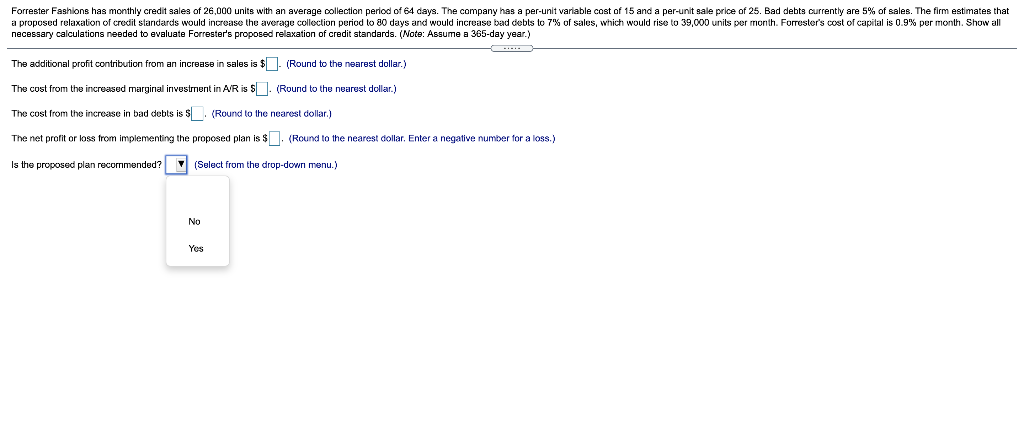

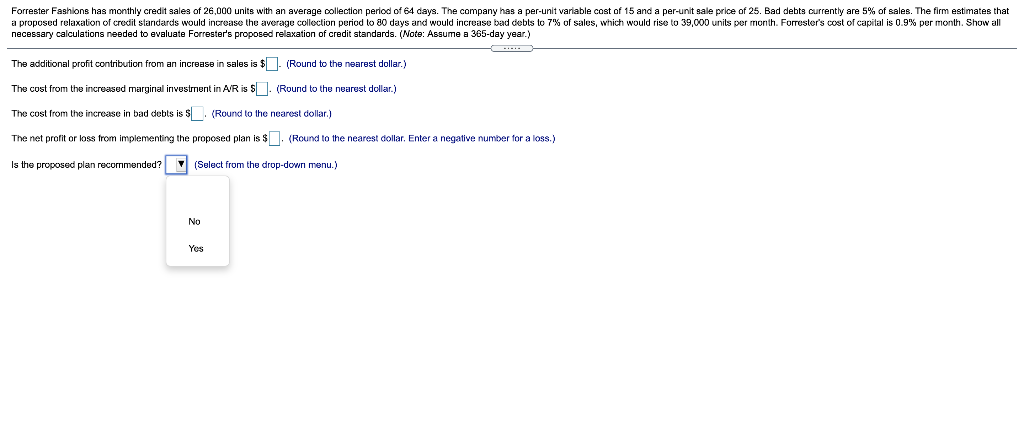

Forrester Fashions has monthly credit sales of 26,000 units with an average collection period of 64 days. The company has a per-unit variable cost of 15 and a per-unit sale price of 25. Bad debts currently are 5% of sales. The firm estimates that a proposed relaxation of credit standards would increase the average collection period to 30 days and would increase bad debts to 7% of sales, which would rise to 39,000 units per month. Forrester's cost of capital is 0.9% per month. Show all necessary calculations needed to evaluate Forrester's proposed relaxation of credit standards. (Note: Assume a 365-day year.) The additional profit contribution from an increase in sales is $ - (Round to the nearest dollar.) The cost from the increased marginal investment in A'R is $. (Round to the nearest dollar.) The cost from the increase in bad debts is s (Round to the nearest dollar.) The net profit or loss from implementing the proposed plan is $. (Round to the nearest dollar. Enter a negative number for a loss.) Is the proposed plan recommended? (Select from the drop-down menu.) No Yos Forrester Fashions has monthly credit sales of 26,000 units with an average collection period of 64 days. The company has a per-unit variable cost of 15 and a per-unit sale price of 25. Bad debts currently are 5% of sales. The firm estimates that a proposed relaxation of credit standards would increase the average collection period to 30 days and would increase bad debts to 7% of sales, which would rise to 39,000 units per month. Forrester's cost of capital is 0.9% per month. Show all necessary calculations needed to evaluate Forrester's proposed relaxation of credit standards. (Note: Assume a 365-day year.) The additional profit contribution from an increase in sales is $ - (Round to the nearest dollar.) The cost from the increased marginal investment in A'R is $. (Round to the nearest dollar.) The cost from the increase in bad debts is s (Round to the nearest dollar.) The net profit or loss from implementing the proposed plan is $. (Round to the nearest dollar. Enter a negative number for a loss.) Is the proposed plan recommended? (Select from the drop-down menu.) No Yos