 16.62% 14.23% 11.84% 9.45% 4.02 3.81 3.10 2.60 2.23 2.12 22.92 24.61 2.02 3.50 1.95 1.72 1.45 26.17 27.54 28.70 1.64 1.18 0.62 0.00 1.17 0.87 0.57 0.28 0.00 Other parameters t=12 beta 2034 10yr bill 3.99% t=12 2034 0.78 Mkt Rp 5yr growth div payout 7.00% 1.0658 0.5556

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started