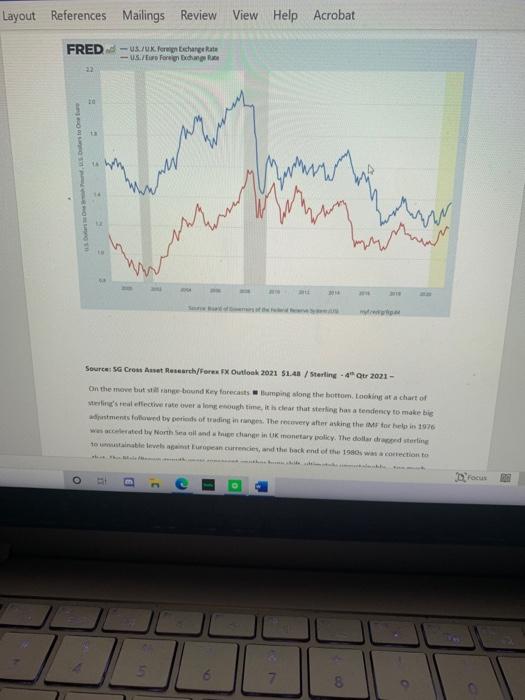

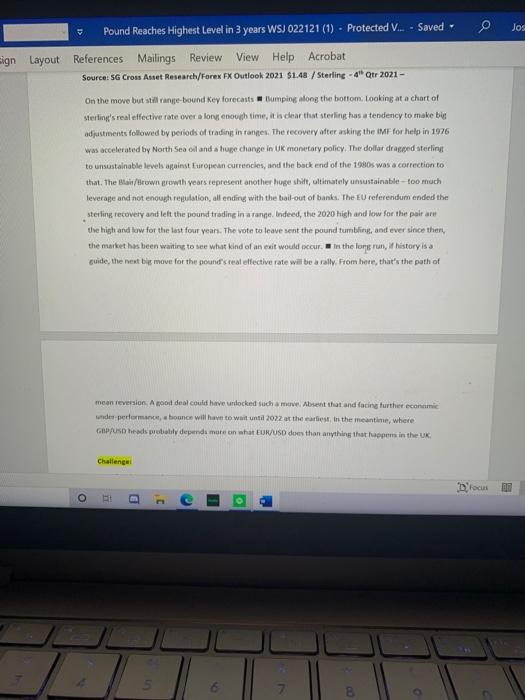

FOREIGN EXCHANGE British Pound Reaches Strongest Level in Nearly Three Years Rapid vaccinations and a trade deal with the EU have made some investors bullish on sterling How many dollars el buysSource: Tullett Prebon 2019201 1501 1751 2001 2251 2501 27513001 3251 3501 37514001 425$1.450 By Caitlin Ostroff Feb. 21, 2021 8:00 am ET The British pound got slammed in recent years by the twin storms of Brexit fears and a particularly bad Covid-19 crisis. But with a trade deal in pocket and a world-leading vaccine program, investors say the upside forces for the currency are now just as strong, The U.K. currency rose to its highest level against the dollar in nearly three years Friday as sterling crossed $1.40, its first time hitting that mark since April 2018 The British economy was among the hardest hit by the pandemic, but now the country is on course to be the first major economy to inoculate its entire adult population, after the government reached its goal of vaccinating 15 million people in mid-February. The U.K. has given the third-highest number of vaccination coses per 100 people, according to Oxford University-based Our WorldinData.org, behind Israel and the United Arab Emirates The fast pace of inoculations, combined with the passage of a Brexit deal at the end of last year, after a period when it appeared the U.K. could crash out of the European Union without one has led some investors to reassess their expectations of UK assets. O Layout References Mailings Review View Help Acrobat Hedge funds had largely neutral net positions on sterling's prospects at the end of last year. This year, they have increased bets that the pound will rise against the dollar 1 "There is a bit of a rerating by investors on the U.K. in general," said Chris Turner, bead of foreign-exchange strategy at ING Bank. "If you compare the exponential pace of the vaccine rollout in the U.K. and U.S. compared with the rest of Europe, that's giving investors confidence in a second quarter recovery." 20 The pound could still be volerable to drop if the UK government doesn't case contains IT O Focus B a ayout References Mailings Review View Help Acrobat The pound could still be vulnerable to drops if the U.K. government doesn't case coronavirus restrictions as quickly as some hope. PHOTO: ANGEL GARCIA BLOOMBERG NEWS Last year, the U.K. economy recorded its biggest contraction in more than three centuries as social distancing and the closure of restaurants, bars, hotels and theaters hurt growth. A higher share of national income is spent on recreation and similar services that require face-to-face contact than in other comparable economies. The vaccine rollout is likely to put pressure on the government to relax restrictions and allow for the economy to begin reopening. Expectations for the ensing of the U.K'S current national lockdown led the Bank of England to strike a more optimistic tone at its February meeting The central bank's comments soothed investor fears that it would enact subzero interest rutes to support the economy. Investors have worried that further interest-rate cuts would weigh on banks' profitability and weaken sterling Investors expect the dollar to also weaken further frotn additional U.S. fiscal stimulus, adding another catalyst for sterling strength. I O D C 5 Layout References Mailings Review View Help Acrobat Sterling has benefited from its perception as a riskier currency than havens like the U.S. dollar or the Japanese yen. This allows it to rally as investors rotate out of U.S. assets, betting that economies whose assets are cheaper could bave a larger scope for a rebound after the vaccine rollout ** As we are a very open economy. we are very affected by the global economic winds and therefore improvement tends to help sterling." said Oliver Blackboum, a multiasset portfolio manager at Janus Henderson Investors. But sterling's rise could also weigh on the country's economic recovery. It would make it - more expensive for other countries to buy U.K, products and is likely to weigh on profitability of large companies with high overseas earnings, which comprise much of the U.K'S FTSE 100 Index The pound could still be vulnerable to drops if the UK government doesn't ease coronavirus restrictions as quickly as some hope, and unexpected hurdles to the vaccine rollout could also hit sentiment. Prime Minister Boris Johnson said he expects to provide a road map toward ending the lockdown, after the most vulnerable are immunized, this week Some of the optimism about the unrolling of restrictions may have gotten ahead of itself," said Jane Foley, head of foreign-exchange strategy at Rabobank. We've still got hurdles aliend." Write to Caitlin Ostroff at caitlin ostrofl@wsj.com Droo D C R Layout References Mailings Review View Help Acrobat FRED-us/UK.Teren schargt Rata - USF Biano 22 erz ww w minen Source SG Cross Anset Research/Forex FX Outlook 2021 $1.48 / Starling - 4 tr 2021- On the move but stilgebound key forecastsumping along the bottom. Looking at a chart of we's real effective rote over a long enough time, it is clear that sterling has a tendency to make big stments food types of trading in anges. The recovery her asking them to be 1976 Was scented by North Sea and in UK monetary policy. The door de conting to ustable levels trecancerrencies and the back end of the 1960s was correction to o Dracus BO 7 Jos Pound Reaches Highest level in 3 years WSJ 022121 (1) - Protected V... - Saved Sign Layout References Mailings Review View Help Acrobat Source: SG Crou Annet Research/Forex FX Outlook 2021 $1.48 / Sterling - 4 tr 2021 - On the move but still range bound Key forecasts Bumping along the bottom. Looking at a chart of Sterling's real effective rate over a long enough time, it is clear that sterling has a tendency to make but adjustments followed by periods of trading in anges. The recovery after asking the IMF for help in 1976 was accelerated by North Sea oil and a huge change in UK monetary policy. The dollar draad sterling to unsustainable levels ainst European currencies, and the back end of the 1980s was a correction to that. The Brown growth years represent another huge shift, ultimately unsustainable-too much leverage and not enough regulation, all ending with the bail-out of banks. The EU referendum ended the sterling recovery and left the pound trading in a range. Indeed, the 2020 high and low for the pair are the high and low for the last four years. The vote to leave sent the pound tumbling, and ever since ther, the market has been waiting to see what kind of an exit would occur. In the long run, history is a cuide, the next big move for the pound's seat effective rate will be a rally From here, that's the path of mean reversion. A deal could have unlocked such a move. Absent that and facing turther economie under perman, bounce will have to wait until 2022 at the earliest in the meantime, where GBP/USD headsprobiol depend more on What EUR/USD does than anything that opens in the UK Challenge Droo O Pound Reaches Highest level in 3 years WSJ 022121 (1) - Protected V... - Saved Jose ign Layout References Mailings Review View Help Acrobat mean reversion. A good deal could have unlocked such a move. Absent that and facing further economie under performance, a bounce will have to wait until 2022 at the earliest in the meantime, where GHP/USD heads probably depends more on what EUR/USD does than anything that happens in the UK Challenger Your firm has a Sterling 4.000.000 ccount receivable due in 6 months. Based on the above artide and the bank research, you need to decide to leave the account receivable fully unhedged, partially hedged or fully hedged. What factors would you consider in your analysis for both the firm and the financial analysis? (The current spot rate is $1,4050/GP-6 mth Libors are follows $0.20% and GBP 0,00%) 1 Focus o C FOREIGN EXCHANGE British Pound Reaches Strongest Level in Nearly Three Years Rapid vaccinations and a trade deal with the EU have made some investors bullish on sterling How many dollars el buysSource: Tullett Prebon 2019201 1501 1751 2001 2251 2501 27513001 3251 3501 37514001 425$1.450 By Caitlin Ostroff Feb. 21, 2021 8:00 am ET The British pound got slammed in recent years by the twin storms of Brexit fears and a particularly bad Covid-19 crisis. But with a trade deal in pocket and a world-leading vaccine program, investors say the upside forces for the currency are now just as strong, The U.K. currency rose to its highest level against the dollar in nearly three years Friday as sterling crossed $1.40, its first time hitting that mark since April 2018 The British economy was among the hardest hit by the pandemic, but now the country is on course to be the first major economy to inoculate its entire adult population, after the government reached its goal of vaccinating 15 million people in mid-February. The U.K. has given the third-highest number of vaccination coses per 100 people, according to Oxford University-based Our WorldinData.org, behind Israel and the United Arab Emirates The fast pace of inoculations, combined with the passage of a Brexit deal at the end of last year, after a period when it appeared the U.K. could crash out of the European Union without one has led some investors to reassess their expectations of UK assets. O Layout References Mailings Review View Help Acrobat Hedge funds had largely neutral net positions on sterling's prospects at the end of last year. This year, they have increased bets that the pound will rise against the dollar 1 "There is a bit of a rerating by investors on the U.K. in general," said Chris Turner, bead of foreign-exchange strategy at ING Bank. "If you compare the exponential pace of the vaccine rollout in the U.K. and U.S. compared with the rest of Europe, that's giving investors confidence in a second quarter recovery." 20 The pound could still be volerable to drop if the UK government doesn't case contains IT O Focus B a ayout References Mailings Review View Help Acrobat The pound could still be vulnerable to drops if the U.K. government doesn't case coronavirus restrictions as quickly as some hope. PHOTO: ANGEL GARCIA BLOOMBERG NEWS Last year, the U.K. economy recorded its biggest contraction in more than three centuries as social distancing and the closure of restaurants, bars, hotels and theaters hurt growth. A higher share of national income is spent on recreation and similar services that require face-to-face contact than in other comparable economies. The vaccine rollout is likely to put pressure on the government to relax restrictions and allow for the economy to begin reopening. Expectations for the ensing of the U.K'S current national lockdown led the Bank of England to strike a more optimistic tone at its February meeting The central bank's comments soothed investor fears that it would enact subzero interest rutes to support the economy. Investors have worried that further interest-rate cuts would weigh on banks' profitability and weaken sterling Investors expect the dollar to also weaken further frotn additional U.S. fiscal stimulus, adding another catalyst for sterling strength. I O D C 5 Layout References Mailings Review View Help Acrobat Sterling has benefited from its perception as a riskier currency than havens like the U.S. dollar or the Japanese yen. This allows it to rally as investors rotate out of U.S. assets, betting that economies whose assets are cheaper could bave a larger scope for a rebound after the vaccine rollout ** As we are a very open economy. we are very affected by the global economic winds and therefore improvement tends to help sterling." said Oliver Blackboum, a multiasset portfolio manager at Janus Henderson Investors. But sterling's rise could also weigh on the country's economic recovery. It would make it - more expensive for other countries to buy U.K, products and is likely to weigh on profitability of large companies with high overseas earnings, which comprise much of the U.K'S FTSE 100 Index The pound could still be vulnerable to drops if the UK government doesn't ease coronavirus restrictions as quickly as some hope, and unexpected hurdles to the vaccine rollout could also hit sentiment. Prime Minister Boris Johnson said he expects to provide a road map toward ending the lockdown, after the most vulnerable are immunized, this week Some of the optimism about the unrolling of restrictions may have gotten ahead of itself," said Jane Foley, head of foreign-exchange strategy at Rabobank. We've still got hurdles aliend." Write to Caitlin Ostroff at caitlin ostrofl@wsj.com Droo D C R Layout References Mailings Review View Help Acrobat FRED-us/UK.Teren schargt Rata - USF Biano 22 erz ww w minen Source SG Cross Anset Research/Forex FX Outlook 2021 $1.48 / Starling - 4 tr 2021- On the move but stilgebound key forecastsumping along the bottom. Looking at a chart of we's real effective rote over a long enough time, it is clear that sterling has a tendency to make big stments food types of trading in anges. The recovery her asking them to be 1976 Was scented by North Sea and in UK monetary policy. The door de conting to ustable levels trecancerrencies and the back end of the 1960s was correction to o Dracus BO 7 Jos Pound Reaches Highest level in 3 years WSJ 022121 (1) - Protected V... - Saved Sign Layout References Mailings Review View Help Acrobat Source: SG Crou Annet Research/Forex FX Outlook 2021 $1.48 / Sterling - 4 tr 2021 - On the move but still range bound Key forecasts Bumping along the bottom. Looking at a chart of Sterling's real effective rate over a long enough time, it is clear that sterling has a tendency to make but adjustments followed by periods of trading in anges. The recovery after asking the IMF for help in 1976 was accelerated by North Sea oil and a huge change in UK monetary policy. The dollar draad sterling to unsustainable levels ainst European currencies, and the back end of the 1980s was a correction to that. The Brown growth years represent another huge shift, ultimately unsustainable-too much leverage and not enough regulation, all ending with the bail-out of banks. The EU referendum ended the sterling recovery and left the pound trading in a range. Indeed, the 2020 high and low for the pair are the high and low for the last four years. The vote to leave sent the pound tumbling, and ever since ther, the market has been waiting to see what kind of an exit would occur. In the long run, history is a cuide, the next big move for the pound's seat effective rate will be a rally From here, that's the path of mean reversion. A deal could have unlocked such a move. Absent that and facing turther economie under perman, bounce will have to wait until 2022 at the earliest in the meantime, where GBP/USD headsprobiol depend more on What EUR/USD does than anything that opens in the UK Challenge Droo O Pound Reaches Highest level in 3 years WSJ 022121 (1) - Protected V... - Saved Jose ign Layout References Mailings Review View Help Acrobat mean reversion. A good deal could have unlocked such a move. Absent that and facing further economie under performance, a bounce will have to wait until 2022 at the earliest in the meantime, where GHP/USD heads probably depends more on what EUR/USD does than anything that happens in the UK Challenger Your firm has a Sterling 4.000.000 ccount receivable due in 6 months. Based on the above artide and the bank research, you need to decide to leave the account receivable fully unhedged, partially hedged or fully hedged. What factors would you consider in your analysis for both the firm and the financial analysis? (The current spot rate is $1,4050/GP-6 mth Libors are follows $0.20% and GBP 0,00%) 1 Focus o C