Question

Forever Young Laboratories Inc. (FYL) was started a few years ago by a group of engineers to design and develop power mobility device (PMDs) for

Forever Young Laboratories Inc. ("FYL") was started a few years ago by a group of engineers to design and develop power mobility device (PMDs) for the regional countries. FYL has invented and patented two models of PMDs: Joy and Happy. As the technology involved in the manufacturing process is both complex and expensive, FYL has been beset by high fixed costs.

Bowen, the company's founder, is particularly concerned and has arranged a conference call

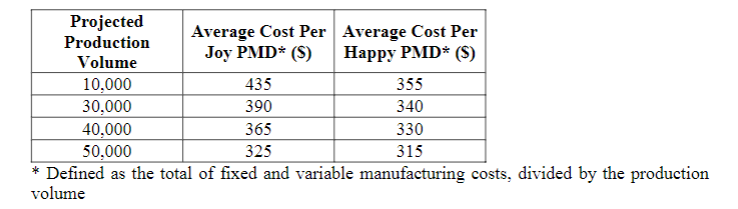

over Zoom to discuss about profitability. He illustrated that average unit cost will fall with

increase in production volume. He reasons that this was due to the company's fixed cost base.

He extracted FYL data to produce the following table:

FYL currently has a production facility with a capacity of producing 60,000 PMDs per year.

Bowen explains that if production reaches full capacity, FYL's profits will soar as all sales

proceeds would not have to recover fixed costs (like rent, depreciation, fixed admin and selling

expenses) and will contribute entirely to profits. As such, he believes presenting and analysing

all product (manufacturing) costs as average unit cost can help management better control costs

and achieve its profits targets. It is his belief that fixed costs is bad for business.

Your team is the management accounting group, and shortly after the conference call, your

Controller called a meeting to address the situation. She wants to know how profitability

changes with production. The current production and sales volume is 30,000 units of Joy PMD

and 20,000 units of Happy PMD respectively. Joy sells at an average selling price of $600 per

unit and Happy, $700 per unit

Required:

(a) Apply cost-volume-profit analysis to calculate the break-even point in units for each

PMD sold by FYL. Other non-manufacturing fixed costs amounted to $2,000,000 per

year.

(b) Explain if Bowen is correct about product costs. In particular, discuss if product costs

can be all presented as unit variable costs for decision making, and whether fixed costs

is bad for business as claimed by Bowen.

Projected Production Average Cost Per Average Cost Per Joy PMD* (S) Volume Happy PMD* (S) 10,000 435 355 30,000 390 340 40,000 365 330 50,000 325 315 * Defined as the total of fixed and variable manufacturing costs, divided by the production volume

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started