Answered step by step

Verified Expert Solution

Question

1 Approved Answer

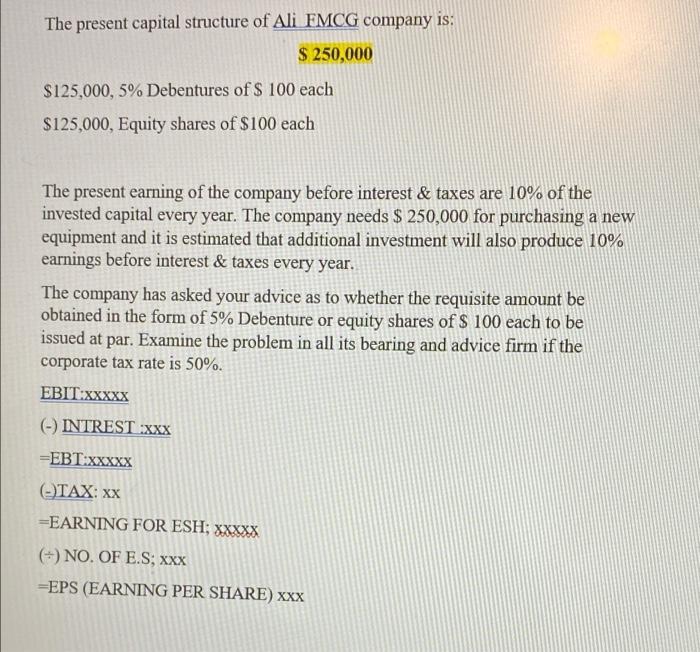

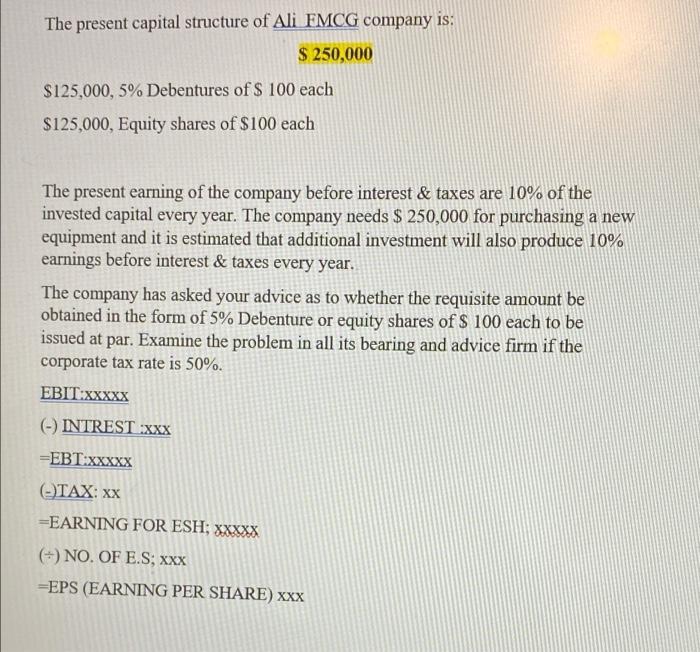

Form excel sheet . The present capital structure of Ali FMCG company is: $ 250,000 $125,000, 5% Debentures of $ 100 each $125,000, Equity shares

Form excel sheet .

The present capital structure of Ali FMCG company is: $ 250,000 $125,000, 5% Debentures of $ 100 each $125,000, Equity shares of $100 each The present earning of the company before interest & taxes are 10% of the invested capital every year. The company needs $ 250,000 for purchasing a new equipment and it is estimated that additional investment will also produce 10% earnings before interest & taxes every year. The company has asked your advice as to whether the requisite amount be obtained in the form of 5% Debenture or equity shares of $ 100 each to be issued at par. Examine the problem in all its bearing and advice firm if the corporate tax rate is 50%. EBIT:XXXXX (-) INTREST :XXX =EBT:xxxxx TAX: xx =EARNING FOR ESH; xxxxx NO. OF E.S; XXX =EPS (EARNING PER SHARE) XXX

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started