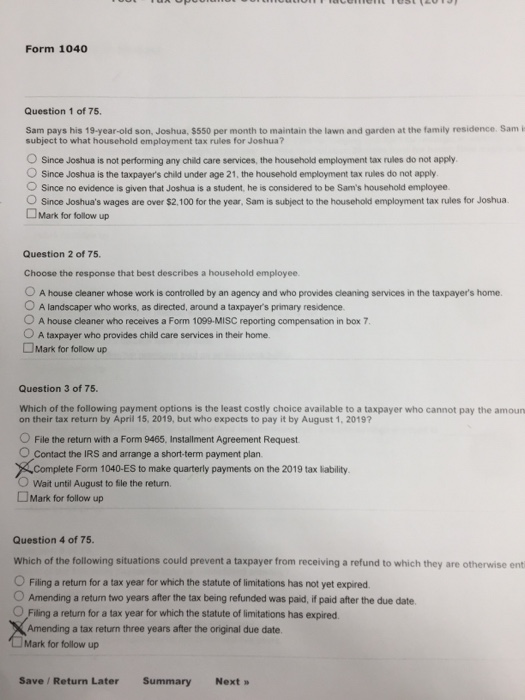

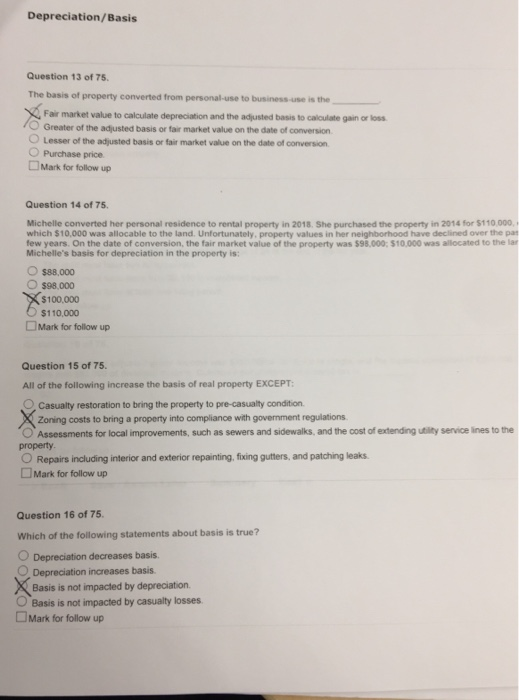

Form 1040 Question 1 of 75. Sam pays his 19-year-old son, Joshua, $550 per month to maintain the lawn and garden at the family residence. Sami subjoct to what household employment tax rules for Joshua? O Since Joshua is not performing any child care services, the household employment tax rules do not apply. O Since Joshua is the taxpayers child under age 21, the household employment tax rules do not apply O Since no evidence is given that Joshua is a student, he is considered to be Sam's household employee O Since Joshua's wages are over $2,100 for the year, Sam is subject to the household employment tax rules for Joshua LJ Mark for follow up Question 2 of 75 Choose the response that best describes a household employee O A house cleaner whose work is controlled by an agency and who provides cleaning services in the taxpayer's home O A landscaper who works, as directed, around a taxpayer's primary residence O A house cleaner who receives a Form 1099-MISC reporting compensation in box 7 O A taxpayer who provides child care services in their home Mark for follow up Question 3 of 75 Which of the following payment options is the least costly choice available to a taxpayer who cannot pay the amoun on their tax return by April 15, 2019, but who expects to pay it by August 1, 2019? O File the return with a Form 9465, Installment Agreement Request O Contact the IRS and arrange a short-term payment plan Complete Form 1040-ES to make quarterly payments on the 2019 tax liability. O Wait until August to file the return. Mark for follow up Question 4 of 75. Which of the following situations could prevent a taxpayer from receiving a refund to which they are otherwise ent O Filing a returm for a tax year for which the statute of limitations has not yet expired. O Amending a return two years after the tax being refunded was paid, if paid after the due date O Filing a return for a tax year for which the statute of limitations has expired Amending a tax return three years after the original due date Mark for follow up Save / Return Later Summary Next Depreciation/Basis Question 13 of 75 The basis of property converted from personal-use to business-use is the Fair market value to calculate depreciation and the adjusted basis to caloulate gain or loss O Greater of the adjusted basis or fair market value on the date of conversion. O Lesser of the adjusted basis or fair market value on the date of conversion O Purchase price Mark for follow up Question 14 of 75 Michelle converted her personal residence to rental property in 2018. She purchased the property in 2014 for $110.000 which $10,000 was allocable to the land. Unfortunately, property values in her neighborhood have declined over the par few years. On the date of conversion, the fair market value of the property was $98,000; $10.000 was allocated to the lar Michelle's basis for depreciation in the property is: O $88,000 O $98.000 $100,000 $110,000 Mark for follow up Question 15 of 75 All of the following increase the basis of real property EXCEPT Casuality restoration to bring the property to pre-casuality condition Zoning costs to bring a property into compliance with government regulations OAssessments for local improvements, such as sewers and sidewalks, and the cost of extending utbility service lines to the property O Repairs including interior and exterior repainting, fixing gutters, and patching leaks Mark for follow up Question 16 of 75 Which of the following statements about basis is true? O Depreciation decreases basis. Depreciation increases basis Basis is not impacted by depreciation. OBasis is not impacted by casualty losses Mark for follow up